Business

Consumers Lament Food Prices In PH

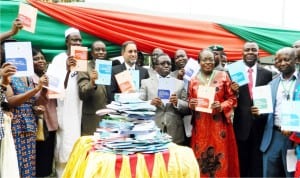

Minister of Health, Prof. Isaac Adewole (middle); Acting Director General, National Agency for Food and Drug Administration Control (Nafdac), Mrs Yetunde Oni (3rd right) and World Health Organisation Country representative, Dr Rui Vaz, at the unveiling of the Nafdac Good Manufacturing Practice Guidelines for Pharmaceutical Products 2016 in Abuja on Tuesday last week.

A cross section of con

sumers of food stuff in Port Harcourt, the Rivers State capital have been lamenting over the price increase on such items, saying the situation is drastically affecting their livelihood.

The consumers, who barred their mind in an interview with The Tide in Port Harcourt at the weekend, said the increase in prices of food stuff was not unconnected with the lingering fuel scarcity across the country.

According to them, the after – effect of the fuel scarcity is seriously affecting them as transporters hike fares while transporting their goods and wares.

They said that government should address the issue of fuel scarcity in order to save the consumers from these untold hardship.

Sister Gloria Alao said the effect of the fuel scarcity is weighing seriously on the consumers as they expend more money to purchase their daily needs.

Alao opined that they are paying for what they did not bargain for as there is 100 per cent increase in most food stuff they bought in the market and elsewhere.

In her reaction, Mrs Abigail Ufoma Jonah, said the sudden increase in prices of food stuffs in the market is really a source of concern to many families as some could not afford it due to the hash economy.

According to her, if government solves the issue of fuel scarcity, the prices of food stuff would drastically reduce as those traders going to the interior to get the stuffs would now pay less to transport them.

Stephen Ibifaa also lamented that food stuff had gone high due to the fuel scarcity and the bitting economy, and called for a lasting solution to save the common people in the society.

Alapakabia Inumama, in her reaction said the rising prices of food stuffs had been a great concern to the masses who are at the receiving end especially the consumers, and appealed for restoration of normalcy in all sectors of the economy.

Transport

Automated Points Concession : FAAN Workers Gave 72hrs To Revise Decisions In PH

Transport

FAAN Announces Pick-Up Points for Go-Cashless Cards

Business

Fidelity Bank To Empower Women With Sustainable Entrepreneurship Skills, HAP2.0

-

Politics5 days ago

2027: NIGERIANS FAULT INEC ON DIGITAL MEMBERSHIP REGISTER DIRECTIVE

-

Politics5 days ago

LP Crisis: Ex-NWC Member Dumps Dumps Abure Faction

-

Politics5 days ago

Politics5 days agoUmahi Dismisses Allegations On Social Media, Insists On Projects Delivery

-

Environment5 days ago

Environment5 days agoLAWMA Director Says Sweeping Reforms Have Improved Waste Collection

-

Politics5 days ago

NATASHA ELECTRIC VEHICLES INITIATIVE IN KOGI CENTRAL

-

Sports5 days ago

Sports5 days agoAbia Not Sure To Secure continental Ticket

-

Politics5 days ago

IT’S A LIE, G-5 GOVS DIDN’T WIN ELECTION FOR TINUBU – SOWUNMI

-

Sports5 days ago

La Liga: Yamal Records First Career Hat-trick