Business

Microfinance Bank To Disburse N300m Credit

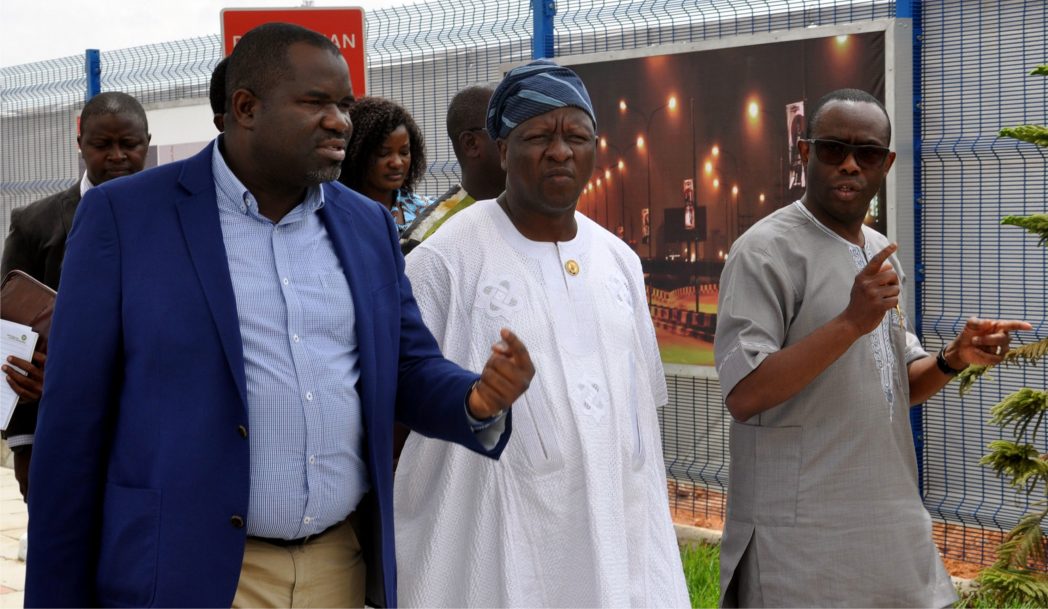

BaoBab Microfinance Bank has opened a new branch at Alaba International Market, Lagos, setting aside N300m to lend to traders to boost their businesses.

The Chief Executive Officer (CEO) of the bank, Mr Olanrewaju Kazeem, said this at the inauguration of the branch on Saturday in Lagos.

He said the Alaba branch was the 10th branch of the bank in Lagos State aside seven others in Kaduna State.

“At Alaba branch, the bank has 50 Portfolio Managers for effective mentoring of clients beyond their businesses,” he said.

The Tide source reports that bank’s investors include International Finance Corporation (IFC), Goodwill and Proparco and Bank of Paris.

BaoBaB Microfinance Bank operates in 13 African countries and China, with headquarters in Paris.

“The countries include Burkina Faso, Democratic Republic of Congo, ivory Coast, Madagascar, Mali, Nigeria, Senegal, Tunisia, Zimbabwe, China and Paris among others,” Kazeem said.

According to him, the bank obtained its National Practice Licence in 2016, and caters for Small and Medium Enterprises (SMEs).

He said the bank, which has successfully disbursed over 112,000 loans to the tune of N32bn, would open more branches to get closer to its 65,000 customers.

Kazeem said the bank also hoped to disburse N25bn nationwide in the future.

He also said the bank had employed 400 Nigerians to enable its loan portfolio to be effectively managed.

The Divisional Police Officer (DP0), Alaba Area Command, Insp Abubukar Ali, commended the bank for opening a branch at Alaba International Market.

He said the police would ensure the safety of the bank and its customers.

Ali, however, urged the bank to support the Nigeria Police Force, especially those working in the area, with modern technology and gadgets that could help to curb crime.

The Vice Chairman of Ojo Local Government, Mrs Idowu Olusola, also commended the bank for opening a branch at Alaba International Market.

She said the local government would support the bank to achieve its objective.

Olusola appealed to traders to repay loans they would obtain from the bank to guard against its collapse.

Transport

Automated Points Concession : FAAN Workers Gave 72hrs To Revise Decisions In PH

Transport

FAAN Announces Pick-Up Points for Go-Cashless Cards