Business

Caution Your Men Against Attacks On Traders, Association Tells CP

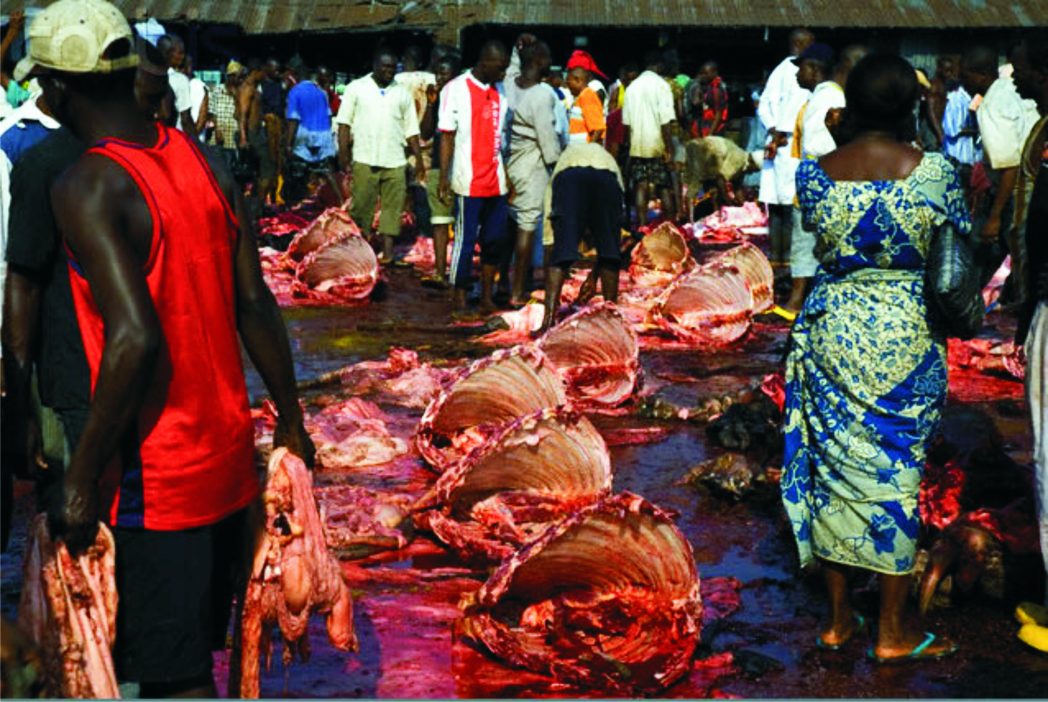

Traders at the Slaughter Market, Port Harcourt, have called on the Rivers State Police Commissioner, Mustapha Dandaura, to caution his men attached to the Rivers State Task Force on Street Trading, Illegal Markets and Motor Parks against unnecessary attacks on traders.

The Secretary, Meat Sellers Association, Slaughter Market chapter, Mr ThankGod Amadi, made the call while reacting to the destruction of some vehicles around the slaughter axis of the state by persons suspected to be members of the task force, last Saturday.

According to him, some men donning the task force vest stormed the park situated at the market last Saturday and unleashed terror on vehicles parked within.

“I’m calling on the Commissioner of Police of Rivers State Command, to call his men to order. If you watch these men in task force, some of them have cutlasses, some of them carry other offensive weapons. We understand offensive weapon is not permitted by any human apart from the law enforcement agency, but these boys use offensive weapons in the name of task force,” he said.

Some commercial drivers on the Slaughter/Woji/Artillery route alleged that an official of the Slaughter branch of the task force, Mr Uzoma Julius, led policemen to the park at the Slaughter Market last Saturday and destroyed the wind shields of more than 36 vehicles parked within the park.

They complained that the task force has refused to show them designated areas where commercial drivers could pick and drop passengers, but only derive joy in chasing them away.

Amadi said, “we’re not expecting all this. The chairman of the task force, Julius Uzoma, while we were just sitting here, we saw him with boys carrying machetes; so for our safety purpose,we just ran away, we don’t know what happened”.

However, the state coordinator of the taskforce, Mr Bright Amaewhule, in a chat with newsmen, denied that his men destroyed vehicles around the slaughter axis of Port Harcourt at the weekend.

He stated that the vehicles were destroyed by hoodlums who attacked officials of the task force around slaughter.

“Last weekend to be precise, while my men were on operation within Trans Amadi axis, some hoodlums and cult members who operate within that Trans Amadi roundabout axis, on sighting our task force boys went after them and they had to resist their attacks. They now ran into that area where stones were being used to attack them.

“Even our own vehicle was vandalised, some of the vehicles which were parked around that area were now attacked, their wind screens were now hit by the stones. That is what my zonal leaders in that area informed me about”, Amaewhule said.

Tonye Nria-Dappa

Business

Agency Gives Insight Into Its Inspection, Monitoring Operations

Business

BVN Enrolments Rise 6% To 67.8m In 2025 — NIBSS

The Nigeria Inter-Bank Settlement System (NIBSS) has said that Bank Verification Number (BVN) enrolments rose by 6.8 per cent year-on-year to 67.8 million as at December 2025, up from 63.5 million recorded in the corresponding period of 2024.

In a statement published on its website, NIBSS attributed the growth to stronger policy enforcement by the Central Bank of Nigeria (CBN) and the expansion of diaspora enrolment initiatives.

NIBSS noted that the expansion reinforces the BVN system’s central role in Nigeria’s financial inclusion drive and digital identity framework.

Another major driver, the statement said, was the rollout of the Non-Resident Bank Verification Number (NRBVN) initiative, which allows Nigerians in the diaspora to obtain a BVN remotely without physical presence in the country.

A five-year analysis by NIBSS showed consistent growth in BVN enrolments, rising from 51.9 million in 2021 to 56.0 million in 2022, 60.1 million in 2023, 63.5 million in 2024 and 67.8 million by December 2025. The steady increase reflects stronger compliance with biometric identity requirements and improved coverage of the national banking identity system.

However, NIBSS noted that BVN enrolments still lag the total number of active bank accounts, which exceeded 320 million as of March 2025.

The gap, it explained, is largely due to multiple bank accounts linked to single BVNs, as well as customers yet to complete enrolment, despite the progress recorded.