Business

LG Boss Promises Tax Waivers To Real Estate Firm

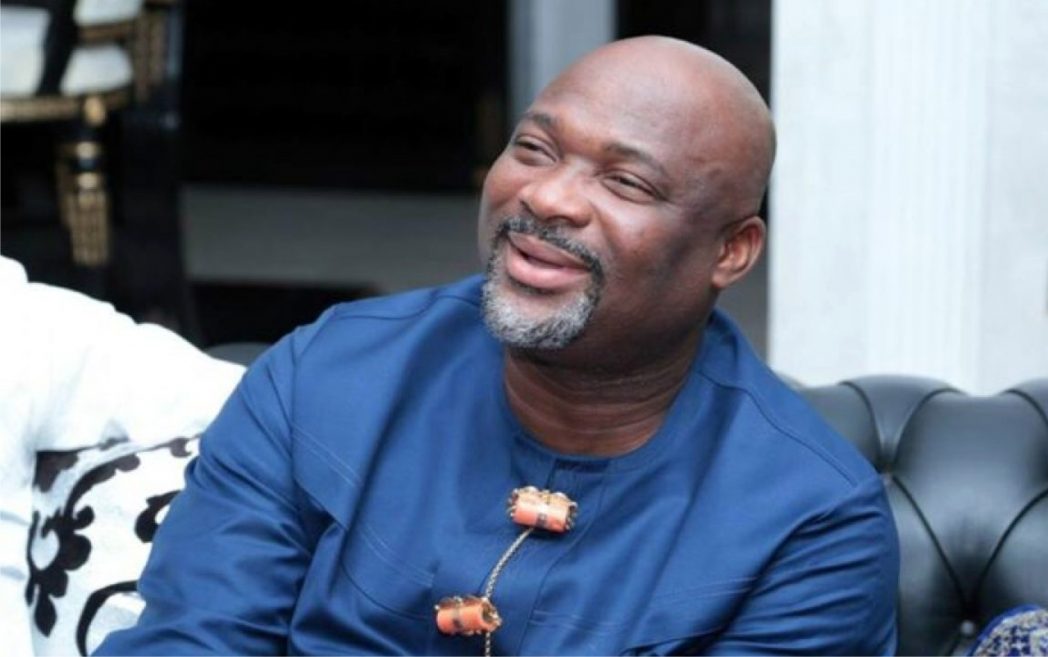

The Chairman of Emohua Local Government Area Dr. Chidi Lloyd, has promised to grant tax waivers to real estate companies willing to site their estate in any part of the area.

Lloyd, in a statement by his Press Secretary, Bright Elendu, and made available to The Tide in Port Harcourt, said his administration is open to partner real estate companies willing to invest in the area, as the council is strategically located and blessed with dry land.

The council Chairman said this at the unveiling of the operational office of Everyday Real Estate Limited in Emohua, the headquarters of Emohua council.

Lloyd described the presence of the company in the Council area as a timely development and expressed happiness that the first real estate development in the area was happening during his tenure.

Representative of the company, Ukechi Dibia, in his remarks, congratulated Lloyd on what he called his “laudable achievements” in the council within a few months of his administration while urging the people of the area to mobilise support for the council chairman to accomplish his vision

Dibia, who is one of the facilitators of the project, said the company had secured its first site in the council, precisely between Elibrada and Oduoha communities along the East-West road and would be commencing construction work soon.

Also speaking, Charles Nathaniel a director in the company, said after comprehensive and empirical research on where to site their estate, they found out that the developmental potential in the real estate business in Emohua council was untapped.

He said the company’s presence in Emohua would create direct employment for about 850 persons, following the company’s plan for N19 billion investments in real estate development in the area.

“The company discovered that the area has 90 per cent of its land on stable land, 85 per cent of the land in the area is what property developers refer to as ‘Buy and Build’, 80 per cent of the land in the area are inter-neighboured and approximately proximal, with 55 per cent of the land on the East-West road, with a friendly atmosphere and ecosystem that surrounds the environs, which the company couldn’t overlook,” he said.

He said the company’s first estate in Emohua is called “Sapphire Estate Phase II” and currently on sale along the Elibrada and Oduoha axis of the East-West road at N980,000 per plot.

Business

Fidelity Bank To Empower Women With Sustainable Entrepreneurship Skills, HAP2.0

Business

President Tinubu Approves Extension Ban On Raw Shea Nut Export

Business

Crisis Response: EU-project Delivers New Vet. Clinic To Katsina Govt.

-

City Crime5 days ago

NCSU Hails Fubara Over 2025 New Telegraph Man Of The Year Award

-

Nation5 days ago

Nigeria Risks Drifting Without Strong Education Policies-Don

-

Nation5 days ago

Ex-UNIPORT SUG Leaders Organise Symposium In Honour Of VC

-

Nation5 days ago

Council Chairman Reconstitutes Revenue, Anti-Illegal Trading Committees To Boost IGR

-

Education4 days ago

Education4 days agoElga boss tasks law students on academics strides

-

News1 day ago

News1 day agoAmend Constitution To Accommodate State Police, Tinubu Tells Senators

-

Politics1 day ago

Politics1 day agoSenate Urges Tinubu To Sack CAC Boss

-

Business1 day ago

President Tinubu Extends Raw Shea Nuts Export Ban To 2027