Business

Of Research, Finance And Cashew Value Chain Dev

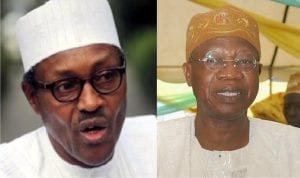

President Buhari and Audu Ogbe, Minister of Agriculture

When President

Muhammadu Buhari-led government came into power in 2015, its desire is to revive the economy through diversification from dependence on crude oil into the non-oil sectors.

With this drive, the government focuses on agriculture among others, apparently because the sector inherent many potential, including foreign exchange earnings, guaranteeing the nation food security and providing raw materials for the manufacturing sector.

The spotlight on agriculture saw cashew gaining the necessary attention as one of the economic crops on which the economy revolved prior to the discovery of crude oil in Nigeria in 1956 at Oloibiri, in now Bayelsa State, in the Niger Delta.

The discovery was made by Shell-BP, at the time the sole concessionaire, after half a century of exploration.

Nigeria joined the ranks of oil producers in 1958 when its first oil field came on stream producing 5,100 bpd.

It is pertinent to note that before then, Nigeria’s major foreign exchange earner was agricultural products, including cocoa, palm oil and groundnuts as recorded in “Groundnut Pyramids’’ of Kano.

Seizing the opportunity that the cashew sub-sector was getting the desired attention it needs; stakeholders under the auspices of the National Cashew Association of Nigeria (NCAN), organised it maiden Cashew Festival and Awards.

The Festival was tagged, “Cashew: A Game Changer for the Nigerian Economy’’.

It is targeted at increasing value addition, fostering more national policies and creating more wealth and that implies economic growth.

The objectives are also to exhibit the potential in the cashew industry, and seek ways to enhance production, processing and ultimately develop the value chains.

Participants included 2,000 farmers, processors, exporters, shipping companies and marketers and government agencies in agriculture from all over the world.

They discussed the challenges militating against the development of the industry, especially production of cashew, and noted that research, access to finance, quality management and commercialisation were affecting the overall growth of the industry.

The participants also proffered interventions that could salvage the situation in the immediate and long-term.

Gov. Abdulfatai Ahmed of Kwara said at the event held on Monday, Feb. 29, in Ilorin, that the state had acquired 13,000 hectares of farmland for unemployed youths to plant cashew.

Ahmed said that different crops, including cashew would be cultivated on the land, adding that the state was ready to support cashew farmers in all ramifications to strengthen the state’s Internally Generated Revenue.

The governor in his keynote address expressed the hope that other state governments would align with the Federal Government as it tilted towards an agriculture-based economy.

According to him, cashew, which seems to be an economic crop in terms of the by-products that could be got from it, like cashew juice, honey, nuts and chocolate among others, is growing in demand globally.

“The global demand for cashew is growing strongly in terms of volume and value and the world demand for cashew will continue to increase rapidly.

“This presents an opportunity for us to increase our foreign exchange earnings, diversify our agriculture products, develop our agro industry and of course, provide employment for our teeming youths,’’ Ahmed said.

The governor also said that the country must take commercialisation seriously in the development of agriculture if the government’s diversification drive would thrive.

“Kwara State is taking the issue of commercial agriculture very serious, on this premise; we have already identified 13,000 hectares of land to be cleared and made available to the unemployed youths in the state.

“Again, one of the crops that have been adopted to be farmed on the land is cashew. We are also creating a new generation of farmers with training of farmers at our integrated farm.

“This to enable them to become change agents in their communities and agriculture will be made a business activity that will attract the youths,’’ Ahmed said.

He noted that farmers needed finance for commercialisation of agriculture, which was important to developing the value chains in agricultural production that was capital intensive.

The News Agency of Nigeria (NAN) reports that already, the state’s micro credit scheme has over 50,000 beneficiaries, including farmers and Small and Medium Enterprises (SME’s).

Also, the government has earmarked N2 billion for the scheme over the next three years.

Mr Segun Awolowo, the Executive Director of Nigerian Export Promotion Council (NEPC) in his paper on “Promoting Nigerian Cashew Export’’, said Nigeria generated 250 million dollars in foreign exchange in 2015.

Awolowo said that processing of cashew which was capital intensive, was just about 10 per cent of the total cashew produced.

He said that there was a steady progression in cashew production from 130,000 metric tons to 155,000 in 2014 and 160,000 in 2015.

The executive director said one of the areas where the council was focusing on is the exportation of raw cashew nuts illegally.

“We need a strong policy from the council that will kick against the illegal exportation of raw cashew nuts outside Nigeria.

“In 2015, raw cashew nuts generated 250 million foreign exchange earnings from 150,000 metric tons of cashew out of 160,000 tons produced in the 2015 cashew season.

“Cashew is one of Nigeria’s main agricultural export produce with about 325,000 hectares presently cultivated and local processing capacity is just 10 per cent.

“There is the projection for increasing locally processed cashew to 50 per cent in the next year. The cashew value chain is one that needs regulation and development to help farmers maximise production,’’ Awolowo said.

He said that the country needed about N100 billion to fund research, production, processing and marketing in the 2016 cashew farming season.

Awolowo asked for the reversal of the export grant presently suspended by the Federal Government and appealed for more support in the distribution of jute bags free of charge.

He suggested that old cashew trees should be cut down and replaced with new hybrid seedlings that would increase production and quality.

On his part, the Managing Director of African Cashew Alliance (ACA), Dr Babafemi Oyewole, said that there was a new scheme by the Central Bank of Nigeria (CBN) to support the commodity sector.

Oyewole said that in line with the CBN scheme, Kwara State Government was going to engage private sector in the development of the crop.

“We have highlighted the challenges and number one is access to finance, and that is why some commercial banks were invited to speak about how they can help farmers to get the necessary credits.

“This is because they are interested in profit making and can mobilise financial resources into the sector.

“Also, donor agencies like USAID Next Project; these are projects that are coming up to support the cashew sector.’’

The managing director also opined that since the rise in the exchange rate of the Dollar, the prices of cashew is increasing.

“The addresses by the Minister of Agriculture and Rural Development and the Gov. Ahmed are a signal that cashew is a very strategic product that government has decided to promote, to replace oil.

“Now that the price of oil is going down while the price of cashew is going up, diversifying the economy via cashew is fast becoming an imperative source of foreign exchange earner and employment provider,’’ Oyewole said.

In the same vein, the Minister of Industry, Trade and Investment, Dr Okechukwu Enelamah, lamented that the total of processed cashew is low.

Nigeria currently produces 160,000 metric tons annually out of which about 50,000 tons (33.3 per cent) is the total processed.

Enalamah challenged stakeholders to up their game by seeing to it that cashew becomes the game changer in the Nigerian economy.

He urged the stakeholders to ensure that they meet the 50 per cent target of the total production within the next few years.

“Not adding value to cashew locally is costing Nigeria huge losses in form of foreign exchange and employment opportunities.

“For example, raw cashew nut is sold at 800 to 900 dollars per metric ton, while processed cashew is sold for 6,000 dollars per metric ton.

“Other problems plaguing the cashew industry includes seed production, packaging and marketing of the commodity,’’ he said.

Enelamah said that the Nigerian Industrial Revolution Plan developed by the ministry was the nation’s first strategic, comprehensive and integrated roadmap to industrialisation.

He said expressed belief that the festival would help to draw a unique chart and evolve a blueprint for harnessing cashew potential to attract investment and increase its value chain in other to sustain economic diversification.

Chief Audu Ogbeh, Minister of Agriculture and Rural Development, said that agriculture contributed about 42 per cent to Nigeria’s annual Gross Domestic Products (GDP).

Ogbeh said that agricultural commodities were traded at high volume in the export market and cash contributed a significant part of this.

“Unlike the oil and gas sector that is an industry restricted to a small part of the country, employing a very tiny population all across its value chains, agricultural commodities are produced in many states.

They involve a large population of actors, providing jobs, incomes and livelihoods across its value chains.

“Now that our foreign reserve is less than 30 billion dollars, which can hardly pay for our five months import bills, Nigeria can no longer afford to allow unbridled capital flight occasioned by huge imports.

“With the free-fall of exchange rate of the Naira, we still believe that every challenge has its opportunities, so, we should leverage on the prevailing exchange rate to boost export,’’ Ogbeh said.

The minister disclosed that one of the priority commodities for foreign exchange earnings that is receiving attention is cashew.

He said cashew was identified as one of five agro-industrial products, among 13 national strategic export products for Nigeria.

Itohan Abara-Laserian, News Agency of Nigeria (NAN)

Itohan Abara-Laserian,

Business

NCDMB, Jake Riley Empower 250 Youths On Vocational Skills

Business

NUJ Partners RSIRS On New Tax Law Education

Transport

Nigeria Rates 7th For Visa Application To France —–Schengen Visa