Business

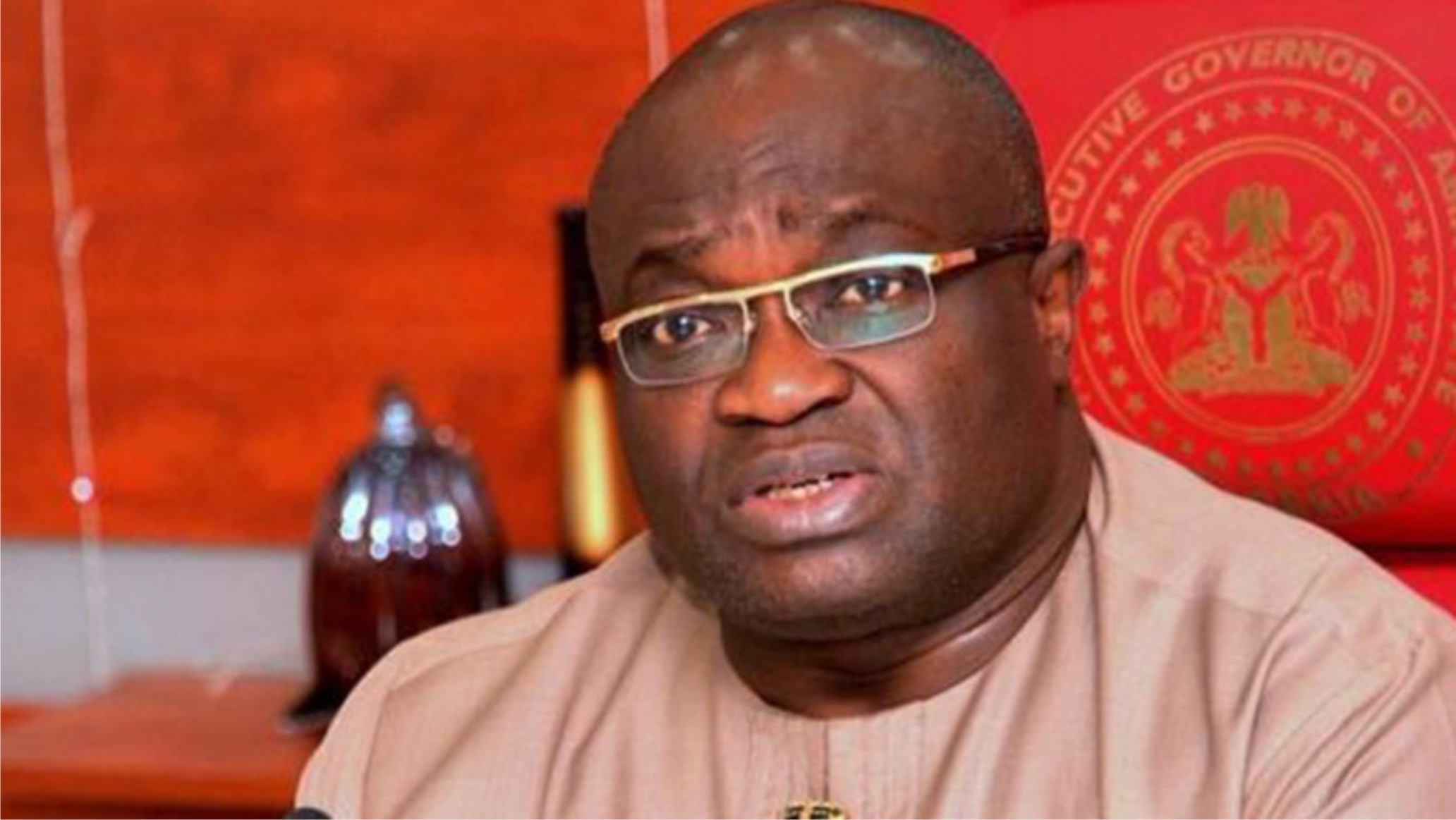

Abia To Clear N21bn Pension Deficit

With a pension deficit of over N21 billion to pensioners, the Abia State Government is set to settle all its pension arrears, the Commissioner for Finance, Dr Aham Uko, has said.

Uko, who spoke to reporters on the verification of pensioners in the state, assured that the exercise would address the challenge.

He said the government was not unmindful that there might be some irregular names on the payroll, hence the need to update the list.

He also said it was the desire of the government that at the end of the exercise, it would not return to the era of pension arrears.

He stressed that Governor Okezie Ikpeazu desired that pensioners should enjoy the benefits of their active service years.

He noted that one of the benefits of the exercise involving over 50 Information Communication Technology (ICT) experts was to ascertain the genuine pensioners.

He said: “We need to know what is the quantum of arrears to know how to liquidate it in the coming months.What is different from what we are doing is that there have to be a finger and facial capture.

“There will be a 10-day exercise, where verifications will be conducted at designated centres across the state, noting that ambulances, free-medical services and, entertainment would be provided for the pensioners.

“The exercise is solely for state pensioners, and the ambulances will be used for both emergencies and reaching out to sick and incapacitated pensioners who could not make it to the centres in their homes.”

Business

Nigeria’s ETF correction deepens as STANBICETF30, VETGRIF30 see 50% decline in a week

Business

BOI Introduces Business Clinic

Business

Dangote signs $400 mln equipment deal with China’s XCMG to speed up refinery expansion

-

Maritime3 days ago

Nigeria To Pilot Regional Fishing Vessels Register In Gulf Of Guinea —Oyetola

-

Maritime3 days ago

Customs Declares War Against Narcotics Baron At Idiroko Border

-

Sports3 days ago

Sports3 days agoGombe-Gara Rejects Chelle $130,000 monthly salary

-

Maritime3 days ago

NIMASA,NAF Boost Unmanned Aerial Surveillance For Maritime Security

-

Sports3 days ago

Sports3 days agoTEAM RIVERS SET TO WIN 4×400 ” MORROW” …Wins Triple jump Silver

-

Sports3 days ago

Sports3 days agoNPFL Drops To 91st In Global League Rankings

-

Maritime3 days ago

NIWA Collaborates ICPC TO Strengthen Integrity, Revenue

-

Sports3 days ago

Sports3 days agoNPFL Impose Fines On Kwara United Over Fans Misconduct