Business

Solid Minerals Corporation: FG Plans JVs With Multinationals

The proposed Solid Minerals Corporation will give Nigeria a stake in all mining activities as it will engage in joint ventures with foreign and local investors in a way that will sanitise and reposition the sector for rapid development, the Solid Minerals Minister, Dr. Oladele Alake, has said.

The Minister, who made the comment in an interview with The Tide’s source, stated that his recent advocacy visit to the mining conference in Perth, Australia, was to market Nigeria as a lucrative mining destination in Africa and globally.

Alake said in Perth, he explained the Nigerian government’s deliberate policies and plans to attract local and foreign investors to the sector by establishing, amongst others, the Nigerian Mining Corporation as a particular-purpose vehicle to engage in joint ventures with multinationals.

According to him, the mining corporation will enable the government to harness the mineral resources substantially, unlike the present situation where it is an all-comer’s affair with the government being shortchanged.

“A special purpose vehicle (SPV) like the Nigerian Mining Corporation (NMC) will go a long way to entirely regulate and sanitise the sector, and act as a government face with multinationals, engage in joint venture arrangements, so that Nigerians will have a stake in all of the ventures that go on in that sector.

“That is the role the corporation is going to play, and it is going to be seriously sanitised with efficient governance structures”, he said.

The Minister expressed optimism that this strategy would correct all past mistakes.

“As we advance with the Nigerian Mining Corporation, it would be like in other developed societies where you have SPVs interfacing on behalf of the government. That is what this NMC is going to do”, he stated.

The source reports that since he assumed office, Alake has declared the Tinubu administration’s plan to develop the solid minerals sector to become the new oil (petroleum) as the key revenue source for Nigeria.

According to a statement by Alaba Balogun, Deputy Director (Information) in the ministry, in order to bolster the shift to mining, the minister said, ‘’Nigeria is shifting attention from hydrocarbons to renewable energy…and the solid minerals underground is a perfect alternative.

“Secondly, since we have been a mono-cultural economy for several decades, there is the imperative to look for other very viable sources of revenue to shore up the GDP of the country; and where also could we look but the vastly untapped and unregulated solid minerals sector that is available to us?’’

Business

Nigeria’s ETF correction deepens as STANBICETF30, VETGRIF30 see 50% decline in a week

Business

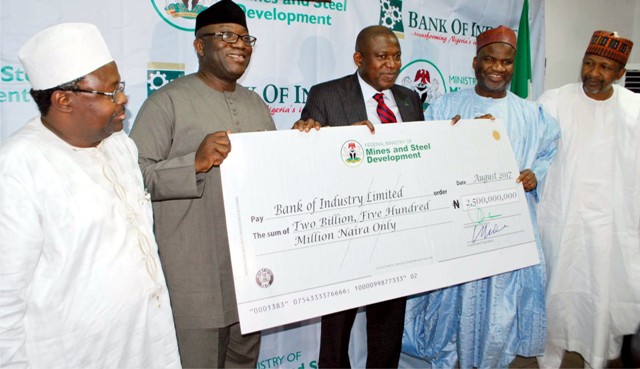

BOI Introduces Business Clinic

Business

Dangote signs $400 mln equipment deal with China’s XCMG to speed up refinery expansion

-

Maritime1 day ago

Customs Declares War Against Narcotics Baron At Idiroko Border

-

Sports1 day ago

Sports1 day agoGombe-Gara Rejects Chelle $130,000 monthly salary

-

Maritime1 day ago

Nigeria To Pilot Regional Fishing Vessels Register In Gulf Of Guinea —Oyetola

-

Maritime1 day ago

NIMASA,NAF Boost Unmanned Aerial Surveillance For Maritime Security

-

Maritime1 day ago

NIWA Collaborates ICPC TO Strengthen Integrity, Revenue

-

Sports1 day ago

Sports1 day agoTEAM RIVERS SET TO WIN 4×400 ” MORROW” …Wins Triple jump Silver

-

Sports1 day ago

Sports1 day agoNSC eyes international hosting rights

-

City Crime24 hours ago

NCSU Hails Fubara Over 2025 New Telegraph Man Of The Year Award