Business

Expert Wants Synergy Between Insurance Leasing Industries

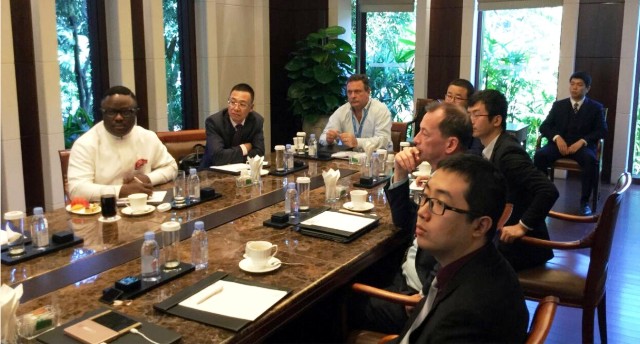

The Managing Director of Law Union and Rock (LUR) Insurance, Mr Jide Orimolade has called for synergy between insurance and leasing industries to boost their potential and enhance lasting relationships.

Orimolade told newsmenon yesterday, on the sideline of Equipment and Leasing Association of Nigeria (ELAN) first quarterly business forum in Lagos.

He said the two industries also needed to maintain strong partnership to enable stakeholders move from quick money approach to focus on long term formidable partnerships.

According to him, the synergy will also ensure cut in cost of production and improve operational efficiency.

He noted that the two industries were not doing well in four key sectors; education, healthcare and transportation, compared to the potential the sectors offered.

The expert also said that there had been steady increase in the demand for household appliances, pleasure cars, accommodation by individuals and families.

The managing director , however, noted that many of the individuals and families concerned could not pay lump sum for the items.

“They therefore look up to leasing companies and if someone leases a car, he needs to insure it too.

“This is a service point where both the leasing company and the insurance company meet.

“No matter the kind of leasing, whether vehicle leasing, agricultural equipment leasing, house or apartment, factory equipment and household appliances, the leased assets have to be saved and secured through insurance,’’ he said.

The insurance boss said the two industries also needed to critically synergise on agriculture in view of the importance of the sector to other sectors of the economy.

‘’Agriculture sector is very strategic as it serves other sectors and changes in this sector directly influence changes in the other sectors.

“Credit facilities extended to this sector by mainstream lending institutions have been huge.

‘’The growing number of small and medium scale businesses in this sector is also an opportunity for leasing and insurance business to thrive.’’

Orimolade also said effective synergy would put the two industries in an added advantage to contribute to the nation’s recovery from economic recession.

‘’We need to reposition ourselves to capture the opportunities that will follow the expected recovery as economic forecasts indicate Nigeria’s recovery from recession and the economy will bounce back in late 2017.

Orimolade urged the two industries to set up joint leasing and insurance research teams to assist them overcome the problems limiting their ability from maximising their potential.

“The much awaited collaboration should be in the areas of product and market research.

“The research should focus on need-satisfying products that address both current and future needs of mutual customers.’’

Business

Two Federal Agencies Enter Pack On Expansion, Sustainable Electricity In Niger Delta

Business

Why The AI Boom May Extend The Reign Of Natural Gas

Business

Ogun To Join Oil-Producing States ……..As NNPCL Kicks Off Commercial Oil Production At Eba

-

Sports2 days ago

Sports2 days ago2026 WC: Nigeria, DR Congo Awaits FIFA Verdict Today

-

Environment2 days ago

Environment2 days agoOxfam, partners celebrate 5 years of climate governance programmes in Nigeria

-

Politics2 days ago

ADC, PDP, LP Missing As INEC Set For By- Elections In Rivers

-

Politics2 days ago

FG’s Economic Policies Not Working – APC Chieftain

-

Politics2 days ago

Politics2 days ago2027: Diri Unveils RHA LG Coordinators, APC Congress Panel

-

Politics2 days ago

Politics2 days agoReps To Meet,’Morrow Over INEC’s 2027 Election Timetable

-

Politics2 days ago

Politics2 days agoGroup Continues Push For Real Time Election Results Transmission

-

Sports2 days ago

Sunderland Overcome Oxford Challenge