Column

Challenges Of NIN Registration

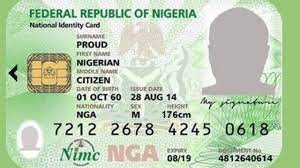

National Identity Number (NIN) registration has been in existence for over a decade now but in recent time its process has become a disturbing issue to a lot of Nigerians.On daily basis, people are faced with a lot of challenges in the process of getting enrolled at the National Identity Management Commission (NIMC) offices across the country.

Due to difficulty encountered by many, Nigerians have been demanding a better organisation of the procedure for enrollment, especially from last year when the Federal Government directed that, for any individual to have access to a lot of things, they must present their NIN.

Since this initiative began and with the challenges many are facing, a lot of questions have been asked concerning what Federal Government really wants to achieve even with the possession of all other identification documents available.

There are several databases gathered over the years about Nigerians. The Government should have synergised with institutions that have people’s data already instead of subjecting them to hardship.Early this year, some unsuspecting enrollees were allegedly attacked by hoodlums at NIMC office on Aba Road in Port Harcourt. Some persons, according to reports, were said to have lost their personal effects to the hoodlums who shot sporadically on that fateful day.

Most people above 18 years of age possess driver’s licence. Their data are with the Federal Road Safety Commission (FRSC). During the time of obtaining Bank Verification Number (BVN), it was also hectic as people spent several hours at the banks to obtain such, especially when government directed that every account holder must have BVN. The BVN is enough since it involves thump printing by the person and after the capture, the bearer’s picture appears on the printed paper.

There was a time when everyone was asked to register their Subscriber Identity Module (SIM) card or phone numbers otherwise they risk disconnection from the Telecom operators. A lot of people encountered problems. Telecoms offices were crowded because of the exercise. The process involved data gathering about the user.

I’m thinking that Federal Government should have used the data gathered through those processes for whatever reasons they may be needed for. In each of these processes, enough information is got about every Nigerian upto the village where the person comes from.

During voter registration exercises, personal data collected about every eligible voter is with Independent National Electoral Commission (INEC).

So,the Federal Government should use information gathered through international passports, BVN, driver’s licence, voter’s card and SIM number. Information from these will definitely help government fight crime since that is what the government wants to achieve, including monitoring of financial transactions in the banks.

The stress involved in queuing for many hours at the NIMC offices cannot be imagined. One can be there from 7:00am to 6:00pm. Sometimes the staff are not enough to capture people. They also complain of lack of materials. The management said any member of staff who involves in bribery should be reported. But it has continued till now even as it is supposed to be free.

I know of someone who just walked into a chief’s palace in one of the South-South states and was conveniently registered and obtained a green labelled slip without spending any kobo that same day.

In this period of COVID-19 pandemic, people gather in their numbers without observing the protocols. Even the staff need social distancing.

Now a Federal High Court in Lagos State has barred the Federal Government from blocking the SIM cards not linked with NIN. The Ministry of Communication and Digital Economy had earlier asked the Nigeria Communication Commission (NCC) to block all SIM cards not linked by April 9th, 2021.

The court ordered that the deadline be extended by two months from the day of the judgement. It declared that with the rising cases of COVID-19 pandemic in Nigeria, the deadline given to over 200 million Nigerians to register and link their NIN with SIM cards would lead to a rush and cause problems.

This has, therefore, led to a lot of reactions from many quarters as the importance attached to NIN registration, despite other data registration and capture by relevant authorities through other means, cannot be imagined. For me, the extension will help reduce the difficulty encountered during registration. Those who have not should use this period of extension to get themselves registered. At least, two months is a whole lot for any serious-minded person considering its importance. The extension should be seen as a way of reducing clustering.

As we can see in Nigeria today, NIN is useful virtually in almost all the things we do. The relevant authorities must have looked at the need critically before such policy was introduced. Although the NIN registration started before the outbreak of the pandemic, but the government should not place a timeline. It should be left open so that people can register at their pace.

The process can be stress-free if government decentralises the centres. More centres should be created with enough personnel even if it involves ad hoc staff. Institutions like the banks, traditional rulers’ palaces, health centres and less busy outfits should be equipped for use as it will help reduce crowd at the major offices like the one on Aba Road in Port Harcourt.

One of the problems some people had was that the policy was introduced during President Olusegun Obasanjo’s tenure. As time went on, slips that were issued then were declared invalid by the same NIMC. So, when the issue of registration came up again, it was looked at from that negative perspective. What came to people’s mind was that it will also become invalid in future.

I think this is where the relevant agencies have to come in, to create more awareness on the need to acquire NIN.

The Federal Government felt that NIN serves as identification instrument for every Nigerian so that wherever anybody goes, if he needs assistance, it will be easy to track him using the number.

By: Eunice Choko-Kayode

Column

Are the Bears Wrong About the Looming Glut in Oil?

Column

Renewable Energy Faces Looming Workforce Crisis

Column

Is It End For Lithium’s Reign As Battery King?

-

News2 days ago

News2 days agoDon Lauds RSG, NECA On Job Fair

-

Transport6 hours ago

Transport6 hours agoNigeria Rates 7th For Visa Application To France —–Schengen Visa

-

Transport6 hours ago

Transport6 hours agoWest Zone Aviation: Adibade Olaleye Sets For NANTA President

-

Rivers5 hours ago

Fubara Restates Continued Support For NYSC In Rivers

-

Niger Delta3 hours ago

Niger Delta3 hours agoPDP Declares Edo Airline’s Plan As Misplaced Priority

-

Oil & Energy6 hours ago

Oil & Energy6 hours agoElectricity Consumers Laud Aba Power for Exceeding 2025 Meter Rollout Target

-

Transport7 hours ago

Transport7 hours agoWhy Air Fares Increaseing, Other Related Challenges……. A O N Spokesperson.

-

News5 hours ago

News5 hours agoDiocese of Kalabari Set To Commence Kalabari University