Business

Analyst Tasks RSG On Workers’ Leave Grants

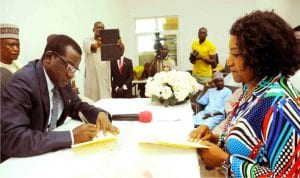

Governor Simon Lalong of Plateau State left), signing the 2016 Appropriation Bill into law in Jos on Tuesday. With him is the Plateau State Commissioner for Finance, Tamwakat Wali

A financial analyst, Mr

Singtoh Oko, has called on the Rivers State Government, to discontinue the process whereby civil servants’ leave grants are built into their monthly salaries and spread through the year.

Oko, who came up with this in an exclusive interview with The Tide, on Wednesday in Port Harcourt, explained that it was better to pay leave grants in bulk to workers when they were due for annual leave.

He explained that apart from the fact that civil servants got their leave grants enbloc when they were due to proceed on annual leave, the scenario changed under former governor Rotimi Amaechi.

Oko, a Rivers State University of Science and Technology (RSUST), trained Accountant, opined that the governor may have felt that paying in lump sum would have adversely affected the economy of the state.

He said that the possibility of having more workers proceeding on annual leave at particular periods could not be ruled out, a situation he explained might be responsible for the past administration to have taken such a policy action.

However, despite whatever reasons the government had then, Oko explained that it was not palatable to the civil servants.

“To a civil servant, though the amount is the same, it is not beneficial to them”.

“Though it is the same amount spread over twelve months, the difference is that when it is a lump or bulk sum and one was going home with it, for that moment one would buy a reasonable item”, he said.

Throwing more light, he said if the government in the future decides to return to the status quo, civil servants should realise that the monthly grant would then be expunged.

According to him, if proper sensitisation was not carried out, certain workers might feel that they have been short-charged.

Transport

Automated Points Concession : FAAN Workers Gave 72hrs To Revise Decisions In PH

Transport

FAAN Announces Pick-Up Points for Go-Cashless Cards

Business

Fidelity Bank To Empower Women With Sustainable Entrepreneurship Skills, HAP2.0

-

Politics3 days ago

2027: NIGERIANS FAULT INEC ON DIGITAL MEMBERSHIP REGISTER DIRECTIVE

-

Environment3 days ago

Environment3 days agoLAWMA Director Says Sweeping Reforms Have Improved Waste Collection

-

Politics3 days ago

LP Crisis: Ex-NWC Member Dumps Dumps Abure Faction

-

Politics3 days ago

Politics3 days agoUmahi Dismisses Allegations On Social Media, Insists On Projects Delivery

-

Sports3 days ago

Sports3 days agoAbia Not Sure To Secure continental Ticket

-

Sports3 days ago

La Liga: Yamal Records First Career Hat-trick

-

Politics3 days ago

NATASHA ELECTRIC VEHICLES INITIATIVE IN KOGI CENTRAL

-

Sports3 days ago

Sports3 days agoCity Survive Leeds’ Challenge At Elland Road