Business

LG Boss Harps On Protection Of Investments …Says Security, Council’s Priority

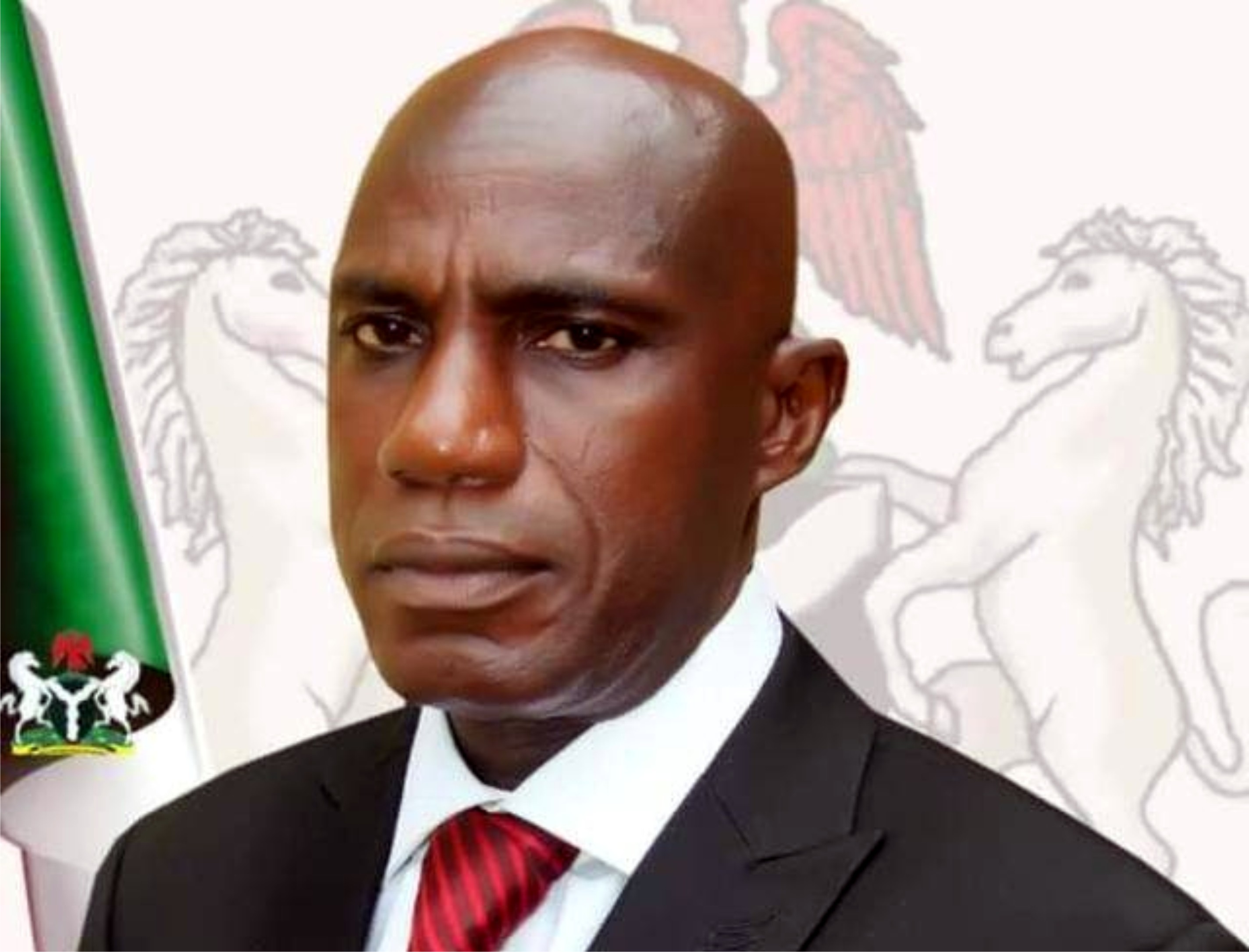

The Chairman of Eleme Local Government Area of Rivers State, Hon. Philip Okparaji, has reiterated the importance of security to investors.

Hon. Okparaji in an exclusive interview with The Tide at the council recently, said that the protection of investments and the lives of the workers, serve as an attraction point to an average investor.

“An investor cannot invest where there is crisis. An average investor looks for where there is security of investment and that is why security is our priority.

“We have been able to curtail the crime rate because of effective police monitoring. We have robust and effective partnership with security agencies in the state to ensure that lives and property are protected within the LGA”, he said.

On the progress of Eleme Employment Bureau, the Chairman said the committee has concluded the stage of data collection.

He noted that the committee is working hard to meet up their terms of reference, adding that “Eleme is one of the areas that have many unemployed youths.

“There are many companies in Eleme and even outsiders who come to look for jobs in the companies, reside here when they fail to secure the jobs”.

Responding to the challenges in the council, the Chairman said that “every great leader faces challenges”.

He reiterated his focus and determination to overcome the challenges and take the LGA to an enviable height before the end of his tenure.

By: Lilian Peters

Business

Agency Gives Insight Into Its Inspection, Monitoring Operations

Business

BVN Enrolments Rise 6% To 67.8m In 2025 — NIBSS

The Nigeria Inter-Bank Settlement System (NIBSS) has said that Bank Verification Number (BVN) enrolments rose by 6.8 per cent year-on-year to 67.8 million as at December 2025, up from 63.5 million recorded in the corresponding period of 2024.

In a statement published on its website, NIBSS attributed the growth to stronger policy enforcement by the Central Bank of Nigeria (CBN) and the expansion of diaspora enrolment initiatives.

NIBSS noted that the expansion reinforces the BVN system’s central role in Nigeria’s financial inclusion drive and digital identity framework.

Another major driver, the statement said, was the rollout of the Non-Resident Bank Verification Number (NRBVN) initiative, which allows Nigerians in the diaspora to obtain a BVN remotely without physical presence in the country.

A five-year analysis by NIBSS showed consistent growth in BVN enrolments, rising from 51.9 million in 2021 to 56.0 million in 2022, 60.1 million in 2023, 63.5 million in 2024 and 67.8 million by December 2025. The steady increase reflects stronger compliance with biometric identity requirements and improved coverage of the national banking identity system.

However, NIBSS noted that BVN enrolments still lag the total number of active bank accounts, which exceeded 320 million as of March 2025.

The gap, it explained, is largely due to multiple bank accounts linked to single BVNs, as well as customers yet to complete enrolment, despite the progress recorded.