Business

Rivers Pensioners Beg For Payment Of Arrears

Pensioners in Rivers State have appealed to the Rivers State Governor, Chief Nyesom Wike, to approve the payment of their pension arrears even as they commended the governor for making good his promise by paying their monthly emoluments.

The retirees, who spoke through their spokesperson, Lucky Ati during a walk to the state secretariat last Tuesday said the pension arrears had been lingering since 2012, following irregularities in the contributory pension scheme policy in the state.

Ati noted also that some of the retirees were being short paid as far back as 2011, adding that the money was so little that it would be seen as inhumane if something was deducted from it.

He stressed that the monthly payment was not enough to meet their financial obligations, saying the payment of the pensioners arrears would go a long way to solve their immediate needs.

The senior citizens appealed to government to address the matter with urgency, suggesting that it could be paid in batches.

He recalled that Governor Wike had in July this year, signed the Rivers State Pensions Reforms Bill into law, which he said, was expected to address the lingering pension issues in the state since 2007.

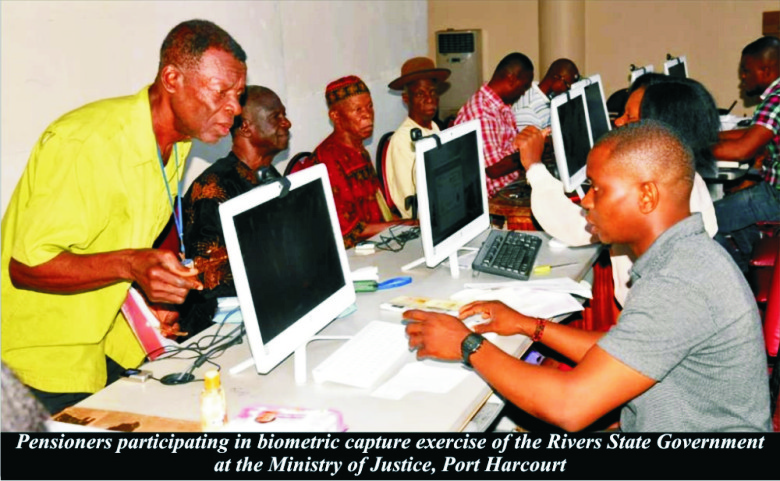

The Tide reports that under the new law, some 800 pensioners who had duly completed their biometrics were placed on the government’s pay roll and have since been receiving their pensions, while payment of their gratuities are still being expected.

Transport

Automated Points Concession : FAAN Workers Gave 72hrs To Revise Decisions In PH

Transport

FAAN Announces Pick-Up Points for Go-Cashless Cards

Business

Fidelity Bank To Empower Women With Sustainable Entrepreneurship Skills, HAP2.0

-

Politics4 days ago

Politics4 days agoSenate Urges Tinubu To Sack CAC Boss

-

News4 days ago

News4 days agoAmend Constitution To Accommodate State Police, Tinubu Tells Senators

-

Business4 days ago

Crisis Response: EU-project Delivers New Vet. Clinic To Katsina Govt.

-

News4 days ago

News4 days agoDisu Takes Over As New IGP …Declares Total War On Corruption, Impunity

-

Business4 days ago

President Tinubu Approves Extension Ban On Raw Shea Nut Export

-

Business4 days ago

President Tinubu Extends Raw Shea Nuts Export Ban To 2027

-

Business4 days ago

Fidelity Bank To Empower Women With Sustainable Entrepreneurship Skills, HAP2.0

-

Sports4 days ago

NDG: Rivers Coach Appeal To NDDC In Talent Discovery