Business

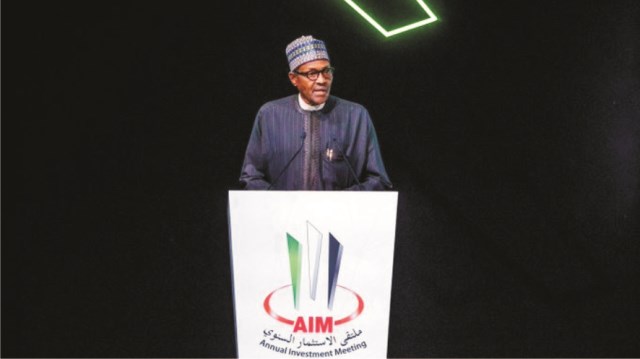

Buhari Woos Investors In Dubai

President Muhammadu Buhari last Monday became Nigeria’s marketer-in-chief as he tried to lure no fewer than six different groups of investors to the country.

Buhari made the sales pitch at the sidelines of the Annual Investment Meeting in Dubai, United Arab Emirates.

He had an irresistible message for all the potential investors: Come to Nigeria and prosper. Come and have handsome returns on your investments, within the shortest possible time.

One of the would-be-investors was Sheikh Ahmed Al Maktoum, a member of the Dubai ruling family. He is on the board of several companies, both state owned and private. He is interested in establishing a power plant in Lagos, and studies have already been completed. Other entrepreneurs who opened companies in Dubai are expected to extend their businesses in Nigeria too.

Lulu Group operates a chain of supermarkets in the Middle East and Asia. Mr Yusuff Alli, chairman of the group told President Buhari that the outfit, with headquarters in Abu Dhabi has over 164 supermarkets and shopping malls. It employs over 50,000 people.

The interest is to work with Nigerian farmers, using local produce to ensure food security. Quality, affordability and hygiene are the watchwords of the company.

Also in bilateral meeting with President Buhari was Sheikh Hussain Al Nowais, chairman of Amea Power. The company develops, owns, and operates thermal and renewable energy projects in Africa, the Middle East and Asia. Its wide range of power solutions include conventional – gas, coal, oil, and renewable – solar, wind and hydro.

Apart from power, the company, which owns Rotana Hotel chain, is also interested in the hospitality sector in Nigeria.

Business

Fidelity Bank To Empower Women With Sustainable Entrepreneurship Skills, HAP2.0

Business

President Tinubu Approves Extension Ban On Raw Shea Nut Export

Business

Crisis Response: EU-project Delivers New Vet. Clinic To Katsina Govt.

-

City Crime5 days ago

NCSU Hails Fubara Over 2025 New Telegraph Man Of The Year Award

-

Nation5 days ago

Nigeria Risks Drifting Without Strong Education Policies-Don

-

Nation5 days ago

Ex-UNIPORT SUG Leaders Organise Symposium In Honour Of VC

-

Nation5 days ago

Council Chairman Reconstitutes Revenue, Anti-Illegal Trading Committees To Boost IGR

-

Education4 days ago

Education4 days agoElga boss tasks law students on academics strides

-

News1 day ago

News1 day agoAmend Constitution To Accommodate State Police, Tinubu Tells Senators

-

Politics1 day ago

Politics1 day agoSenate Urges Tinubu To Sack CAC Boss

-

Business1 day ago

President Tinubu Extends Raw Shea Nuts Export Ban To 2027