Business

Firm Awards Scholarship To 58 Students In Rivers

An oil firm, Enercon Nigeria Limited, has restated its commitment in the development of its host community.

Chairman of the company, Chief Chris Iheanacho, made this pledge Tuesday during the scholarship at voyage award ceremony. A total of 58 students benefitted from the scholarship grant of N10 million while another cheque valued at N2 million was issued for the administration of the scheme.

The Chairman who was represented by the Business Development Manager of the firm, Mr. Chima Ukoumunne, said the gesture was in fulfilment of its commitment to offer scholarship on an annual basis to members of Nkiken Oka Mba Landlords Association, Ngoke compound, Alode, in Eleme Local Government Area of Rivers State.

He described education as a key ingredient to the growth and empowerment of any given community and charged the recipients to make the best use of the money for the course it was set out to achieve.

The Chairman regretted that work on the project site was delayed because of the challenges in obtaining the Certificate of Occupancy (C of O) from the Rivers State Government which is a requirement by the firm’s technical partners in order to commence the project.

He further promised employment opportunities to jobless youths from the community when the project was completed and appealed for the support and friendly working environment to help the company achieve.

Iheanacho clarified that Christaben Nigeria Limited, the company that entered into the agreement with the host landlords is a subsidiary of Enercon Nigeria Limited.

Responding, the Chairman, Landlords Association, Rev. Canon Ransome Goya Ngoke (JP) commended the company’s management for its gesture and promised a cordial working relationship with the firm.

He, however, urged the firm to be transparent in its dealings and to pay strong attention to the promise of employment to youths of the host community.

Chris Oluoh

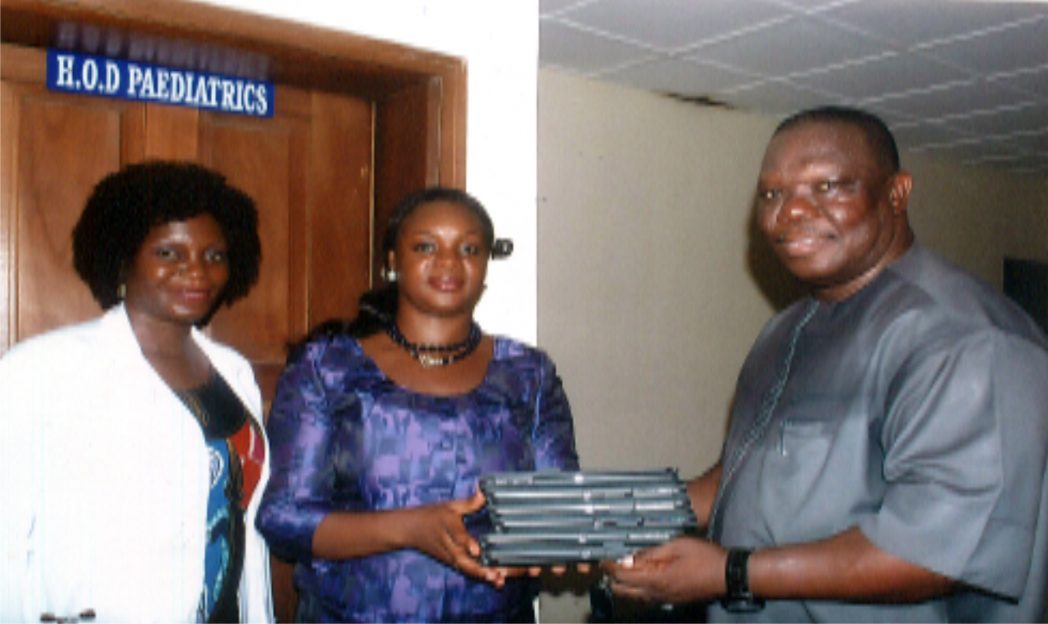

Special Adviser to the Rivers State Governor on ICT, Engr. Goodliffe Nmekini (right) presenting ipads to Head of Department Paediatrics Braith Waite Memorial Specialist Hospital, Dr Ajibola Alabi (middle). With them are, Dr Josephine Aiyafo during Executive Governor of Rivers State, Rt Hon Rotimi Chibuike Amaechi, inspecting instaled ICT facility by Rivers State ICT Department. Photo: Egberi A. Sampson

Transport

Automated Points Concession : FAAN Workers Gave 72hrs To Revise Decisions In PH

Transport

FAAN Announces Pick-Up Points for Go-Cashless Cards

Business

Fidelity Bank To Empower Women With Sustainable Entrepreneurship Skills, HAP2.0

-

Politics2 days ago

2027: NIGERIANS FAULT INEC ON DIGITAL MEMBERSHIP REGISTER DIRECTIVE

-

Environment2 days ago

Environment2 days agoLAWMA Director Says Sweeping Reforms Have Improved Waste Collection

-

Politics2 days ago

LP Crisis: Ex-NWC Member Dumps Dumps Abure Faction

-

Sports2 days ago

Sports2 days agoAbia Not Sure To Secure continental Ticket

-

Politics2 days ago

Politics2 days agoUmahi Dismisses Allegations On Social Media, Insists On Projects Delivery

-

Transport2 days ago

Transport2 days agoFAAN Announces Pick-Up Points for Go-Cashless Cards

-

Sports2 days ago

La Liga: Yamal Records First Career Hat-trick

-

Sports2 days ago

Sports2 days agoCity Survive Leeds’ Challenge At Elland Road