Business

Prepare Nigerians For Subsidy Removal, Stakeholders Urge FG

Some Nigerian stakeholders have urged the Federal Government (FG) to prepare the Nigerian masses for higher fuel prices that will follow the removal of the petrol subsidy in the years ahead.

Some of the stakeholders who interacted with The Tide on the subsidy removal said it is the responsibility of the government, economic think-tanks, the media, and labour unions to prepare Nigerians for post-subsidy fuel prices coming ahead.

While some fingered the government, others said it was the responsibility of all, particularly labour unions, media and economic think-tanks.

An Economist with UT Finance Limited, Dr Dennis Chukwu, in his response to the issue, said there is need to properly communicate to Nigerians on the planning for what is going to be a major change in the system.

He said a collective effort was required from the perspective of government in terms of a policy reform.

”And, the media, as one of the most powerful tools that can communicate change, and articulate the right message to support necessary adjustments to a post-fuel subsidy Nigeria”, he said.

Also responding seperately, a developmental economist, Joseph Ameh, said Economic Think-Tanks have a role in explaining the economic implications to Nigerians, especially for those at the “bottom of the pyramid”, who constitute the masses.

According tohim, it is basically the job of the government to explain to the public why, and how the policy will be carried out, to reassure to the people.

“If government is not taking the lead in this, then it is not going to work. We do not have enough revenues to service our debts. Our revenues are down because we are paying subsidies and NNPC has remitted little to nothing to the Federation Account.

“The government is violating the Fiscal Responsibility Act. If there is no political will from the government, then we will still be talking about fuel subsidies next year.” he said.

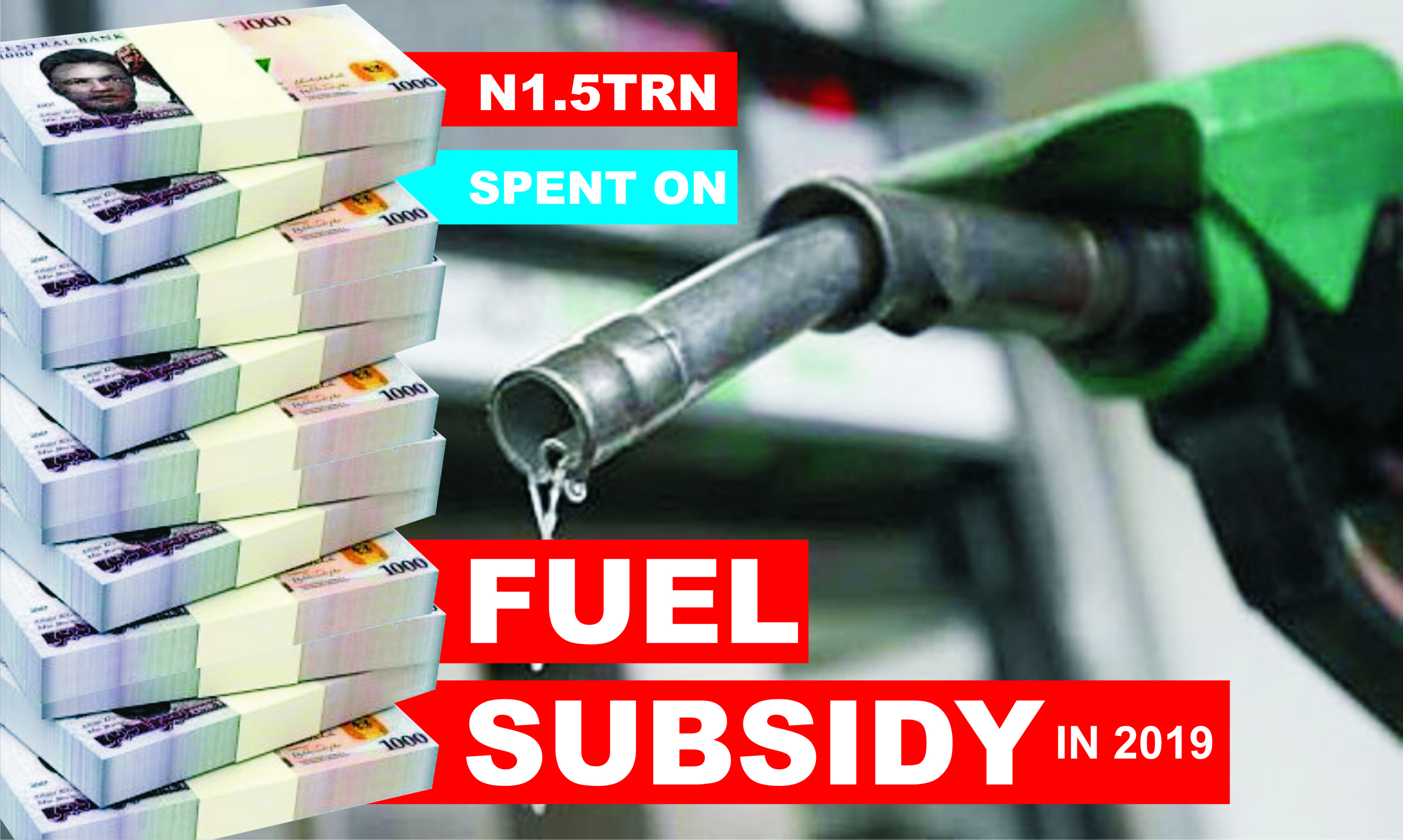

Meanwhile, dwindling national resources has taken a huge toll on the economy with the government suggesting harsher fiscal times to come in 2023, if fuel subsidies are retained.

The Minister of Finance and National Planning, Zainab Ahmed, had said the government’s budget deficit was expected to exceed N12.42 trillion if petroleum subsidies were maintained for the entire 2023 fiscal cycle.

Ahmed had disclosed this while appearing before the House of Representatives Committee on Finance to defend the 2023-2025 Medium Term Expenditure Framework (MTEF) and Fiscal Strategy Paper (FSP).

She said the Federal Government planned to borrow over N11 trillion and sell national assets to finance the budget deficit in 2023.

On his part, an Associate Professor of economics at the Federal University, Wukari, Taraba State, Frank Michah, while speaking to aviation correspondents at the Port Harcourt International Airport recently on the state of Nigerian economy, had said Nigeria’s revenue to GDP is nine per cent, while Ghana’s is 13 per cent, noting that Nigeria is seven times Ghana’s population of 31 million.

According to him, Kenya and Angola have revenue-to-GDP ratios of 16.6 per cent and 20.9 per cent respectively, adding that Nigeria does not also collect enough taxes as its tax to GDP is nine per cent, with the least recorded in 2016.

By: Corlins Walter

Business

Agency Gives Insight Into Its Inspection, Monitoring Operations

Business

BVN Enrolments Rise 6% To 67.8m In 2025 — NIBSS

The Nigeria Inter-Bank Settlement System (NIBSS) has said that Bank Verification Number (BVN) enrolments rose by 6.8 per cent year-on-year to 67.8 million as at December 2025, up from 63.5 million recorded in the corresponding period of 2024.

In a statement published on its website, NIBSS attributed the growth to stronger policy enforcement by the Central Bank of Nigeria (CBN) and the expansion of diaspora enrolment initiatives.

NIBSS noted that the expansion reinforces the BVN system’s central role in Nigeria’s financial inclusion drive and digital identity framework.

Another major driver, the statement said, was the rollout of the Non-Resident Bank Verification Number (NRBVN) initiative, which allows Nigerians in the diaspora to obtain a BVN remotely without physical presence in the country.

A five-year analysis by NIBSS showed consistent growth in BVN enrolments, rising from 51.9 million in 2021 to 56.0 million in 2022, 60.1 million in 2023, 63.5 million in 2024 and 67.8 million by December 2025. The steady increase reflects stronger compliance with biometric identity requirements and improved coverage of the national banking identity system.

However, NIBSS noted that BVN enrolments still lag the total number of active bank accounts, which exceeded 320 million as of March 2025.

The gap, it explained, is largely due to multiple bank accounts linked to single BVNs, as well as customers yet to complete enrolment, despite the progress recorded.