Business

Capital Market Indices Up By 1.03%

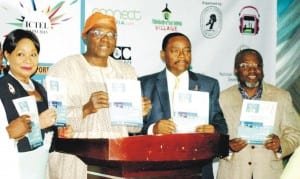

L-R: Vice President, Lagos Chamber of Commerce and Industry (LCCI), Dr Nike Akande, LCCI President, Alhaji Remi Bello, Vice President and Chairman, Trade Promotion Board, Dr Michael Olawale-Cole and Chairman, Specialised Exhibition Committee, Mr Sola Oyetayo, at the unveiling of Information Communication Technology and Telecommunications Industry (ICTEL) Expo 2015 in Lagos, recently. Photo: NAN

Trading on the Nigerian Stock Exchange (NSE) for the third consecutive day maintained an upward trend with the market indicators appreciating by 1.03 per cent.

The Tide source reports that the All-Share Index on Wednesday rose by 305.91 basis points or 1.03 per cent to close at 29,889.91.

This is against 29,584.00 posted on Tuesday due to price growth recorded by some highly capitalised stocks.

Forte Oil topped the gainers’ chart for the day, increasing by N9.82 to close at N206.34 per share.

Total Nigeria came second with N4 to close at N144, while Nigerian Breweries also appreciated by N4 to close at N136 per share.

Stanbic IBTC chalked up N1.10 to close at N29 and Zenith Bank rose by 83 kobo to close at N17.53 per share.

The market capitalisation rose by N102 billion or 1.03 per cent to close at N9.974 trillion compared with N9.872 trillion achieved on Tuesday.

Analysts attributed the persistent growth in spite of uncertainties surrounding the general elections to low price of equities and improved earning reports declared by companies in 2014 financial year.

They added that the retention of the Monetary Policy Rate at 13 per cent by the Monetary Policy Committee (MPC) of the Central Bank of Nigeria (CBN) contributed to the rally.

Conversely, Nestle and Mobil Oil topped the laggards’ chart having lost N5 each to close at N800 and N140 per share respectively.

Access Bank lost 30k to close at N5.60, while Dangote Cement dropped 28k to close at N152.60 per share.

NAHCO lost 19k to close at N4.61 per share.

In all, investors bought and sold 433.87 million shares worth N4.004 billion transacted in 3,915 deals, indicating an increase of 105 per cent.

This is in contrast with 211.43 million shares worth N2.85 billion traded in 3,808 deals on Tuesday.

An analysis of the activity chart showed that Mansard Insurance emerged the most traded equity with 86.28 million shares worth N263.14 million.

Zenith Bank sold 60.73 million shares valued N1.06 billion, while FBN Holdings accounted for 41.044 million worth N354.68 million.

Transcorp sold 40.79 million shares worth N115.89 million and Access Bank traded 39.354 million shares valued N223.78 million.

Business

NCDMB, Jake Riley Empower 250 Youths On Vocational Skills

Business

NUJ Partners RSIRS On New Tax Law Education

Transport

Nigeria Rates 7th For Visa Application To France —–Schengen Visa

-

Politics3 days ago

Politics3 days agoPFN Rejects Call For INEC Chairman’s Removal Over Genocide Comments

-

Rivers3 days ago

Rivers3 days agoFasthire, PHCCIMA, CIPM Host CareerFest 2026 In PH

-

Sports3 days ago

Sports3 days agoEnekwechi wins Orlen Cup in season opener

-

Sports3 days ago

Sports3 days agoFalconets, Senegalese Lionesses arrive Ibadan for qualifier

-

Politics3 days ago

Politics3 days agoHoodlums Disrupt LP-ADC Defection Event In Lagos

-

Sports3 days ago

Sports3 days agoSimba open Nwabali talks

-

Politics3 days ago

Politics3 days agoRemoval From INEC’s Portal, Abure-Led LP Faction Mulls Legal Action

-

Niger Delta3 days ago

Niger Delta3 days agoTinubu, Jonathan, Diri Pay Last Respect To Ewhrudjakpo