Business

NHF: Civil Servants Task FMBN On Accomodation

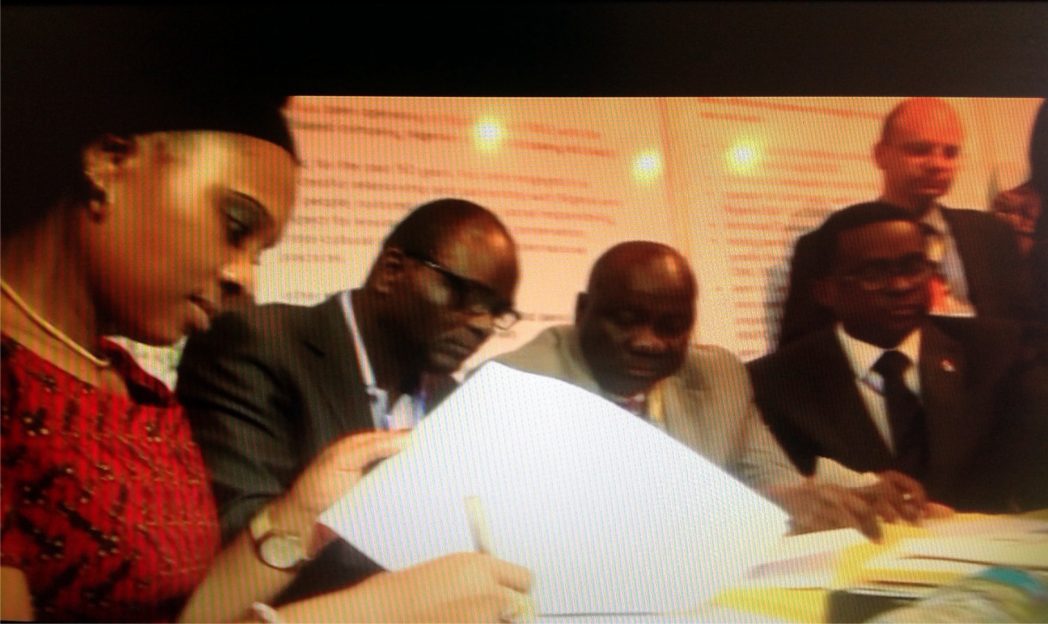

The General Manager, Nigerian Content Development/Nigerian Agip Oil Company, Mrs Callista Azogu (1st right) signing the M.o. U between Nigerian Agip Exploration and Petroleum Technology Association of NIgerian while others watch, recently in Port Harcourt

Civil Servants in Rivers

State have appealed to the management of the Federal Mortgage Bank of Nigeria (FMBN) to ensure that its promise of accommodation through the National Housing Fund was fulfilled.

Some civil servants who spoke with The Tide in Port Harcourt at the weekend said they were weary of such promise which always ended in the pages of newspapers.

One Mrs Ibilagba West said that over the years, some ‘smart’ people in the banking industry have used such means to dupe civil servants of their hard earned income.

She regretted that the workers have now become a platform to execute all sorts of transactions. West, said if the FMBN are claiming to be sincere in their promise, they should commence the first phase of the project before the end of the first quarter of next month.

According to her, executors of such ventures also capitalise on the plights of the average Nigerian worker to rob them of some other attainable benefits, while calling on the Labour Congress to set up machineries that will henceforth regulate such promises.

Another respondent, Mr Joe Ogbu blamed the situation on the inability of the government to provide some basic needs of its workers.

He recalled that in the Western world, things like accommodation have been almost forgotten issue, due to the level of attention given to it.

Ogbu, also tasked those in authority to as a matter of urgency, draw attention to the welfare of the workers.

Concerning the issue of ATM card issuance as promised by FMBN to the contributors of the National Housing Fund in June, the civil servants called on Bank to expedite action, maintaining that they were tired of what they described as too much explanations.

They argued that since the workers are the main source of the country’s economic productivity, it would be a healthy practice to also make them the first partakers of every other of its benefits.

They also described as pitiable a situation where most civil servants retire with nothing to show for it, adding that something meaningful ought to be done.

FMBN, had promised to give out loan of up to the tune N15 million, to stretch within 30 years with an interest rate of six per cent.

Business

Agency Gives Insight Into Its Inspection, Monitoring Operations

Business

BVN Enrolments Rise 6% To 67.8m In 2025 — NIBSS

The Nigeria Inter-Bank Settlement System (NIBSS) has said that Bank Verification Number (BVN) enrolments rose by 6.8 per cent year-on-year to 67.8 million as at December 2025, up from 63.5 million recorded in the corresponding period of 2024.

In a statement published on its website, NIBSS attributed the growth to stronger policy enforcement by the Central Bank of Nigeria (CBN) and the expansion of diaspora enrolment initiatives.

NIBSS noted that the expansion reinforces the BVN system’s central role in Nigeria’s financial inclusion drive and digital identity framework.

Another major driver, the statement said, was the rollout of the Non-Resident Bank Verification Number (NRBVN) initiative, which allows Nigerians in the diaspora to obtain a BVN remotely without physical presence in the country.

A five-year analysis by NIBSS showed consistent growth in BVN enrolments, rising from 51.9 million in 2021 to 56.0 million in 2022, 60.1 million in 2023, 63.5 million in 2024 and 67.8 million by December 2025. The steady increase reflects stronger compliance with biometric identity requirements and improved coverage of the national banking identity system.

However, NIBSS noted that BVN enrolments still lag the total number of active bank accounts, which exceeded 320 million as of March 2025.

The gap, it explained, is largely due to multiple bank accounts linked to single BVNs, as well as customers yet to complete enrolment, despite the progress recorded.

Business

AFAN Unveils Plans To Boost Food Production In 2026

-

News2 days ago

News2 days agoNigeria Has Woken Up From Slumber Under Tinubu – Shettima

-

News2 days ago

News2 days agoOji Clears Air On Appointment Of 15 Special Advisers By Fubara

-

Featured2 days ago

Featured2 days agoRivers: Impeachment Moves Against Fubara, Deputy Hits Rock …As CJ Declines Setting Up Panel

-

News2 days ago

Nigeria To Begin Exporting Urea In 2028 -NMDPRA

-

City Crime2 days ago

Health Commissioner Extols Fubara’s Commitment To Community Healthcare Delivery

-

Niger Delta2 days ago

Tinubu, Leading Nigeria To Sustainable Future – Okowa … Lauds Oborevwori Over Uromi Junction Flyover Construction

-

News2 days ago

News2 days agoEFCC Indicts Banks, Fintechs In N162bn Scams

-

News2 days ago

Situation Room Decries Senate’s Delay On Electoral Act, Demands Immediate Action