Business

Recession: Nigeria Remains Investors’ Destination – MAN

The President of Manufac

turers Association of Nigeria (MAN), Mr Frank Jacob, says in spite of the current economic recession in Nigeria, the country is still an attractive investors destination.

Jacob made the statement in an interview with newsmen on Thursday in Abuja.

He said that the problem of Nigeria was that it practised a mono-product economy which solely depended on crude oil revenue.

Jacob said with the current drive by the Federal Government to diversify the nation’s economy, the fight against corruption and insecurity, “I believe we will make progress”.

“Nigeria’s rating in the global economy is not that bad because Nigeria has a lot of untapped resources which, if harnessed, will add more value to its economy.

“Nigeria is still attractive investors’ destination, with all its potentials, what we are suffering is because of our currency fluctuation which is a temporary setback, ‘Jacob said.

According to 2015 report of International Monetary Fund, the Gross Domestic Product (GDP) of the South Africa was 301 billion Dollars at Rand’s current exchange rate.

“While that of Nigeria is 296 billion dollars.

The report noted that rand had gained more than 16 Per cent against U.S. currency since the start of 2016 while in contrast, Nigeria’s Naira had lost more than a third of its value.

It added that rand firmed more than a per cent against the dollar, to R13.29, adding that Nigeria and South Africa were facing recession, having contracted in the first quarter of the year.

Nigeria’s economy shrank by 0.4 per cent while South Africa’s GDP contracted by 0.2 per cent.

Transport

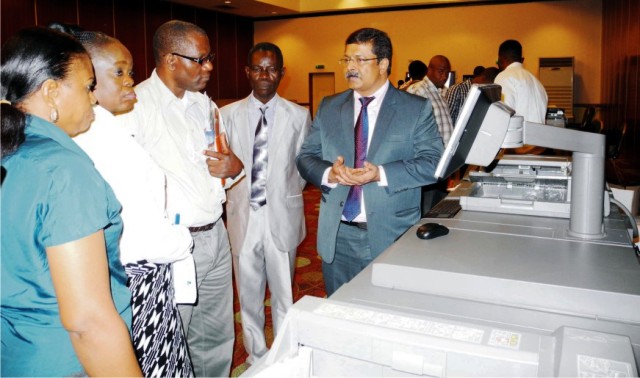

Automated Points Concession : FAAN Workers Gave 72hrs To Revise Decisions In PH

Transport

FAAN Announces Pick-Up Points for Go-Cashless Cards

Business

Fidelity Bank To Empower Women With Sustainable Entrepreneurship Skills, HAP2.0

-

Politics3 days ago

Politics3 days agoSenate Urges Tinubu To Sack CAC Boss

-

News3 days ago

News3 days agoAmend Constitution To Accommodate State Police, Tinubu Tells Senators

-

News3 days ago

News3 days agoDisu Takes Over As New IGP …Declares Total War On Corruption, Impunity

-

Business3 days ago

Crisis Response: EU-project Delivers New Vet. Clinic To Katsina Govt.

-

Business3 days ago

President Tinubu Extends Raw Shea Nuts Export Ban To 2027

-

Business3 days ago

President Tinubu Approves Extension Ban On Raw Shea Nut Export

-

Sports3 days ago

NDG: Rivers Coach Appeal To NDDC In Talent Discovery

-

Business3 days ago

Fidelity Bank To Empower Women With Sustainable Entrepreneurship Skills, HAP2.0