Business

Subsidy Removal: ‘Good For Investment, To Check Rising Debt’

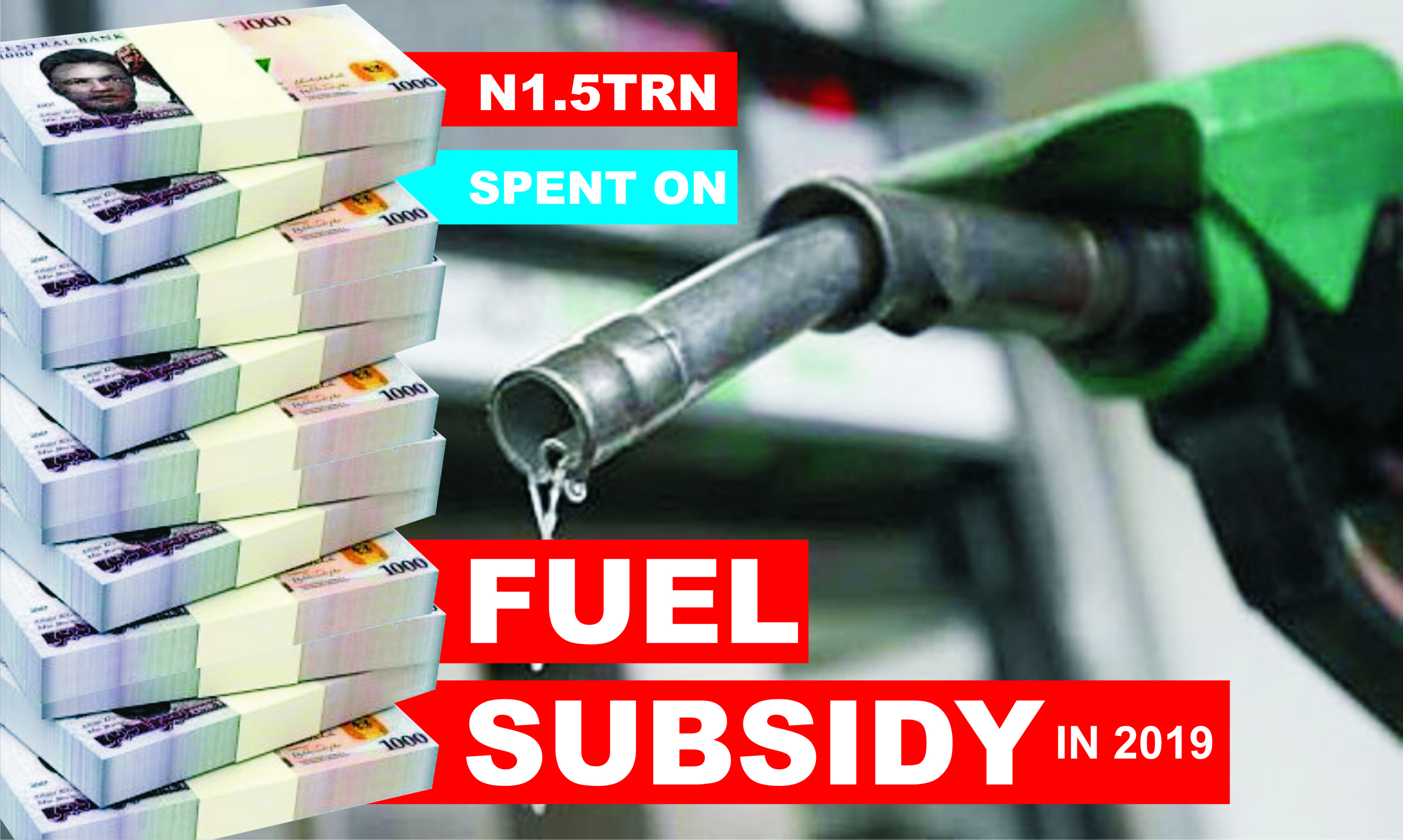

The Lagos Chamber of Commerce and Industry (LCCI) has said the Federal Government’s planned removal of petrol subsidy remains one of the best economic decisions that will not only reduce Nigeria’s debts, but will also tackle widespread corruption in the oil sector.

President of LCCI, Dr Michael Olawale-Cole, stated this during the chamber’s second quarter state of the economy conference yesterday in Lagos.

Recall that Nigeria secured an $800 million relief package from the World Bank to minimise the effect of subsidy removal on the most vulnerable in the society.

Recent data by the Debt Management Office puts Nigeria’s public debt at N46.25 trillion ($103.11 billion) as at end-December 2022, compared to N39.56 trillion ($95.77 billion) in 2021.

Olawale-Cole urged the Federal Government to begin to roll out several cushioning measures ahead of the subsidy removal in the second half of the year to mitigate any likely disruptions to the economy.

“Removal of fuel subsidies is, amongst others, expected to spur investments in domestic refining and petrochemicals and create a significant value chain for the various stakeholders.

“Though the planned removal of fuel subsidies may cause further northward movement of inflation in the short term, it is arguably one of the best economic decisions to reduce our unsustainable debts and widespread corruption in that sector.

“The government must, however, take cognisance of its socio-economic implications, especially with unemployment at the unwholesome rate of about 40 per cent”, he said.

The LCCI’s boss picked holes in borrowing to fund subsidies or support uneconomic ventures, saying the government’s fixation on debt accumulation was unhealthy.

He said the government must prioritise exploring other avenues, including opening equity opportunities, offloading/selling of its real estate holdings and tackling oil theft to create room for fiscal manipulation.

Olawale-Cole stressed the need to importantly follow the recently launched and restructured Ministry of Finance Incorporated (MOFI) by President Muhammadu Buhari on February 1, to optimise national assets.

He advised that copious references should henceforth be made on the growth and returns of the country’s stock of financial assets in corporate equities, real estate and infrastructure spaces.

This, he said, would provide local and global observers a balanced picture of our financial position.

“It would also motivate national asset managers, led by MOFI, to grow our assets and the returns on them as well as motivate our national liability managers, led by the DMO, to minimise our liabilities and the costs we incur on them with equal vigour.

“Indeed, issuance of joint reports by MOFI and DMO would be most ideal going forward.

“One-sided updates on liabilities with no updates on assets when such updates were adequately available could well be blamed for some of the downgrades of Nigeria’s debt issuance risk profile and outlook.

“The rating outcomes would have been more favourable, had updates on assets been provided side-by-side with updates about liabilities”, he stated.

Addressing inflationary pressure which inched upwards in March to 22.04 per cent, Olawale-Cole noted that hiking monetary policy rate had thus far proven to be ineffective and insufficient in taming inflation.

He stated that in most economies, amid the cost-of-living crisis, the priorities remained achieving sustained disinflation and reasonable real growth.

Business

Agency Gives Insight Into Its Inspection, Monitoring Operations

Business

BVN Enrolments Rise 6% To 67.8m In 2025 — NIBSS

The Nigeria Inter-Bank Settlement System (NIBSS) has said that Bank Verification Number (BVN) enrolments rose by 6.8 per cent year-on-year to 67.8 million as at December 2025, up from 63.5 million recorded in the corresponding period of 2024.

In a statement published on its website, NIBSS attributed the growth to stronger policy enforcement by the Central Bank of Nigeria (CBN) and the expansion of diaspora enrolment initiatives.

NIBSS noted that the expansion reinforces the BVN system’s central role in Nigeria’s financial inclusion drive and digital identity framework.

Another major driver, the statement said, was the rollout of the Non-Resident Bank Verification Number (NRBVN) initiative, which allows Nigerians in the diaspora to obtain a BVN remotely without physical presence in the country.

A five-year analysis by NIBSS showed consistent growth in BVN enrolments, rising from 51.9 million in 2021 to 56.0 million in 2022, 60.1 million in 2023, 63.5 million in 2024 and 67.8 million by December 2025. The steady increase reflects stronger compliance with biometric identity requirements and improved coverage of the national banking identity system.

However, NIBSS noted that BVN enrolments still lag the total number of active bank accounts, which exceeded 320 million as of March 2025.

The gap, it explained, is largely due to multiple bank accounts linked to single BVNs, as well as customers yet to complete enrolment, despite the progress recorded.

Business

AFAN Unveils Plans To Boost Food Production In 2026

-

News2 days ago

News2 days ago2026 Budget: FG Allocates N12.78bn For Census, NPC Vehicles

-

Featured5 days ago

Featured5 days agoTinubu Hails NGX N100trn Milestones, Urges Nigerians To Invest Locally

-

Politics2 days ago

Politics2 days agoWike’s LGAs Tour Violates Electoral Laws — Sara-Igbe

-

Sports2 days ago

Sports2 days agoAFCON: Osimhen, Lookman Threaten Algeria’s Record

-

Politics2 days ago

Politics2 days agoRivers Political Crisis: PANDEF Urges Restraint, Mutual Forbearance

-

Maritime2 days ago

Maritime2 days agoMARITIME JOURNALISTS TO HONOUR EX-NIWA MD,OYEBAMIJI OVER MEDIA SUPPORT

-

Sports2 days ago

Sports2 days agoArsenal must win trophies to leave legacy – Arteta

-

Sports2 days ago

Sports2 days agoPalace ready To Sell Guehi For Right Price