Business

How We Emerged Africa’s Foremost Telecoms Regulator – NCC

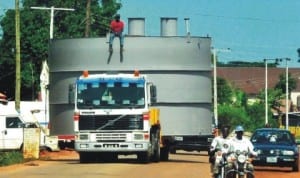

An articulated vehicle carrying an industrial tank on Warri-Efunrun Road in Delta State last Sunday. Photo: NAN

The Nigerian Commu

nications Commission (NCC) last Sunday said that its five-point strategic agenda was essential in its recognition as the foremost telecoms regulator in Africa.

The Public Affairs Director of NCC, Mr Tony Ojobo, said in Lagos that the agenda had yielded many results.

Ojobo said that the commission had a focused leadership and staff who were ensuring that the regulatory body was moving to enviable heights in Nigeria and Africa.

He said that the Executive Vice Chairman of NCC, Dr Eugene Juwah, came up with a five-point agenda which included broadband deployment, capacity building and strengthening of international relationship.

According to him, the agenda also includes compliance monitoring and enforcement as well as consolidation.

‘’All of these have been the drive that have taken the commission to where it is today as the International Telecommunication Union (ITU) has recognised NCC as the foremost regulator in Africa.

‘’We have people from other regulatory agencies in Africa coming to NCC to understudy what we have been doing that have enabled us to remain at the forefront of telecoms regulation,’’ he said.

Ojobo said that the agenda was geared toward ensuring that the global community always recognises Nigeria as a destination country for telecoms investment.

He noted that the Juwah-led five point agenda had made it possible for the cost of Short Messaging Service (SMS) to be reduced from N15 to N4 per message.

Ojobo said that the commission had also reduced interconnect rates, resulting in reduction in call rates and other services offered by the operators.

‘’In the area of compliance monitoring and enforcement, within this time, we have had the Key Performance Indicators (KPIs) gazetted; that has given us the force to actually bite.

‘’Breaches in the KPIs have led to sanctioning of the service providers. Sanctions are always very huge; they are usually not pleasant for the operators to pay.

‘’So to some degree, the KPIs have brought some kind of sanity to the industry.

“It has brought some discipline in the industry and made operators more accountable and responsive to consumers’ complaints,’’ he said.

The telecoms umpire was last Saturday recognised by the Beacon of Information and Communications Technology (BoICT) as the “ Regulator of the Year.

Transport

Automated Points Concession : FAAN Workers Gave 72hrs To Revise Decisions In PH

Transport

FAAN Announces Pick-Up Points for Go-Cashless Cards

Business

Fidelity Bank To Empower Women With Sustainable Entrepreneurship Skills, HAP2.0

-

Politics2 days ago

2027: NIGERIANS FAULT INEC ON DIGITAL MEMBERSHIP REGISTER DIRECTIVE

-

Environment3 days ago

Environment3 days agoLAWMA Director Says Sweeping Reforms Have Improved Waste Collection

-

Politics2 days ago

LP Crisis: Ex-NWC Member Dumps Dumps Abure Faction

-

Politics2 days ago

Politics2 days agoUmahi Dismisses Allegations On Social Media, Insists On Projects Delivery

-

Sports2 days ago

Sports2 days agoAbia Not Sure To Secure continental Ticket

-

Sports2 days ago

La Liga: Yamal Records First Career Hat-trick

-

Sports2 days ago

Sports2 days agoCity Survive Leeds’ Challenge At Elland Road

-

Politics2 days ago

NATASHA ELECTRIC VEHICLES INITIATIVE IN KOGI CENTRAL