Business

NB, Consolidated Breweries Merger, Good For Real Sector – Stakeholders

Some investors’ and capi

tal market operators at the nation’s bourse say the proposed merger between Nigerian Breweries (NB) Plc and Consolidated Breweries, will attract more foreign investors to the real sector of the economy.

The stakeholders said in separate interviews in Lagos that the merger between both companies would provide another impetus for foreign investors to review their interests in Nigeria.

According to them, the affirmation of the proposed merger at the December 4, separate Court Ordered Meetings (COM) will further leverage the Nigerian real sector operations.

The Chairman, Nigeria Professional Shareholders Association, Mr Godwin Anono said that the shareholders would support the merger because of the enhanced profitablity that would result from the exercise.

He said that the shareholders would support all the resolutions of the COM to ensure speedy conclusion of the merger plan.

Anono said that the merger would stimulate economic growth and development of the capital market.

He, however, called on other shareholders to support the merger which he described as a welcome development in the Nigerian capital market.

The President, Nigeria Shareholders Solidarity Association (NSSA), Mr Timothy Adesiyan expressed shareholders readiness for the consolidation.

Adesiyan said that the merger would turnaround the fortunes of both companies in terms of robust growth and return on investment.

The NSSA boss called on the Securities and Exchange Commission (SEC) to ensure protection of the minority shareholders in the merger process.

The President, Association of Stockbroking Houses of Nigeria (ASHON), Mr Emeka Madubuike said that the merger would increase the depth of the capital market.

Madubuike said that the merger would enhance the overall prospect of the company’s business in terms of profitability and wider market reach.

“We are expecting a much stronger NB with robust dividend at the completion of the seamless merger,” Madubuike said.

He said that the company’s brand will be stronger with international quality at the completion of the exercise.

The Managing Director, Standard Union Securities Ltd., Mr Sehinde Adenagbe said that the synergy would be good for the shareholders.

Adenagbe said that the business combination was a good development for the capital market and would increase the market capitalisation of the nation’s bourse.

He said that investors should use the opportunity and increase their stake in the company to benefit from the enlarged market share.

Adenagbe said that Consolidated breweries would complement the existing breweries of NB to ensure adequate supply of products to the market.

Heineken, the majority shareholder in Nigerian Breweries in 2005 acquired a controlling stake in Consolidated Breweries.

Heineken had earlier said that the merge was part of their long term strategy of positioning their businesses in the fast growing Nigeria beer and malt drinks.

The proposed merger was recently approved by the Securities and Exchange Commission (SEC).

Under the arrangement of the merger, four shares of NB would be exchanged for five shares of Consolidated Breweries or a cash consideration of N120 per share of Consolidated Breweries held.

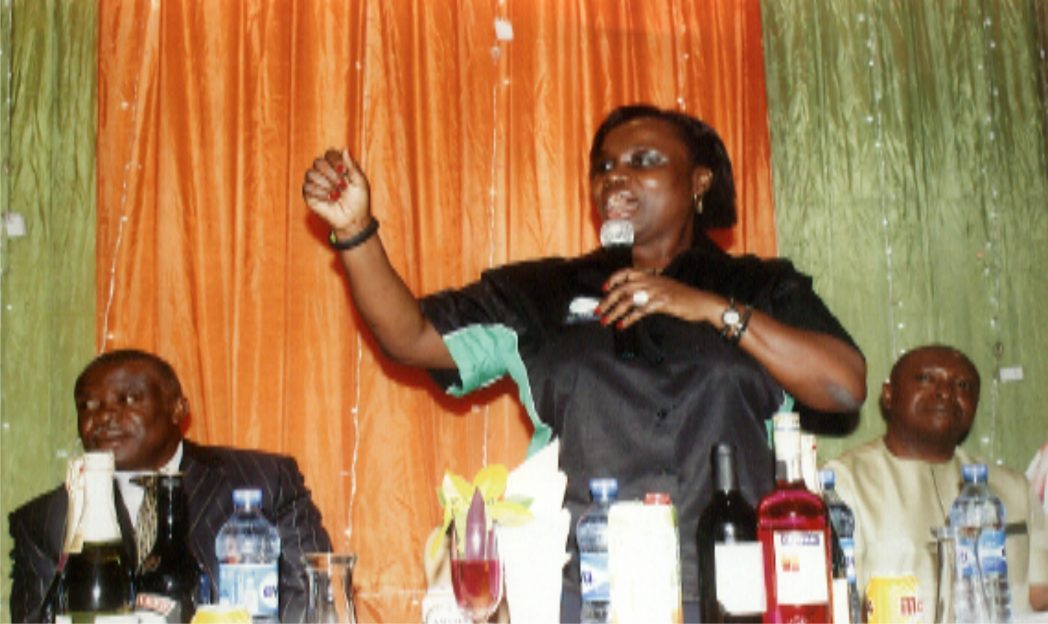

Executive Chairman, Rivers State Internal Revenue Service, Onene Osila Obele-Oshoko (middle), delivering an address, during the media dinner organised by RIRS in Port Harcourt recently. With her are board member, Sir Nelson Wali (left) and another board member, Mr. Christian Ogbowu. Photo: Egberi A. Sampson

Business

NCDMB, Jake Riley Empower 250 Youths On Vocational Skills

Business

NUJ Partners RSIRS On New Tax Law Education

Transport

Nigeria Rates 7th For Visa Application To France —–Schengen Visa

-

News7 hours ago

News7 hours agoNLC Threatens Nationwide Protest Over Electoral Act Amendment

-

News7 hours ago

News7 hours agoTinubu Embarks On Two-Day State Visit To UK, March 18

-

Maritime5 hours ago

Maritime5 hours agoCustoms Hands Over Seized Cannabis Worths N4.7bn To NDLEA

-

Maritime6 hours ago

Maritime6 hours agoOver 6,223 Seafarers Abandoned In 2025 – Says ITF

-

Oil & Energy5 hours ago

Oil & Energy5 hours agoTake Concrete Action To Boost Oil Production, FG Tells IOCs

-

Editorial5 hours ago

Editorial5 hours agoSustaining OBALGA’s Ban On Street Trading

-

Politics5 hours ago

Politics5 hours agoI DEFECTED OUT OF CONVICTION …NO ONE COULD’VE IMPEACHED MY LATE DEPUTY ~ DIRI

-

Oil & Energy5 hours ago

Oil & Energy5 hours agoPETROAN Cautions On Risks Of P’Harcourt Refinery Shutdown