Business

Monarch Harps On Proper Resources Management

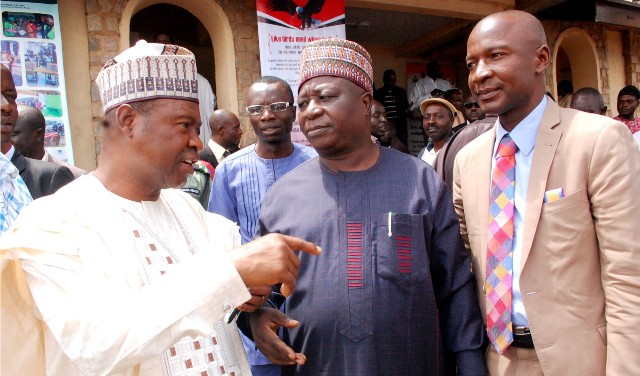

The Amanyanabo of Nembe Kingdom and former Minister for Petroleum, HRM Chief Edmund Dakoru has said that what Niger needs most now is proper management of our resources rather than the call for restructuring.

He said that there will still be agitations, even when restructuring had been done or the country being divided into six autonomous zones.

Dakrou, who was speaking to aviation correspondents at the Port Harcourt International Airport Omagwa while responding to questions on the state of Nigeria’s economy, noted that the major cause for agitations among groups is because of bad governance.

He said, where there is good governance, that there will not be agitations for restructuring, adding that the fundamental problem in the country is that people think that power belong to them and their family when they get to power.

“We need to restructure our mindset, ourselves and behaviour. We must realize that power belong to the people and must govern very well. That is where our problem lies.

“Even if you restructure, there will still be problems, if there is no good governance and accountability to the people. There is no true democracy within the states.

“What we need is equal opportunities to governance, equal access to power. Those reforms recommended by Justice Belgore should be implemented, and such can end agitation for restructuring”, he said.

The royal father however expressed fear that many states will exploit their citizens more than what they are experiencing now from the centre, if the clamour for state police will be granted.

Corlins Walter

Transport

Automated Points Concession : FAAN Workers Gave 72hrs To Revise Decisions In PH

Transport

FAAN Announces Pick-Up Points for Go-Cashless Cards