Business

Governors Lament Rising Petroleum Subsidy

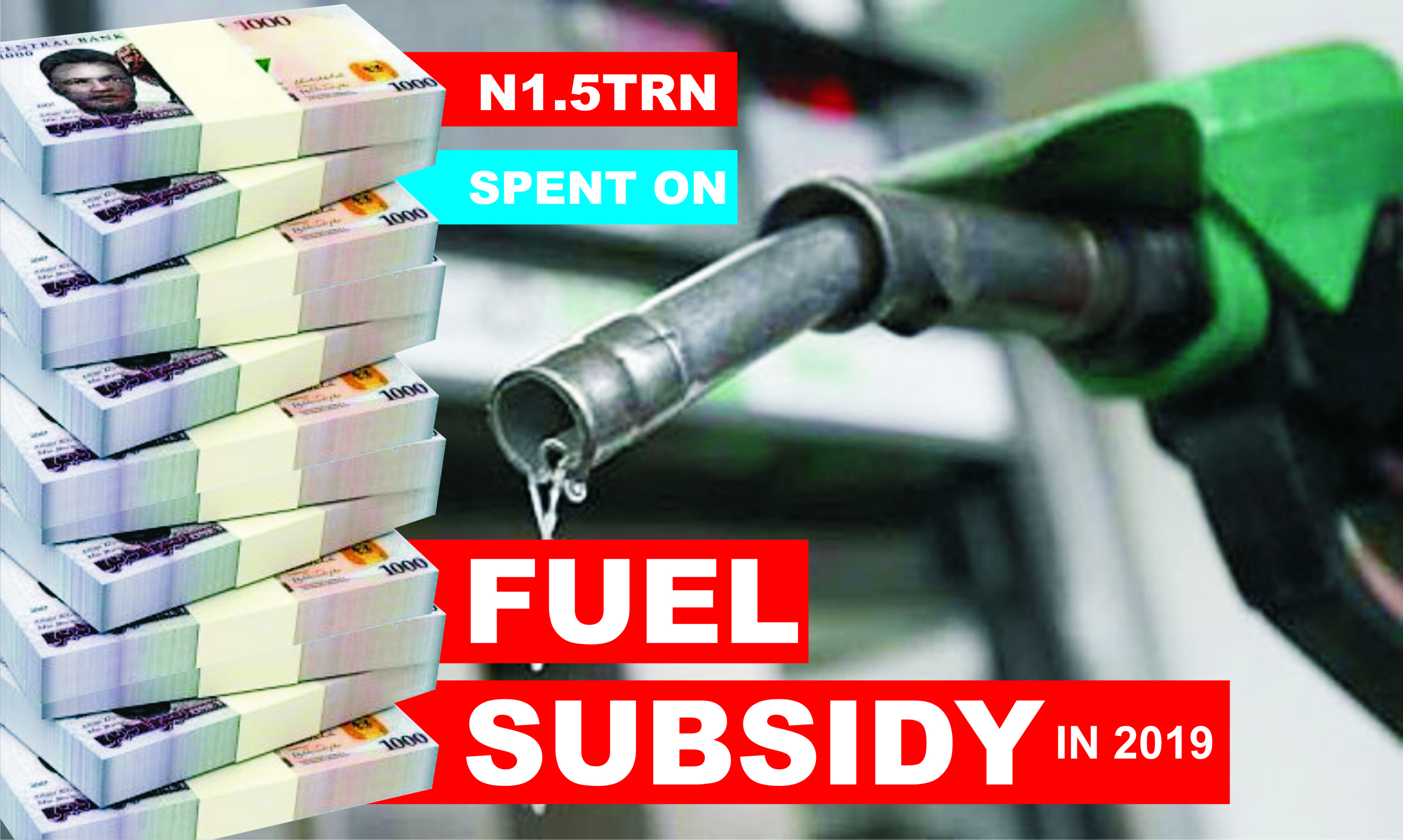

Governors in Nigeria under the aegies of the Nigeria Governors’ Forum (NGF) have lamented over the rising subsidy on petroleum products, particularly Premium Motor Spirit (PMS), saying it has placed immense financial burden on States.

NGF, the umbrella body for the 36 State Governors in Nigeria, disclosed this in a memo forwarded to the House of Representatives.

The memo, which was signed by the Head, Legislative Liaison, Peace and Security, NGF, Fatima Usman Katsina, for Chairman of the Forum, is in response to the call by the House for memoranda by the Ad Hoc Committee on the Volume of Fuel Consumed Daily in Nigeria, tasked with investigating the actual amount of PMS the country consumes daily.

Titled “Findings on the Volume of Fuel Consumed Daily in Nigeria”, and dated July 1, 2022, the memo was addressed to the Committee’s Chairman, Abdulkadir Abdullahi.

It stated in part: “Although the operating environment has significantly worsened since the report was released, with NNPC (Nigeria National Petroleum Company) now consistently reporting zero remittance to the Federation Accountant as profit from joint venture, production sharing contract and miscellaneous operations, the position of the forum remains generally the same”.

The governors referred the House to a November 2021 report by its National Executive Council’s ad hoc committee interfacing with the Nigeria National Petroleum Corporation (NNPC) on the appropriate pricing of PMS in Nigeria, which was chaired by Governor of Kaduna State, Nasir el-Rufai, and had governors of Edo, Jigawa, Ebonyi, Akwa Ibom and Ekiti, as well as the Governor of the Central Bank of Nigeria; Minister of Finance, Budget and National Planning; Accountant-General of the Federation, Group Managing Director of the NNPC and the Permanent Secretary, MBNP.

They also recalled how the report noted that the “federation (FAAC) net oil & gas revenues have been declining since 2019 and are projected to decline significantly in 2022 by between N3bn and up to N4.4bn unless action is taken now.”

The memo further read, “The following are some of the major findings relating to the volume of fuel consumed in the country:

“Remittances to the Federation Account Allocation Committee have continued to shrink as NNPC recovers shortfall quite arbitrarily from the Federation’s crude oil sales revenue. FAAC deductions for PMS subsidy are above 2019 levels, even without adjusting for reduced purchasing power of the naira due to inflation and FX rate deterioration.

“An analysis of the average monthly PMS consumption by states showed that a third of the country accounts for over 65 per cent consumption of PMS. The analysis showed that the following States of Lagos, Oyo, Ogun, Abuja, Delta, Kano, Kwara, Edo, Rivers, Kaduna, Kebbi and Adamawa accounted for 65 per cent of PMS consumption in the country. Most states with high PMS consumption either have borders with neighbouring countries or are in close proximity, this has been an avenue for smugglers to benefit from profitable arbitrage opportunities in PMS pricing.

“Households directly consume only about 25 per cent of the PMS that is consumed nationally, with the remaining three-quarters being consumed by firms, MDAs, transport operators or smuggled to neighbouring countries where the PMS price is nearly three times what it is in Nigeria; and of the PMS consumed by households, the richest 40 per cent of households account for over three-quarters of the PMS purchased by households, while the poorest 40 per cent of households purchased less than 3 per cent of all PMS sold in Nigeria.

“In the current fiscal regime, remittances to FAAC would continue to shrink as NNPC recovers this shortfall from the Federation as a result of crude oil price recovery.

“The report recommended a PMS pricing structure that addresses regional arbitrage and smuggling of PMS and provides additional revenue to the Federation Account.

“There is a significant market opportunity for additional export revenue streams for Nigeria to be had given the price parity with our neighbouring countries.

“Privatisation of the three government refineries as is, or after their full rehabilitation if affordable and viable, and expediting the licensing procedure for modular refineries will reduce the recurring government expenditure on refinery maintenance and increase the country’s refining capacity.”

The governors noted that there were also economic risks highlighted in the report. “Fiscal pressures are threatening Nigeria’s recovery, as rising prices continue to push millions into poverty,” they said.

According to the memo, “Rising prices are pushing millions of Nigerians into poverty. Rising inflation between 2020 and 2021 is expected to have pushed an additional 5-6 million Nigerians into poverty.

“Food insecurity is increasing in both poor and non-poor households, with some adults skipping meals. Because inflation is high, even if it remains stable, it will continue to push many more Nigerians into poverty.

“Fiscal pressures are growing unsustainably with the PMS subsidy significantly reducing the flow of revenues into the Federation Account.

“Thirty-five out of 36 states are likely to see transfers from the federation fall (in nominal terms) between 2021 and 2022, with the average decline projected to be about 11 per cent. Most states are already experiencing fiscal stress, with 30 out of 36 states recording fiscal deficits in 2020, including Lagos and every oil-producing state except Akwa Ibom.

“With the projected decline in gross distributable federation revenues in 2022, fiscal deficits and debt burdens will grow even larger and faster. This will mean that transfers from the federation will not be enough to cover even salaries, and certainly not recurrent costs, which are growing in nominal terms.

“With the coming into effect of the Petroleum Industry Act, gross oil & gas revenues could be (much) lower than currently projected because of the new fiscal terms and the earmarking of deductible revenues specified in the PIA, and that could reduce net oil & gas revenues even further”.

Consequently, the NGF stated that greater accountability and transparency around oil and gas revenues “are the only immediate options for easing the pressure on government finances and maximising socially responsible profit gain.”

Business

Fidelity Bank To Empower Women With Sustainable Entrepreneurship Skills, HAP2.0

Business

President Tinubu Approves Extension Ban On Raw Shea Nut Export

Business

Crisis Response: EU-project Delivers New Vet. Clinic To Katsina Govt.

-

City Crime5 days ago

NCSU Hails Fubara Over 2025 New Telegraph Man Of The Year Award

-

Nation5 days ago

Nigeria Risks Drifting Without Strong Education Policies-Don

-

Nation5 days ago

Ex-UNIPORT SUG Leaders Organise Symposium In Honour Of VC

-

Nation5 days ago

Council Chairman Reconstitutes Revenue, Anti-Illegal Trading Committees To Boost IGR

-

Education4 days ago

Education4 days agoElga boss tasks law students on academics strides

-

News1 day ago

News1 day agoAmend Constitution To Accommodate State Police, Tinubu Tells Senators

-

Politics1 day ago

Politics1 day agoSenate Urges Tinubu To Sack CAC Boss

-

Business1 day ago

President Tinubu Extends Raw Shea Nuts Export Ban To 2027