Business

Nigeria’s China Imports Up By 183.91%, Debts Hit $3.67bn

Nigeria’s import from China rose by 183.91 per cent from N530.98 billion in the first quarter of 2018 to N1.51 trillion the same period in 2022.

Data on foreign trade from the National Bureau of Statistics (NBS) shows that Nigeria had its relates imports from China.

Specifically, within the period under review, China occupies the first spot out of 10 countries from which Nigeria engaged in import.

Available data further showed that while China is responsible for the bulk of the nation’s imports, export to China is negligible, and the country was missing from the nation’s top 10 export destination in the first quarters of 2018 – 2020, and that of 2022.

In the first quarter of 2021, however, China ranked on the top 10 export destination when it ranked third with N190.11billion. In the same quarter, total imports from China were put at N2.01trillion.

Meanwhile, imports from China grew across the five quarters under review. In Q1 2018, it was N530.98bn, but grew to N979.29 billion in Q1 2019, and N1.11tn in Q1 2020. It was highest in Q1 2021 at N2.01trillion and dropped to N1.51 trillion in Q1 2022.

According to the NBS, imports from China include motorcycles, machines for reception of voice, electrical apparatus for line telephony, or line telegraphy, mackerel, parts of machinery for working on rubber or plastics, crude salt, compressed salt used in animal feeding, antibiotics, and herbicides.

Nigeria’s exports to China in the period under review included, polyethylene, leather, sesamum seeds, cashew nuts, zinc ores and concentrates, as well as lead ores and concentrates.

In Q1 2022, imports to China accounted for 25.55 per cent of the total import of N5.90 tillion; in Q1 2021, it was 29.34 per cent of the total imports (N6.85 trillion); in Q1 2020, it was 26.28 per cent of the total import (N4.22 trillion); in Q1 2019, it was 26.4 per cent of total imports (N3.70 trillion); while it was 21.1 per cent of the total imports (N2.52 trillon) in Q1 2018.

Commenting on the situation, the Chairman, Export Group, Manufacturers Association of Nigeria/Vice Chairman, Sapele Integrated Industries Limited. Mr Ede Dafinone, said there is no equality requirement on imports and exports for nations.

“There is no guarantee or requirement for any country to import and export the same volume from each other.

“If Nigeria is exporting a certain quantity worth of goods and services and importing another quantity of goods and services from another country, the issue is what is the next difference with net import and export.

“There is no requirement as to which country is responsible for this. It doesn’t matter where the deficit is as long as there is an overall surplus, he said.

The bilateral relationship between Nigeria and China has improved in recent years: in the period under review, Nigeria’s borrowing from China increased by 89.94 per cent to hit $3.67 billion, making it the nation’s largest bilateral lender.

According to the Debt Management Office, about $3.12 billion of the loans from China are project-tied.

Such projects include: 11 projects such as the Nigerian Railway Corporation’s modernisation project; Abuja Light Rail project; and Four Nigerian airports’ terminals expansion project in Abuja, Kano, Lagos, and Port Harcourt.

Business

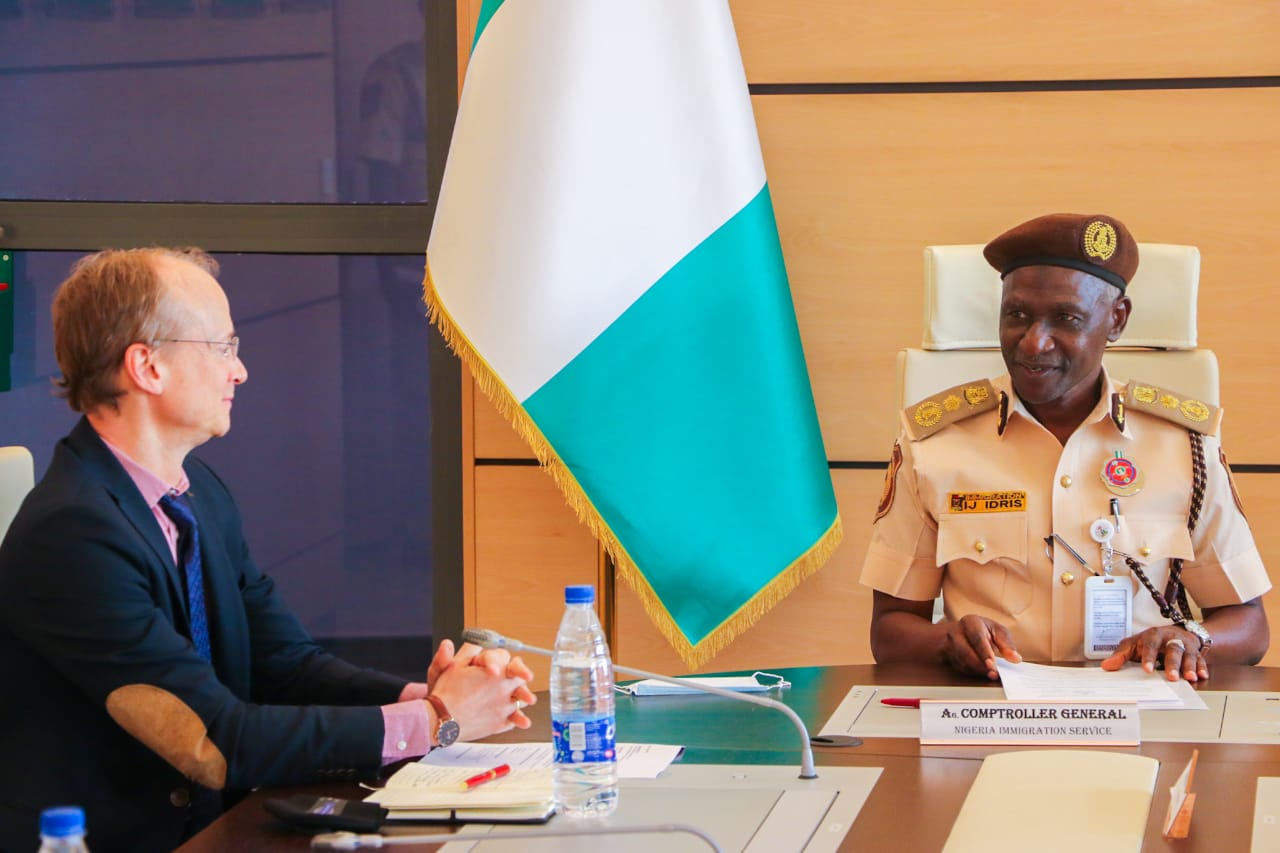

Agency Gives Insight Into Its Inspection, Monitoring Operations

Business

BVN Enrolments Rise 6% To 67.8m In 2025 — NIBSS

The Nigeria Inter-Bank Settlement System (NIBSS) has said that Bank Verification Number (BVN) enrolments rose by 6.8 per cent year-on-year to 67.8 million as at December 2025, up from 63.5 million recorded in the corresponding period of 2024.

In a statement published on its website, NIBSS attributed the growth to stronger policy enforcement by the Central Bank of Nigeria (CBN) and the expansion of diaspora enrolment initiatives.

NIBSS noted that the expansion reinforces the BVN system’s central role in Nigeria’s financial inclusion drive and digital identity framework.

Another major driver, the statement said, was the rollout of the Non-Resident Bank Verification Number (NRBVN) initiative, which allows Nigerians in the diaspora to obtain a BVN remotely without physical presence in the country.

A five-year analysis by NIBSS showed consistent growth in BVN enrolments, rising from 51.9 million in 2021 to 56.0 million in 2022, 60.1 million in 2023, 63.5 million in 2024 and 67.8 million by December 2025. The steady increase reflects stronger compliance with biometric identity requirements and improved coverage of the national banking identity system.

However, NIBSS noted that BVN enrolments still lag the total number of active bank accounts, which exceeded 320 million as of March 2025.

The gap, it explained, is largely due to multiple bank accounts linked to single BVNs, as well as customers yet to complete enrolment, despite the progress recorded.

Business

AFAN Unveils Plans To Boost Food Production In 2026

-

Sports4 days ago

Sports4 days agoTinubu Lauds Super Eagles’ after AFCON bronze triumph

-

Sports4 days ago

Sports4 days agoAFCON: Lookman gives Nigeria third place

-

Sports4 days ago

Sports4 days agoFulham Manager Eager To Receive Iwobi, Others

-

Sports4 days ago

Sports4 days ago“Mikel’s Influence Prevent Some Players Invitation To S’Eagles Camp”

-

Sports4 days ago

Sports4 days agoMan of The Match award Excites Nwabali

-

Sports4 days ago

Sports4 days agoRemo, Ikorodu set for NPFL hearing, Today

-

Sports4 days ago

Sports4 days agoPolice Games: LOC inspects facilities in Asaba

-

Niger Delta4 days ago

Niger Delta4 days agoINC Polls: Ogoriba Pledges To Continuously Stand For N’Delta Rights … Picks Presidential Form