Business

NSE All-Share Index Drops By 0.52%

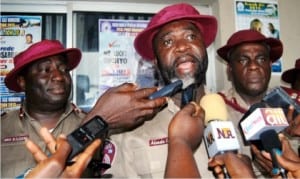

L-R: Head of Media Relations and Strategy, FRSC, Corps Commander Bisi Kazeem, representative of the Corps Marshal, Deputy Corps Marshal Ademola Lawal and Corps Public Education Officer, Corps Commander Imoh Etuk, during the 2015 Annual Petroleum Tanker Drivers’ Certification inEleme Local Government Area of Rivers State on Wednesday

The profit taking embarked upon by investors persisted on Wednesday with market indices dropping by 0.52 per cent, following price loses.

The Tide source reports that trading for the third consecutive day maintained a downward trend as the All-Share Index lost 162.60 points or 0.52 per cent to close at 31,107.11.

This was against 31,269.71 posted on Tuesday due to huge losses recorded by some blue chip equities.

The market capitalisation dropped further by N55 billion to close at N10.662 trillion in contrast with N10.717 trillion recorded on Tuesday.

Mobil led the laggards’ chart with a loss of N8.20 to close at N156.80 per share.

Nestle came second shedding N5 to close at N860, while Guinness dropped N4 to close at N127 per share.

Seplat lost N2 to close at N298, while Flour Mill dipped N1.47 to close at N28.03 per share.

On the other hand, Forte Oil recorded the highest gain to lead the gainers’ table, appreciating by N7.02 to close at N212 per share.

Nigerian Breweries rose by 50k to close at N126.50, while Port Paints gained 18k to close at N3.95 per share.

Dangote Cement appreciated by 15k to close at N150, while Custodian Insurance grew by 10k to close at N4.20 per share.

In spite of the drop in market indices, the volume of shares traded rose by 54.51 per cent with a turnover of 434.17 million shares worth N1.69 billion achieved in 3,105 deals.

Reports say that this was against 280.99 million shares valued N2.91 billion traded in 3,716 deals on Tuesday.

Standard Alliance Insurance drove the turnover with a total of 250 million shares worth N125 million traded in six deals.

Access Bank trailed with 72.21 million shares valued N333.71 million achieved in 236 deals, while GT Bank sold 15.29 million shares worth N365.81 million in 244 deals.

FBN Holdings traded 12.27 million shares valued N83.16 million transacted in 358 deals, while UBA accounted for 11.56 million shares worth N45.70 million exchanged in 98 deals.

Business

NIMASA Marks 2025 Customer Week, Pledges Service Excellence

Business

SEME Customs Foils Smuggling Attempt Of Expired Flour, Seizes N2bn Contraband

Business

LASG UNVEILS GROUNDBREAKING OMI-EKO PROJECT AT FIVE COWRIES TERMINAL

-

Nation4 days ago

Rivers Chief Judge Pardon 14 Inmates From Prison To End 2024/2025 Legal Year

-

Nation4 days ago

Cancer Care: Expert Seeks Hospice In UPTH

-

News4 days ago

News4 days agoUse Service Year To Build Capacity, Fubara Urges Corp Members

-

Featured4 days ago

Featured4 days agoWorkers’ Audits Not Meant For Downsizing – Walson Jack

-

Nation4 days ago

Union Petitions EFCC, ICPC Over Tax Fraud Allegations Against Daewoo, Saipem

-

Politics4 days ago

Politics4 days agoSenate Confirms Amupitan As INEC Chairman

-

Nation4 days ago

Nation4 days agoHYPREP Remains Steadfast In Adhering To International Standards—Zabbey …As Regulators, Asset Owners Hail Project

-

News4 days ago

News4 days agoNERC Approves N28bn For Procurement Of Meters For Band A Customers