Editorial

No To Pension Fund Borrowing

Being a country most notorious for borrowings, it does not come across as a consternation that Nigeria would ask to take a N2 trillion loan from the dedicated Pension Fund. Expectedly, the proposal has raised the ire of labour unions, workers, groups and critical stakeholders who have vehemently repudiated the idea. Despite that, the federal government seems intent on going ahead with the planned action.

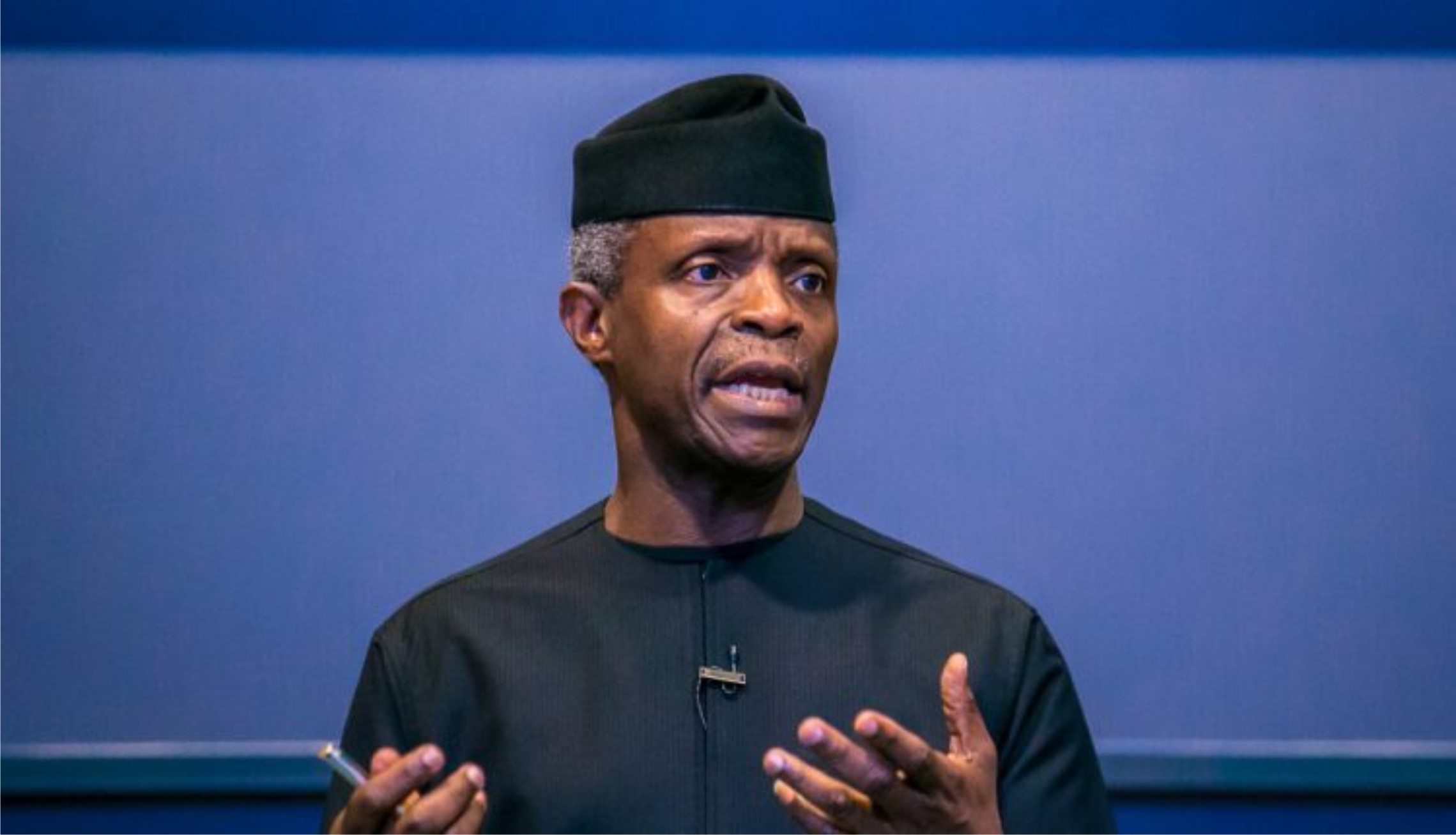

The Vice President, Prof Yemi Osinbajo, confirmed the government’s position at the National Economic Council (NEC) meeting he presided lately where he revealed that plans had been perfected to take N2 trillion from the current N10 trillion domiciled in the pension till to finance the rejuvenation of decomposing infrastructure.

However, if the glitches that characterised the pension schemes prior to 2004 are anything to go by, then, this is a fatal move that must be halted. Our suspicion is deepened by the fact that at the moment, the government’s indebtedness to pensions in accrued rights, pension differentials, minimum pension guarantee, pension increase is well over N400 billion.

Government needs to be reminded that the Contributory Pension Scheme came into existence in 2004 to replace the moribund Defined Pension Scheme. It is fully funded by workers and employers and privately managed by Pension Fund Administrators. The monies are in the individual Retirement Savings Account (RSA). Therefore, it is significant that the consent of the workers is, at least, sought.

While infrastructure is a colossal asset around the world, and especially in most advanced countries in which private investors could invest Pension Fund and make high returns, here, infrastructure is yet to be an asset because Nigeria runs a dysfunctional economy, morbidly dependent on crude oil revenue. It is an economy that sustains enormous corruption and relies ponderously on the importation of goods and services that can effortlessly be generated here.

A recent Central Bank of Nigeria (CBN) report indicated that the Federal Government registered N4.62 trillion deficit in 2019. That year, its highest expenditure went on recurrent at N4.05 trillion out of a budget of N8.9 trillion. This is certainly an unworkable economic exemplification. A country which keeps allocating more resources to consumption cannot guarantee that the funds its government seeks to borrow will not be frittered on politicians and civil servants.

We firmly believe that the government does not have to borrow to erect or maintain infrastructure if it can cut on its garish lifestyle. For example, besides the prodigious sums expended on federal lawmakers, fuel subsidy alone cost the nation N2.95 trillion in 2018. With this, we find it hard to comprehend why the four refineries that gulped about $400 million between 2013 and 2015 cannot be auctioned to private investors who can run them efficiently.

Again, a report by the Debt Management Office (DMO) stated that as of September 2019, Nigeria had a debt profile of N26.21 trillion or $85.3 billion while debt servicing alone costs N2 trillion annually on average. This has more severely compromised the nation’s debt-to-GDP ratio. The obvious implication is that the current ratio cannot sustain a serious borrowing any longer. So, what is the repayment plan for the N2 trillion when debt servicing guzzles so much?

In a surprisingly bold statement, the Federal Government claims it needs the N2 trillion to plough into infrastructural upswings like the rails, roads and power. These are desirable projects, no doubt, but it will be harmful to divert pension capital to them. In the first place, it doesn’t make sense to keep plunging public funds into power when in the privatisation exercise of November 2013, N1.7 trillion was disbursed to stabilise the sector without the anticipated result. The way it is, if the entire N2 trillion is assigned to the sector, no improvement may be recorded.

During the 2008 economic crisis, the Assets Management Corporation of Nigeria deployed N5 trillion to bail out some ailing firms. But because there is a consistent dearth of political will in the country, that large sum is yet to be recouped by various administrations till date. Why look elsewhere when this money is more than twice the N2 trillion being sought for? Furthermore, what happened to funds granted private organisations like the Aviation Fund and Textile Fund? Of course, they have gone down the drain and unaccounted for while the culprits walk unhindered.

It is a fact that pension depositories are used to construct infrastructure in developed countries, particularly those with a vast ratio of Pension Fund to GDP. However, with a Pension Fund to GDP ratio of 6.7 per cent, Nigeria cannot cut a slice of its pension reserves to invest in infrastructure without jeopardising workers’ fortune. To be suitable to do that, our infrastructure market must be developed and well regulated.

We express grave concern at the fate of Nigerian workers in the face of incessant borrowings by our governments without corresponding development. It is unthinkable to borrow from the Pension Fund when the citizens have not felt the impact of the mounting debts foisted on the country. What is paramount to contributors and other stakeholders alike is the safety of the Fund, which, unfortunately, government cannot guarantee. This action of government has the potential to threaten the scheme and erode contributors’ confidence.

Accordingly, we strongly apprise the federal government to think twice and desist from overstepping the Pension Reform Act 2004 to gratify its crave to build infrastructure. This was the issue with Argentina when its then President, Cristina Fernandez, manoeuvred the parliament and clutched the country’s $30 billion Pension Fund. Instantly, international investors’ confidence wiggled and the economy went into a free fall.

As the regulatory agency, the National Pension Commission (PenCom) should not subject pension revenue to undue hazard by granting political office holders access to the Fund. Like birds of passage, politicians have no stake in the pension money; as such, they have to be prevented by all means from intruding on the future of Nigerian workers. The government with their itchy fingers should maintain a distance from the pension proceeds to stave off Argentina’s ugly experience.

·

· · ·

Editorial

As NDG Ends Season 2

Editorial

Beginning A New Dawn At RSNC

Editorial

Sustaining OBALGA’s Ban On Street Trading

-

News3 days ago

News3 days agoAmend Constitution To Accommodate State Police, Tinubu Tells Senators

-

Politics3 days ago

Politics3 days agoSenate Urges Tinubu To Sack CAC Boss

-

News3 days ago

News3 days agoDisu Takes Over As New IGP …Declares Total War On Corruption, Impunity

-

Business3 days ago

President Tinubu Extends Raw Shea Nuts Export Ban To 2027

-

Business3 days ago

Crisis Response: EU-project Delivers New Vet. Clinic To Katsina Govt.

-

Sports3 days ago

NDG: Rivers Coach Appeal To NDDC In Talent Discovery

-

Business3 days ago

President Tinubu Approves Extension Ban On Raw Shea Nut Export

-

Rivers3 days ago

Etche Clan Urges Govt On Chieftaincy Recognition