Business

FG Begins 40% Workers’ Pay Rise Against Subsidy Removal

The Federal Government is set to begin payment of the planned increase in civil servants’ pay by the end of this month, The Tide source reports.

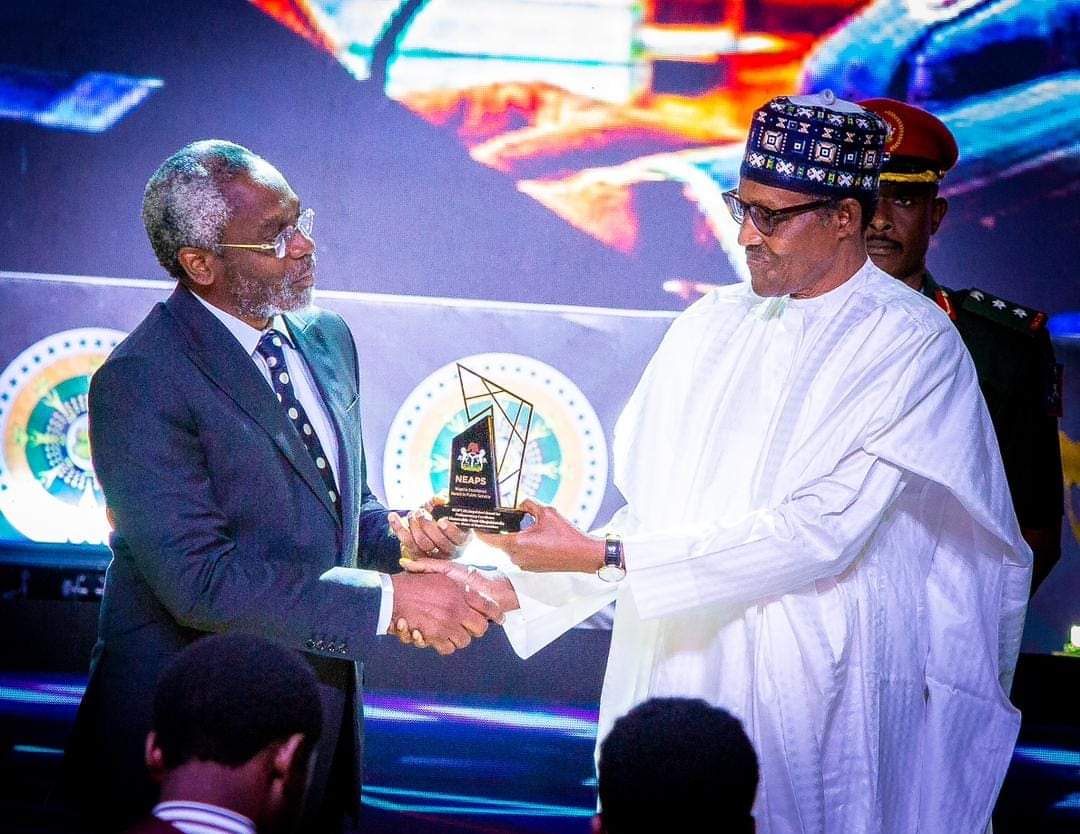

According to the source, President MuhammaAdu Buhari is expected to give his final assent for disbursement any moment.

If the proposal sails through, it means the increase will be coming about two months to the June date proposed for the removal of petrol subsidy.

The source further noted that the fresh pay increase, tagged “consequential allowance”, would lead to a 40 per cent rise in the current pay of Federal Government workers.

The Director of Press and Public Relations, Ministry of Labour and Employment, Olajide Oshundun, who revealed this to the source, said the Federal Government might begin payment of the 40 per cent pay rise by the end of April this year, adding that the three months arrears of January, February and March would be paid at a later date.

Oshundun said, “Consequential allowance salaries will be increased by 40 per cent for civil servants from level 1 to level 17.

“What we receive now is called ‘consolidated public service salary structure’, it is the combination of basic and all allowances. So, the increase will be 40 per cent of what a public servant is earning now.

“They will start paying from the end of this month (April) and the arrears of January, February and March will be paid later.

“The salary increase is effective from January 2023. That is the proposal submitted by the committee set up to look into salary adjustment for civil servants, but am not sure if the President has signed it yet”.

Last month, the Minister of Labour and Employment, Chris Ngige disclosed that the Federal Government had approved a pay raise for civil servants in the country.

He added that the pay rise had been included in the 2023 budget, noting that it would take effect from January 1, 2023.

Ngige described the pay raise as a peculiar allowance for civil servants in view of the current economic reality and it is meant to help government workers to cushion the effects of rising inflation, rising cost of living, hikes in transportation fare, housing and electricity tariffs.

The source reports that Nigeria’s headline inflation increased to 22.04 per cent year-on-year in March, the highest rate since September 2005.

According to the National Bureau of Statistics data, the latest rise in inflation rate is the third consecutive increase this year, increasing by 0.13 per cent points when compared to the February 2023 headline inflation rate.

The NBS added that the cost of food and beverages contributed significantly to overall inflation.

“The contributions of items on the divisional level to the increase in the headline index are food and non-alcoholic beverages (11.42 per cent); housing, water, electricity, gas, and other fuel (3.69 per cent); clothing and footwear (1.69 per cent); transport (1.43 per cent); furnishings, household equipment and maintenance (1.11 per cent); education (0.87 per cent); health (0.66 per cent); miscellaneous goods and services (0.37 per cent); restaurant and hotels (0.27 per cent); alcoholic beverage, tobacco and kola (0.24 per cent); recreation and culture (0.15 per cent) and communication (0.15 per cent),” the NBS report added.

Transport

Automated Points Concession : FAAN Workers Gave 72hrs To Revise Decisions In PH

Transport

FAAN Announces Pick-Up Points for Go-Cashless Cards

Business

Fidelity Bank To Empower Women With Sustainable Entrepreneurship Skills, HAP2.0

-

Politics4 days ago

2027: NIGERIANS FAULT INEC ON DIGITAL MEMBERSHIP REGISTER DIRECTIVE

-

Environment4 days ago

Environment4 days agoLAWMA Director Says Sweeping Reforms Have Improved Waste Collection

-

Politics4 days ago

LP Crisis: Ex-NWC Member Dumps Dumps Abure Faction

-

Politics4 days ago

Politics4 days agoUmahi Dismisses Allegations On Social Media, Insists On Projects Delivery

-

Sports4 days ago

Sports4 days agoAbia Not Sure To Secure continental Ticket

-

Politics4 days ago

NATASHA ELECTRIC VEHICLES INITIATIVE IN KOGI CENTRAL

-

Sports4 days ago

La Liga: Yamal Records First Career Hat-trick

-

Sports4 days ago

Sports4 days agoPSG Extend Lead In Ligue 1