Business

Export Refined Raw Materials, Expert Urges FG

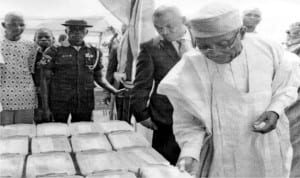

Minister of Agriculture, Chief Audu Ogbeh (right), inspecting some agricultural products at the 2016 National Agricultural Show in Keffi, Nasarawa last Tuesday.

Materials Science and

Technology Society of Nigeria(MSN) has called on the Federal Government to increase its foreign exchange earnings by ensuring that only refined raw materials and minerals are exported.

The President of the society, Prof. Abdul-Kareem Ahmed, made the call yesterday during an interview with newsmen in Abuja.

According to him, the nation should be processing its raw materials into finished products and even go as far as advanced materials to maximise their usefulness.

It would be recalled that raw materials or mineral resources become advanced once they are processed into higher modification for superior performance.

“We want government, the private sector and other stakeholders to come together and make contributions toward acquiring necessary equipment to be able to produce the advance materials from mineral resources in the country.

“We have many raw materials in the country that can be used for advance materials.

“When you produce advance materials, you have added a lot of values and when you now export, you earn a lot of foreign exchange.

“Using the processed products in the country will also reduce importation, which means our currency will gain more value,” he said.

On availability of technical knowhow required to add value to abundant raw materials in the country, MSN president said that increase in research funding and training would boost indigenous expertise.

“We need to develop indigenous knowhow to be able to process these materials into advanced materials which of cause we use a lot but we import virtually all of them.

“We also need to improve on our research funding because at the moment, our researches are not good enough because we don’t have state-of the-art equipment to carry out these researches,’’ Ahmed said.

He said that the nation’s crude petroleum could be used to make many petroleum base materials like polyethylene resin a derivable from ethylene, a by-product of crude petroleum.

Ahmed said that the same value could be added to iron ore in the nation, saying “our iron ore can also be refined to make super alloyed”.

The association president said that MSN would continue to organise conferences, lectures and workshops for its members and other stakeholders in the country.

“These workshops and trainings will increase the proficiencies of its members and make them to be more in tuned with the technical knowhow of refining raw materials locally,’’ he said.

President Muhamadu Buhari had said during the inauguration of his government in May 29, 2015, that he would ensure diversification of the economy to reduce dependence on oil.

Business

Agency Gives Insight Into Its Inspection, Monitoring Operations

Business

BVN Enrolments Rise 6% To 67.8m In 2025 — NIBSS

The Nigeria Inter-Bank Settlement System (NIBSS) has said that Bank Verification Number (BVN) enrolments rose by 6.8 per cent year-on-year to 67.8 million as at December 2025, up from 63.5 million recorded in the corresponding period of 2024.

In a statement published on its website, NIBSS attributed the growth to stronger policy enforcement by the Central Bank of Nigeria (CBN) and the expansion of diaspora enrolment initiatives.

NIBSS noted that the expansion reinforces the BVN system’s central role in Nigeria’s financial inclusion drive and digital identity framework.

Another major driver, the statement said, was the rollout of the Non-Resident Bank Verification Number (NRBVN) initiative, which allows Nigerians in the diaspora to obtain a BVN remotely without physical presence in the country.

A five-year analysis by NIBSS showed consistent growth in BVN enrolments, rising from 51.9 million in 2021 to 56.0 million in 2022, 60.1 million in 2023, 63.5 million in 2024 and 67.8 million by December 2025. The steady increase reflects stronger compliance with biometric identity requirements and improved coverage of the national banking identity system.

However, NIBSS noted that BVN enrolments still lag the total number of active bank accounts, which exceeded 320 million as of March 2025.

The gap, it explained, is largely due to multiple bank accounts linked to single BVNs, as well as customers yet to complete enrolment, despite the progress recorded.

Business

AFAN Unveils Plans To Boost Food Production In 2026

-

Sports4 days ago

Sports4 days agoTinubu Lauds Super Eagles’ after AFCON bronze triumph

-

Sports4 days ago

Sports4 days agoAFCON: Lookman gives Nigeria third place

-

Sports4 days ago

Sports4 days agoFulham Manager Eager To Receive Iwobi, Others

-

Sports4 days ago

Sports4 days ago“Mikel’s Influence Prevent Some Players Invitation To S’Eagles Camp”

-

Sports4 days ago

Sports4 days agoMan of The Match award Excites Nwabali

-

Sports4 days ago

Sports4 days agoRemo, Ikorodu set for NPFL hearing, Today

-

Sports4 days ago

Sports4 days agoPolice Games: LOC inspects facilities in Asaba

-

Niger Delta4 days ago

Niger Delta4 days agoINC Polls: Ogoriba Pledges To Continuously Stand For N’Delta Rights … Picks Presidential Form