Business

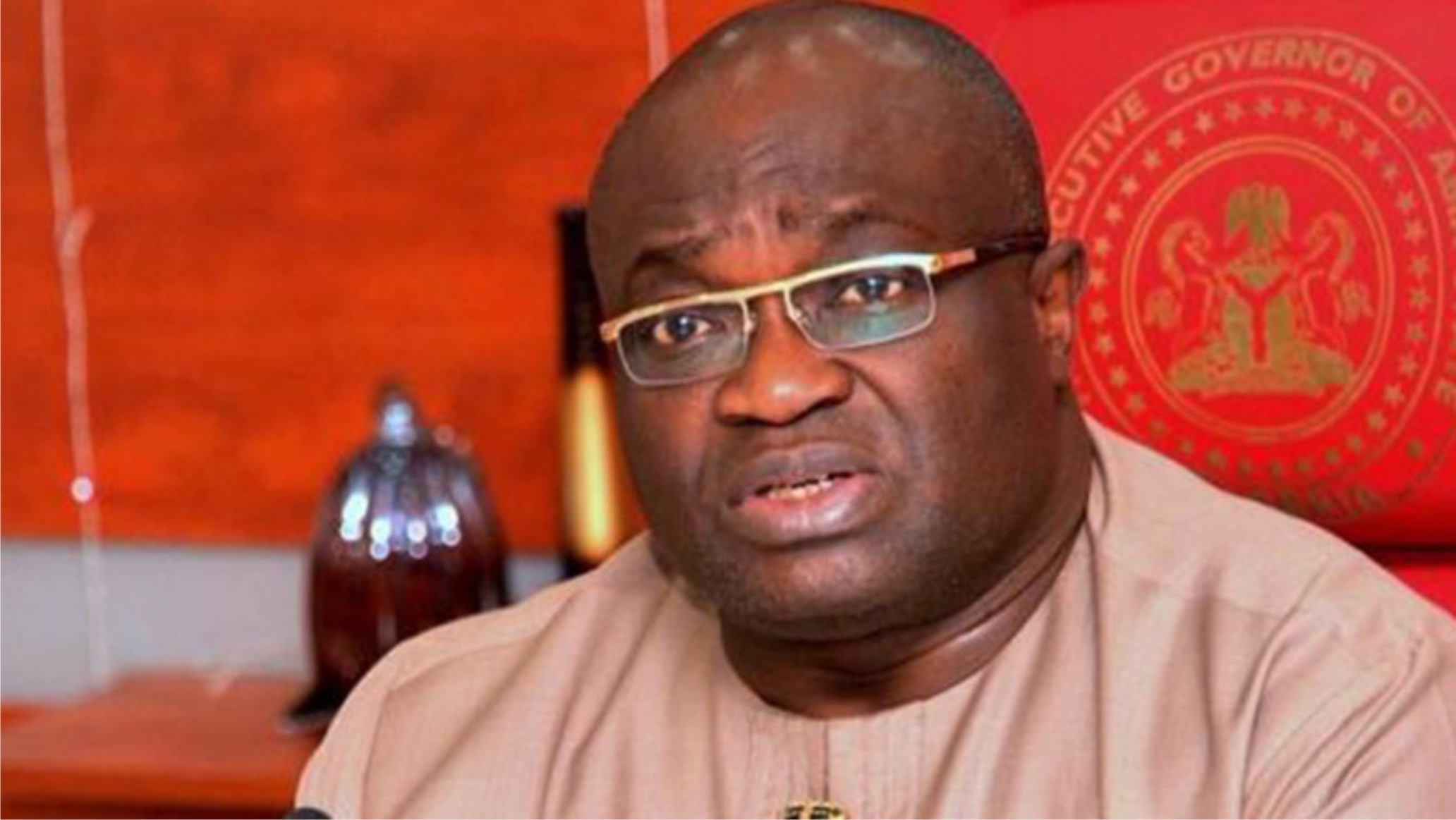

Abia To Clear N21bn Pension Deficit

With a pension deficit of over N21 billion to pensioners, the Abia State Government is set to settle all its pension arrears, the Commissioner for Finance, Dr Aham Uko, has said.

Uko, who spoke to reporters on the verification of pensioners in the state, assured that the exercise would address the challenge.

He said the government was not unmindful that there might be some irregular names on the payroll, hence the need to update the list.

He also said it was the desire of the government that at the end of the exercise, it would not return to the era of pension arrears.

He stressed that Governor Okezie Ikpeazu desired that pensioners should enjoy the benefits of their active service years.

He noted that one of the benefits of the exercise involving over 50 Information Communication Technology (ICT) experts was to ascertain the genuine pensioners.

He said: “We need to know what is the quantum of arrears to know how to liquidate it in the coming months.What is different from what we are doing is that there have to be a finger and facial capture.

“There will be a 10-day exercise, where verifications will be conducted at designated centres across the state, noting that ambulances, free-medical services and, entertainment would be provided for the pensioners.

“The exercise is solely for state pensioners, and the ambulances will be used for both emergencies and reaching out to sick and incapacitated pensioners who could not make it to the centres in their homes.”

Transport

Automated Points Concession : FAAN Workers Gave 72hrs To Revise Decisions In PH

Transport

FAAN Announces Pick-Up Points for Go-Cashless Cards

Business

Fidelity Bank To Empower Women With Sustainable Entrepreneurship Skills, HAP2.0

-

Politics2 days ago

2027: NIGERIANS FAULT INEC ON DIGITAL MEMBERSHIP REGISTER DIRECTIVE

-

Environment2 days ago

Environment2 days agoLAWMA Director Says Sweeping Reforms Have Improved Waste Collection

-

Politics2 days ago

LP Crisis: Ex-NWC Member Dumps Dumps Abure Faction

-

Politics2 days ago

Politics2 days agoUmahi Dismisses Allegations On Social Media, Insists On Projects Delivery

-

Sports2 days ago

Sports2 days agoAbia Not Sure To Secure continental Ticket

-

Sports2 days ago

La Liga: Yamal Records First Career Hat-trick

-

Politics2 days ago

IT’S A LIE, G-5 GOVS DIDN’T WIN ELECTION FOR TINUBU – SOWUNMI

-

Sports2 days ago

Sports2 days agoCity Survive Leeds’ Challenge At Elland Road