Business

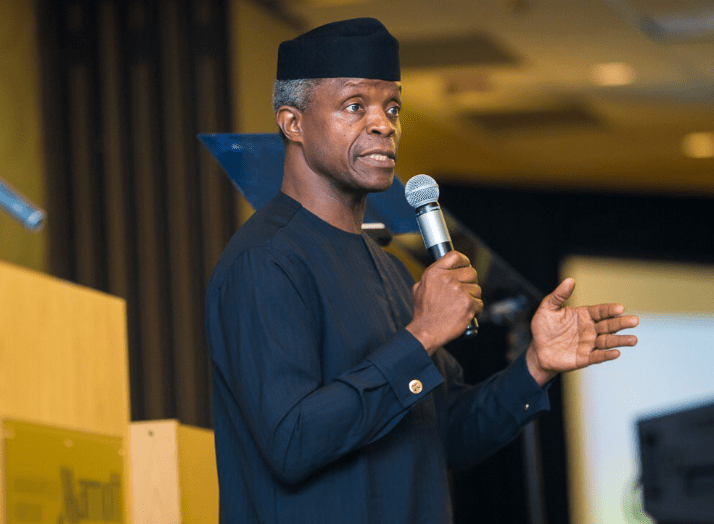

Osinbajo Meets IMF, World Bank Over Economic Stimulus

Vice-President Yemi Osinbajo, on Tuesday, met with representatives of the International Monetary Fund (IMF) and the World Bank via video conference to discuss collaborative strategies for the economic stimulus packages planned by the Federal Government.

The Osinbajo-led Economic Sustainability Committee had stated that it was working out a stimulus package that would take the country’s economy out of global recession to positive growth in 2021.

The committee was inaugurated by President, Muhammadu Buhari, earlier this month.

The Senior Special Assistant to the Vice President on Media and Publicity, Laolu Akande, posted a video on Twitter on Tuesday, showing Osinbajo in a video conference meeting.

The tweet read, “VP Osinbajo has been busy today holding video conference-based meetings with IMF and World Bank representatives on how the agencies can collaborate with President Buhari’s forthcoming additional economic stimulus packages. Video shows just-concluded meeting with World Bank Nigeria reps.”

The Minister of Finance, Budget and National Planning, Zainab Ahmed, who is a member of the economic sustainability committee, had on April 17, said the global economy would go into recession in 2020 as a result of the coronavirus pandemic.

According to her, the prediction of the IMF that Nigeria will go into a negative growth of 3.4 per cent next year is based on an assessment of the National Bureau of Statistics.

The minister, however, noted that the stimulus package being worked out by the economic sustainability committee would be approved by the President, before it would be announced to Nigerians.

Transport

Automated Points Concession : FAAN Workers Gave 72hrs To Revise Decisions In PH

Transport

FAAN Announces Pick-Up Points for Go-Cashless Cards