Business

MFB Has Potentials To Boost Economy -Bank MD

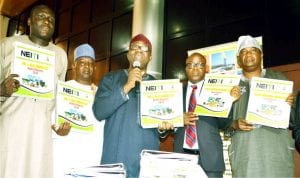

Minister of Solid Minerals Development, Dr Kayode Fayemi (middle), Executive Secretary, Nigeria Extractive Industries Transparency Initiative (NEITI), Mr Waziri Adio (2nd right) and members of the National Stakeholders Working Group (NSWG) on NEITI, Alhaji Lawan Hantewa (2nd left), Mr Kola Banwo (left) and Mr Gbenga Onayiga, at the public presentation of 2013 Oil and Gas Industry Audit Reports in Abuja on Monday.

Managing Director,

Nigeria Police Force (NPF) Microfinance Bank Plc., Mr Akin Lawal, on Monday said that the microfinance sub-sector had huge potentials that could boost the country’s economy.

Lawal, who disclosed this in an interview with the News Agency of Nigeria (NAN) in Abuja, urged Nigerians to depend less on foreign articles.

“Microfinance business has very huge potential and the most basic thing for us to do is to look inward.

“We should be less dependent on foreign articles that one way or the other always call for foreign exchange and find ways to boost our economy.

“This can be achieved by looking at how creative we can be. We should come up with products that will not only be attractive to us but one that we can also export,” he said.

Lawal said that the major constraint in the sector was access to funds and cost of doing business, stating that some top MFBs had however found ways to surpass the challenge.

He explained that the NPF had been able to surpass this through funds from the cooperative and welfare insurance of its core investor, being the police force.

He said that the police MFB was set up primarily to look into the welfare of the police as well as the general public.

“We are not limited or restricted to the police alone, but we are also open to the general public who are interested.”

The NPF boss, however, urged the regulators to provide more support to the sub-sector to enable it to contribute its quota to the growth of the economy.

He said that the regulators support was required in the areas of cost of doing business and access to funds and called for more intervention funds by the government.

Business

Nigeria’s ETF correction deepens as STANBICETF30, VETGRIF30 see 50% decline in a week

Business

BOI Introduces Business Clinic

Business

Dangote signs $400 mln equipment deal with China’s XCMG to speed up refinery expansion

-

Maritime1 day ago

Customs Declares War Against Narcotics Baron At Idiroko Border

-

Maritime1 day ago

Nigeria To Pilot Regional Fishing Vessels Register In Gulf Of Guinea —Oyetola

-

Sports1 day ago

Sports1 day agoGombe-Gara Rejects Chelle $130,000 monthly salary

-

Maritime1 day ago

NIMASA,NAF Boost Unmanned Aerial Surveillance For Maritime Security

-

Maritime1 day ago

NIWA Collaborates ICPC TO Strengthen Integrity, Revenue

-

Sports1 day ago

Sports1 day agoTEAM RIVERS SET TO WIN 4×400 ” MORROW” …Wins Triple jump Silver

-

Sports1 day ago

Sports1 day agoNSC eyes international hosting rights

-

City Crime1 day ago

NCSU Hails Fubara Over 2025 New Telegraph Man Of The Year Award