Oil & Energy

Stakeholders And Oil, Gas Exploration

Some stakeholders in the oil and gas industry have advised the Federal Government to make provision in subsequent national budgets for offshore and onshore exploration activities to encourage new discoveries.

They gave the advice in separate interviews with newsmen in Lagos last Friday while reviewing the oil and gas sector for 2018.

The former President, Nigerian Association of Petroleum Explorationists (NAPE), Mr Biodun Adesanya, said in 2018, there was noticeable improvement in the revenue generation occasioned by better oil price and less disruption in export volumes.

“In 2019, we should work harder to sustain and improve on the modest gains of 2018 especially the production and export infrastructures.

“They also need to conduct licensing round.”

Adesanya, who is also the Managing Director, Degeconek Nig. Ltd., urged government to develop the country’s modular refineries to reduce importation of refine petroleum products.

“The modular refinery concept is a good idea but its implementation will be difficult under the existing structure.

“How would it resolve the challenges of the Niger Delta region, how will it be funded?

“How can the crude supply be guaranteed, what currency will the crude be sold to the refineries given that products will be sold in Naira,” he said.

The former Chairman, Society of Petroleum Engineers (SPE), Nigeria Council, Mr Chikezie Nwosu, said establishing fairly comfortable oil price should be of particular interest to the oil and gas industry in 2019 and beyond.

He said the current uncertainty in global politics had effects on the global economy and that prediction of market trends was becoming increasingly difficult.

According to him, global political tensions add significant uncertainty to an already challenged oil and gas industry; demand versus supply economics.

“The tensions between the USA and Iran, the Saudi Arabian issues with the killing of the journalist Jamal Khashoggi and the withdrawal of Qatar from OPEC.

“The trade tariff skirmishes between China and the USA, BREXIT and the sudden announcement of the total withdrawal of the USA from Syria, all added to the global tensions,” he said.

Predicating the budget, Nwosu said it depended to a large extent on oil revenues, adding that an oil price of 60 dollars per barrel seemed a bit optimistic.

“A more realistic range will probably be between 40 dollars and 45 dollars per barrel, allowing for windfall receipts if higher, but also providing a hedge against lower oil prices.

“Oil production from the current data as at September stood between 2.03 million barrels per day and 2.3 million barrels per day is possible.

“This, however, provided the 2019 elections are peaceful and the results do not aggravate the Niger-Delta and host and impacted communities.

“It will be good if all four key component bills of the Petroleum Industry Bill are passed by the National Assembly, and assented to by the Presidency, early enough in the year before mid-year 2019.”

Nwosu said that would bring the needed peace to the host and impacted communities, as they become partners in the exploitation of oil and gas resources.

According to him, it will also restructure the industry and NNPC to be more effective, with a world class governance structure.

He said the bill would also attract the necessary direct investments, both local and foreign.

“Markets, including the oil and gas industry, do not like uncertainty and the PIB will go a long way to address the framework for doing business in the Nigerian oil and gas industry,” he said.

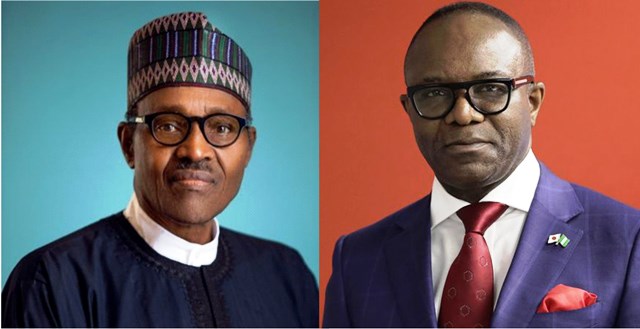

Nwosu said of particular importance was the full implementation of the seven big must wins initiated by Dr Ibe Kachikwu and supported by Dr Maikanti Baru which addresses many policy challenges in the industry.

He said unlocking the huge potential of the gas resources would also help in diversifying and growing the Nigerian economy through its impact on power, agriculture and other industry.

He said integrated Oil and Gas Field Development Plans (FDPs) must be emphasised by NNPC and some urban planning concepts must be encouraged.

This, he said was to ensure that there was leverage on synergies of development by the various operators, especially in offshore developments, and significantly lowering unit technical costs.

He said to encourage investments in exploration, it was important for NNPC to insist that exploration and appraisal plans are an integral part of all FDPs.

The Chairman, Integrated Oil and Gas Ltd., Mr Emmanuel Iheanacho, said that in the last 10 years, the demand for refined products had always been on the increase.

Iheanacho said that building a modular refinery of about 1,000 barrel cost over 1.2 billion dollars.

“Building a modular refinery is not easy, apart from citing your refinery beside the sea, one can as well site it near a marginal oil field.

“Finance is the major reasons why most investors in the modular refineries abandoned it.

“No bank is ready to give loan to any investor in modular refineries that is why it is just only two out of 40 investors given licences that were able to build it.

“Government should engage the banks to provide the finance needed for building modular refineries,” he said.

In his views, the Director-General, Lagos Chamber of Commerce and Industry, Mr Muda Yusuf, urged the Federal Government to review its policy on refined products to encourage investors into the sector.

Yusuf said: “It is a pity that after many years of oil discovery, the country is still importing its refined products for consumption.

“As long as we have oil and gas sector link with the government, private investors will continue to evade the sector.”

The chamber’s director-general also urged the government to overhaul the sector to encourage private investors.

The former Chairman, Nigerian Council of Society of Petroleum Engineers, Dr Saka Matemilola, urged NNPC to repair the existing refineries to improve its production.

Matemilola also urged Department of Petroleum Resources not to revoke the licences of investors who were unable to build modular refineries.

According to him, withdrawing the licences will not solve the problems facing the sector.

He said that there was need to work with the licence owners to address the issue of sourcing for finance from the banks to build the refineries.

Reports say that the Vice President, Prof. Yemi Osinbajo, in June, confirmed that 10 modular refineries were at advanced stages of development in the Niger Delta.

The 10 modular refineries are located in five out of the nine states in the Niger Delta region.

The states include Akwa Ibom, Cross River, Delta, Edo and Imo states.

Osinbajo said that two of the refineries, Amakpe Refinery (Akwa Ibom) and OPAC Refinery (Delta State), have had their mini-refinery modules already fabricated, assembled and containerised overseas and ready for shipment to Nigeria for installation.

The total proposed refining capacities of the 10 licensed refineries stands at 300,000 barrels.

Similarly, in November, the Minister of State for Petroleum Resources, Dr Ibe Kachikwu, said there were strong indications that three out of the 40 planned modular refineries would come on stream by end of 2019.

“Out of the 40 licenses issued, only 10 have shown progress by submitting their programmes and putting something on the ground.

“By end of 2019, we are assured that three private modular refineries would come on stream,’’ he said.

Yusuf writes for News Agency of Nigeria.

Yunus Yusuf

Oil & Energy

Reps C’mitee Moves To Resolve Dangote, NUPENG Dispute

Oil & Energy

Increased Oil and Gas: Stakeholders Urge Expansion Of PINL Scope

Oil & Energy

Digital Technology Key To Nigeria’s Oil, Gas Future

Experts in the oil and gas industry have said that the adoption of digital technologies would tackle inefficiencies and drive sustainable growth in the energy sector.

With the theme of the symposium as ‘Transforming Energy: The Digital Evolution of Oil and Gas’, he gathering drew top industry players, media leaders, traditional rulers, students, and security officials for a wide-ranging dialogue on the future of Nigeria’s most vital industry.

Chairman of the Petroleum Technology Association of Nigeria (PETAN), Wole Ogunsanya, highlighted the role of digital solutions across exploration, drilling, production, and other oil services.

Represented by the Vice Chairman, Obi Uzu, Ogunsanya noted that Nigeria’s oil production had risen to about 1.7 million barrels per day and was expected to reach two million barrels soon.

Ogunsanya emphasised that increased production would strengthen the naira and fund key infrastructure projects, such as railway networks connecting Lagos to northern, eastern, and southern Nigeria, without excessive borrowing.

He stressed the importance of using oil revenue to sustain national development rather than relying heavily on loans, which undermine financial independence.

Comparing Nigeria to Norway, Ogunsanya explained how the Nordic country had prudently saved and invested oil earnings into education, infrastructure, and long-term development, in contrast to the nation’s monthly revenue distribution system.

Chief Executive Officer (CEO) and Executive Secretary of the Major Energies Marketers Association of Nigeria (MEMAN), Clement Using, represented by the Secretary of the Association, Ms Ogechi Nkwoji, highlighted the urgent need for stakeholders and regulators in the sector to embrace digital technologies.

According to him, digital evolution can boost operational efficiency, reduce costs, enhance safety, and align with sustainability goals.

Isong pointed out that the downstream energy sector forms the backbone of Nigeria’s economy saying “When the downstream system functions well, commerce thrives, hospitals operate, and markets stay open. When it fails, chaos and hardship follow immediately,” he said.

He identified challenges such as price volatility, equipment failures, fuel losses, fraud, and environmental risks, linking them to aging infrastructure, poor record-keeping, and skill gaps.

According to Isong, the solution lies in integrated digital tools such as sensors, automation, analytics, and secure transaction systems to monitor refining, storage, distribution, and retail activities.

He highlighted key technologies including IoT forecourt automation for real-time pump activity and sales tracking, remote pricing and reconciliation systems at retail fuel stations, AI-powered pipeline leak detection, terminal automation for depot operations, digital tank gauging, and predictive maintenance.

-

News1 day ago

News1 day ago2027: Tinubu’s Presidency Excites APC Stalwarts…As Group Berates NWC For Party Crisis In Bayelsa

-

Niger Delta1 day ago

Ewhrudjakpo Tasks CS-SUNN On Effective Nutrition Awareness

-

Sports1 day ago

Sports1 day agoAkomaka Emerges South South Representative Board Member In NCF

-

Sports1 day ago

Sports1 day agoTottenham Salvage Point Against Wolves

-

Oil & Energy1 day ago

Oil & Energy1 day agoIncreased Oil and Gas: Stakeholders Urge Expansion Of PINL Scope

-

News1 day ago

News1 day agoFG denies claims of systematic genocide against Christians

-

News1 day ago

News1 day agoUN Honours Ogbakor Ikwerre President General

-

Niger Delta1 day ago

Niger Delta1 day agoOtu Reiterates Commitment To Restor State’s Civil Service