Business

LCCI, KPMG Task Govt On VAT Increase

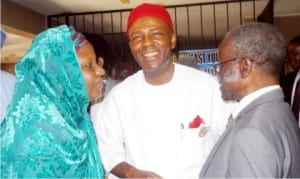

L-R: Permanent Secretary, Federal Ministry of Science and Technology, Dr Lawal Habiba; Minister of Science and Technology, Dr Ogbonnaya Onu and the President, Nigeria Academy of Engineering (NAE), Prof. Raifu Salawu, during a courtesy visit of NAE’s delegation to the Minister in Abuja, yesterday

The Lagos Chamber of Commerce and Industry (LCCI) yesterday said there was a need to boost the nation’s internally generated revenue through higher consumption tax.

The Director-General of LCCI, Mr Muda Yusuf, told newsmen in Lagos that emphasis on tax revenue generation should shift to consumption tax.

He suggested that tax should shift from taxes on investors and entrepreneurs to taxing consumption of some products and services.

Yusuf spoke against the backdrop of the recommendation of the IMF Managing Director, Christine Lagarde, that Nigeria should increase its VAT.

According to him, the ratio of tax to GDP in Nigeria is one of the lowest in the world.

Yusuf said that imposition of VAT in Nigeria should be in favour of the poor by exempting some goods consumed by the poor.

“This is necessary so that they do not compound the poverty rate challenges in the country”.

The LCCI chief also called for more efficient tax administration in the country by plugging all loopholes for tax evasion.

“Presently, those paying tax are in the formal sector. There has to be a framework to ensure that those in the informal sector also pay tax to boost tax revenue.”

Mr Ayo Salami, a tax expert at KPMG, also told newsmen that the suggestion by IMF was in order since VAT increase was enshrined in the National Tax Policy framework.

Salami, a Partner of Tax, Regulatory and People Services at KPMG, said that the policy laid more emphasis on indirect taxation.

According to the tax expert, less emphasis should be on direct taxation because of low cost of collection and evasion.

“The question is that if VAT rate is increased, how much the government will be willing to give back via reduction in direct tax that is corporate tax and personal income tax.

“This is to ensure that the populace is not worse off even if the government benefits in terms of tax revenue collection.”

Business

Two Federal Agencies Enter Pack On Expansion, Sustainable Electricity In Niger Delta

Business

Why The AI Boom May Extend The Reign Of Natural Gas

Business

Ogun To Join Oil-Producing States ……..As NNPCL Kicks Off Commercial Oil Production At Eba

-

Sports2 days ago

Sports2 days ago2026 WC: Nigeria, DR Congo Awaits FIFA Verdict Today

-

Environment2 days ago

Environment2 days agoOxfam, partners celebrate 5 years of climate governance programmes in Nigeria

-

Politics2 days ago

ADC, PDP, LP Missing As INEC Set For By- Elections In Rivers

-

Politics2 days ago

FG’s Economic Policies Not Working – APC Chieftain

-

Politics2 days ago

Politics2 days ago2027: Diri Unveils RHA LG Coordinators, APC Congress Panel

-

Politics2 days ago

Politics2 days agoReps To Meet,’Morrow Over INEC’s 2027 Election Timetable

-

Politics2 days ago

Politics2 days agoGroup Continues Push For Real Time Election Results Transmission

-

Sports2 days ago

Sunderland Overcome Oxford Challenge