Business

IFC Plans To Invest $1.5bn In Nigeria

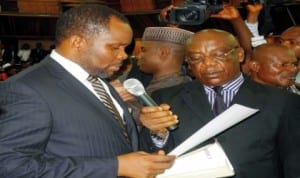

Justice Boloukurome Ugo, taking his oath at the swearing-in of new Judges of the Court of Appeal in Abuja, last Monday. Photo: NAN

The International Finance Corporation (IFC) has said it would invest $1.5bn (about N246bn) to support housing and infrastructure development in Nigeria.

The Executive Vice President of IFC, Mr Jim-Yong Cai, made this known to newsmen in Abuja shortly after a private meeting with the Minister of Finance, Dr. Ngozi Okonjo-Iweala.

Cai said the investment would focus on housing, transport and other infrastructure, especially power.

“IFC has been following what is happening in key sectors of the Nigeria’s economy and we are encouraged to join in the investment in some of them, especially housing, which is important in providing homes to many citizens.

“We are very committed to enlarging our commitment and scale up our investment in Nigeria,” he said.

IFC Country Manager in Nigeria, Mr Solomon Adegbie-Quaynor, said $255m (about N39.82bn) of the proposed investment in the country would go to Nigeria Mortgage Refinancing Company.

“The opportunity the IFC is going to bring is going to be much, but ultimately it is to make sure that NMRC as an institution is sustained.

“We are going to help in the area of public governance, formal underwriting standards, among others,” he said.

Adegbie-Quaynor added that IFC would key into what the World Bank was already doing to improve the environment and other issues in the housing sector. She added that JPMorgan is cooperating with regulators.

Transport

Automated Points Concession : FAAN Workers Gave 72hrs To Revise Decisions In PH

Transport

FAAN Announces Pick-Up Points for Go-Cashless Cards

Business

Fidelity Bank To Empower Women With Sustainable Entrepreneurship Skills, HAP2.0

-

Politics4 days ago

2027: NIGERIANS FAULT INEC ON DIGITAL MEMBERSHIP REGISTER DIRECTIVE

-

Environment4 days ago

Environment4 days agoLAWMA Director Says Sweeping Reforms Have Improved Waste Collection

-

Politics4 days ago

LP Crisis: Ex-NWC Member Dumps Dumps Abure Faction

-

Politics4 days ago

Politics4 days agoUmahi Dismisses Allegations On Social Media, Insists On Projects Delivery

-

Sports4 days ago

Sports4 days agoAbia Not Sure To Secure continental Ticket

-

Politics4 days ago

NATASHA ELECTRIC VEHICLES INITIATIVE IN KOGI CENTRAL

-

Sports4 days ago

La Liga: Yamal Records First Career Hat-trick

-

Sports4 days ago

Sports4 days agoPSG Extend Lead In Ligue 1