Business

LCCI, KPMG Task Govt On VAT Increase

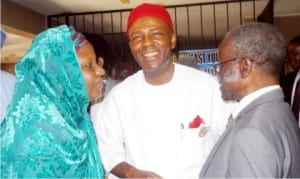

L-R: Permanent Secretary, Federal Ministry of Science and Technology, Dr Lawal Habiba; Minister of Science and Technology, Dr Ogbonnaya Onu and the President, Nigeria Academy of Engineering (NAE), Prof. Raifu Salawu, during a courtesy visit of NAE’s delegation to the Minister in Abuja, yesterday

The Lagos Chamber of Commerce and Industry (LCCI) yesterday said there was a need to boost the nation’s internally generated revenue through higher consumption tax.

The Director-General of LCCI, Mr Muda Yusuf, told newsmen in Lagos that emphasis on tax revenue generation should shift to consumption tax.

He suggested that tax should shift from taxes on investors and entrepreneurs to taxing consumption of some products and services.

Yusuf spoke against the backdrop of the recommendation of the IMF Managing Director, Christine Lagarde, that Nigeria should increase its VAT.

According to him, the ratio of tax to GDP in Nigeria is one of the lowest in the world.

Yusuf said that imposition of VAT in Nigeria should be in favour of the poor by exempting some goods consumed by the poor.

“This is necessary so that they do not compound the poverty rate challenges in the country”.

The LCCI chief also called for more efficient tax administration in the country by plugging all loopholes for tax evasion.

“Presently, those paying tax are in the formal sector. There has to be a framework to ensure that those in the informal sector also pay tax to boost tax revenue.”

Mr Ayo Salami, a tax expert at KPMG, also told newsmen that the suggestion by IMF was in order since VAT increase was enshrined in the National Tax Policy framework.

Salami, a Partner of Tax, Regulatory and People Services at KPMG, said that the policy laid more emphasis on indirect taxation.

According to the tax expert, less emphasis should be on direct taxation because of low cost of collection and evasion.

“The question is that if VAT rate is increased, how much the government will be willing to give back via reduction in direct tax that is corporate tax and personal income tax.

“This is to ensure that the populace is not worse off even if the government benefits in terms of tax revenue collection.”

Business

Agency Gives Insight Into Its Inspection, Monitoring Operations

Business

BVN Enrolments Rise 6% To 67.8m In 2025 — NIBSS

The Nigeria Inter-Bank Settlement System (NIBSS) has said that Bank Verification Number (BVN) enrolments rose by 6.8 per cent year-on-year to 67.8 million as at December 2025, up from 63.5 million recorded in the corresponding period of 2024.

In a statement published on its website, NIBSS attributed the growth to stronger policy enforcement by the Central Bank of Nigeria (CBN) and the expansion of diaspora enrolment initiatives.

NIBSS noted that the expansion reinforces the BVN system’s central role in Nigeria’s financial inclusion drive and digital identity framework.

Another major driver, the statement said, was the rollout of the Non-Resident Bank Verification Number (NRBVN) initiative, which allows Nigerians in the diaspora to obtain a BVN remotely without physical presence in the country.

A five-year analysis by NIBSS showed consistent growth in BVN enrolments, rising from 51.9 million in 2021 to 56.0 million in 2022, 60.1 million in 2023, 63.5 million in 2024 and 67.8 million by December 2025. The steady increase reflects stronger compliance with biometric identity requirements and improved coverage of the national banking identity system.

However, NIBSS noted that BVN enrolments still lag the total number of active bank accounts, which exceeded 320 million as of March 2025.

The gap, it explained, is largely due to multiple bank accounts linked to single BVNs, as well as customers yet to complete enrolment, despite the progress recorded.

Business

AFAN Unveils Plans To Boost Food Production In 2026

-

News3 days ago

News3 days agoOji Clears Air On Appointment Of 15 Special Advisers By Fubara

-

News3 days ago

News3 days agoNigeria Has Woken Up From Slumber Under Tinubu – Shettima

-

Featured3 days ago

Featured3 days agoRivers: Impeachment Moves Against Fubara, Deputy Hits Rock …As CJ Declines Setting Up Panel

-

City Crime3 days ago

Health Commissioner Extols Fubara’s Commitment To Community Healthcare Delivery

-

News3 days ago

Nigeria To Begin Exporting Urea In 2028 -NMDPRA

-

Niger Delta3 days ago

Tinubu, Leading Nigeria To Sustainable Future – Okowa … Lauds Oborevwori Over Uromi Junction Flyover Construction

-

News3 days ago

US – Nigeria Security Engagement Translating Into Tangible Operational Gains – NSA

-

News3 days ago

News3 days agoKing Jaja Impacted Beyond Rivers -Deputy Gov