Oil & Energy

Twists, Turns Of PHCN Privatisation

Thousands of former staff

of the Power Holding Company of Nigeria (PHCN) recently, besieged the zonal office of the company along Moscow Road in Port Harcourt, in desperate move to prove their originality and get captured in the last biometric revalidation exercise.

Leader of a team of verification officers from the Bureau of Public Enterprises (BPE), told journalists that the exercise was designed to accommodate staff who were not captured in previous verification exercises and who were unable to get their terminal benefits which is an integral aspect of the privatisation of PHCN.

In the crowd were some pensioners in their seventies cladding their original documents much older than PHCN itself as they were employed by the National Electric Power Authority (NEPA) that transformed to PHCN. They came from different parts of the country to Port Harcourt for the exercise.

Mr Sunday Nnadi who said he came all the way from Arochukwu had spent three days yet, he did not see any hope of getting through. “All the officers do is asking me to fill one form after the other. It is becoming endless,” Nnadi said.

Another staff said, “I put in 35 years serving this company and the only way to thank or appreciate my efforts is to suffer me like this”, said an old ex-staff who simply gave his name as John.

“Imagine, some of us come from Ondo, Enugu, Edo, Lagos, Katsina, but we had been stranded here for the past three years with the government people turning us to beggers,” he continued.

A former executive member of the National Union of Electricity Employees (NUEE), Rivers State branch, who also came for the exercise querried if the privatization of PHCN was made to bring sorrow to former staff of the firm.

According to him, the present verification is the sixth time workers were being subjected to the exercise, yet to no avail, as many of them were yet to receive their terminal package.

The former exco member of NUEE accused the new investors of sacking virtually all the NUEE executive members because of the unions insistence on members’ welfare.

“They targeted us even when a good number of us have enviable records of service and laid us off while re-engaging others. This is unfair,” he noted.

Responding to the allegation of inhuman treatment of staff and witch hunting of ex-unionists, the BPE team leader said the staff, especially those from Enugu zone, had refused to cooperate and were unruly thereby making the exercise chaotic.

He also said that people were taking undue advantage of the verification to defraud the system.

“About 86,000 PIN numbers have been presented by PHCN workers who were less than 50,000 even when each was expected to present one PIN Number only.

He also said there were cases of different persons claiming to be next of kin of some dead staff and that it created confusion and delay.

“The problem is not from the team but from the workers themselves,” said the BPE official.

He further said fraudsters and imposters were desperately adding to the whole situation revealing that two impostors had been arrested.

He stated that the team was made up of representatives from NUEE, BPE, National Union of Pensioners, Pencom, State Security services, PHCN headquarters, Nigeria Electricity Liability Management Companies, Ministry of Power, Senior Staff Union. “The essence is to make it a one-stop shop as there are different bodies to handle various issues and claims,” he added.

He explained that the new investors were to buy PHCN without any liability and that many retirees were not paid by PHCN before the verification, so BPE is also compiling the authentic list as to enable government clear the payment and that such new challenges were not foreseen earlier.

Restating the Federal Government’s determination to clear all backlog of arrears, he said so far about N361 billion has been paid to ex-PHCN staff.

Another source of the challenges facing the team, according to the leader was the way things were being run in the company. “We have NEPA I and NEPA II. The NEPA II staff were employed by staff of PHCN to assist them in the field, at the end of the month they received about N5000, or N10,000 and we are also handling the complex situation.

He assured that at last, all will get fair treatment from the team and particularly noted that he was not aware of any witchhunting of any former staff as a result of his or her role in the union that championed staff welfare in the past.

The critical state of power had remained a major concern and both the government and a cross-section of Nigerians are of the opinion that if the power sector was fixed, it would impact on the socio-economic wellbeing of Nigerians irrespective of class, place or occupation.

In adherence to this, Federal Government under past administrations had taken steps to revive the sector but efforts were frustrated by many factors.

The past administration under President Olusegun Obasanjo, started early by appointing Bola Ige, who was suddenly killed and the death of Bola Ige affected Obasanjo effort until recently, the present administration under Dr Goodluck Jonathan approached the problem through privatization.

In a bid to achieve, a former Minister of Power, Prof Bart Nnaji, was disgraced our of office mainly because of the dogged fight by NUEE which accused Nnaji of attempting to buy off the sector with his cronies from inside and outside the country.

Though President Jonathan had no option than to sack Prof Nnaji. Sincerely, the exit of Nnaji had not removed the hitches mounting on the privatisation process of the national power company.

Just last week, power consumers in Azikiwe Street in Port Harcourt, gathered in their numbers at the Port Harcourt Electricity Distribution Company, Diobu Business Unit to lay a complaint over poor supply and arbitrary billing.

Though, the group could not meet the Diobu Business Unit Manager, but according to them, a senior staff in the manager’s office told them to go and pay their bill first before complaining stressing that was the new order.

Investigation has also shown that the newly re-engaged staff of PHCN in the new firm were working in fears and that the system has become different from what it used to be when they were with PHCN as government parastatal.

One of the staff said as their six months probation period is fast coming to an end, they do not know their fate.

Irrespective of your posting or level, it is mandatory now that you sign the attendance register daily on resumption between 7:30 and 8am and closing time at 5pm,” he said adding that “it does not matter whether you were in the field or office, you must first get to the office in the morning to sign and return to the office to sign off at closure.

Another lady at Rumuola Business unit narrated some experience. “My brother, the beat has changed and, like it or not, you must change your dancing step to ryme with the new rhythm or you are in trouble,” she said.

She said the reengaged staff work under fear and great uncertainty and most times she remains in office till evening and must not complain or ask for extra pay.

But Mr Clement Jacob, a business consultant faulted the approach of the new investors. “The maxim is that you must give the new workers new orientation to enable them work towards your new vision otherwise, you ought not to blame the workers.

Jacob is of the view that since the ex-PHCN staff were given the civil service orientation, there was need to re-orientate them through some short time training and seminars where the new investors should guide the staff along their new mission as to meet target and succeed at last.

He said it is unfair to subject the new staff to new strategy without preparing them for that.

“In business management, such procedure is unacceptable and it is unfair to punish them.”

The aim of the privatisation, according to Jacob, who runs Matrix Business consult in Port Harcourt, is to achieve improvement in power supply for Nigerians to enable the business environment become better.

He, however, stressed that the staff ought to work with happiness and clearly defined targets to enable the private investors make their profit, “but with the way they are going, I am afraid if they would not meet hitches,” he added.

But Prince Emmanuel Ogba, it is too early to assess the new investors. All must join hands with them to succeed because their success would reflect in improved services.

He remarked that if the new privatization strategy fails, it is not the failure of the private investors but that of Nigeria and called for understanding and collaboration of all in Nigeria even as he advised the power investors to be open to Nigeria.

Prince Ogba urged the new investors to integrate the masses in their operations because of the multidisciplinary nature of the sector and suggested a lot of awareness campaign from the investors at workers’ level and masses or consumers levels.

“It is natural that consumers will complain if the services are not encouraging so the new investors should be proactive and give their strategic staff modern training to meet the new challenges,” he continued.

But to Mrs Joyce Oriji, a cold room operator, “Nigeria is going no where without fixing power. We can fail in leadership but if we get the power sector right so many things would fall into good shape”, she said.

To arrest the problem of irrational and arbitrary billing, some power watchers expressed the view that card system should be adopted as it is done in the telecommunication subsector.

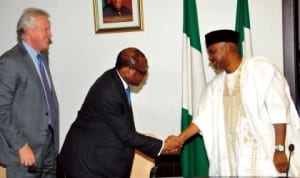

L-R: Chairman, General Electric, Mr Jeffrey Immelt, Minister of Trade and Investment, Mr Olusegun Aganga and Vice President Namadi Sambo, during a meeting with officials of general electric in Abuja last Friday.

Photo: NAN

Chris Oluoh

Oil & Energy

NERC, OYSERC Partner To Strengthen Regulation

Oil & Energy

NLC Faults FG’s 3trn Dept Payment To GenCos

Oil & Energy

PENGASSAN Rejects Presidential EO On Oil, Gas Revenue Remittance ……… Seeks PIA Review

-

News2 days ago

News2 days agoAmend Constitution To Accommodate State Police, Tinubu Tells Senators

-

Politics2 days ago

Politics2 days agoSenate Urges Tinubu To Sack CAC Boss

-

News2 days ago

News2 days agoDisu Takes Over As New IGP …Declares Total War On Corruption, Impunity

-

Business2 days ago

President Tinubu Extends Raw Shea Nuts Export Ban To 2027

-

Business2 days ago

Crisis Response: EU-project Delivers New Vet. Clinic To Katsina Govt.

-

Business2 days ago

President Tinubu Approves Extension Ban On Raw Shea Nut Export

-

Business2 days ago

Business2 days agoPENGASSAN Rejects Presidential EO On Oil, Gas Revenue Remittance … Seeks PIA Review

-

Business2 days ago

FG Pushes Cassava Bioethanol Drive To Boost Industrial Growth