Business

Lagos NURTW Injects 100 New Buses Into BRT

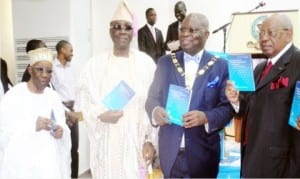

L-R: Founder, Chartered Institute of Bankers of Nigeria, (CIBN), Alhaji Oladimeji Otiti, Oba of Lagos, Obarilwan Akiolu, President, CIBN, Dr Sina Aina and Chairman, First City Monument Bank, Otunba Micheal Balogun, during the unveiling of a book titled “The Economy of Financial Inclusion In Nigeria” written by Dr Aina in Lagos.

The Chairman, Lagos State branch of the National Union of Road Transport Workers (NURTW), Alhaji Tajudeen Agbede said the union had injected nearly 100 new buses to Bus Rapid Transport (BRT) on Lagos roads, to ease passengers’ traffic.

Agbede told newsmen yesterday in Lagos that the NURTW buses were injected to phase out buses that were worn out from all BRT routes.

“We have pushed out almost 100 buses to reduce passengers’ traffic caused by less number of buses and those that are not in good condition and we are still expecting more.

“All the buses that are not in good condition are going to be phased out gradually.

“We cannot just remove every bus that is not in good condition out of the road.

“Removal of rickety buses at once will cause passengers’ traffic and reduce movement of people using the BRT buses.

“Rickety buses will be taken for repairs and put back to work to complement the number of buses available for passengers’ use.

“NURTW is committed to serve the people of Lagos State to their convenience,” Agbede said.

A passenger at Mile 12, Segun Muibi, said that most of the BRT buses were rickety and needed to be changed.

He commended the Lagos State Government for repairing the dilapidated BRT roads.

“All the vehicles brought in during the commencement of 1st BRT operations in Nigeria are still in use after they have gone through a lot of repairs.

“Most of the BRT buses are still plying the roads, because there were inadequate number of buses to replace the worn out buses,” Muibi said.

Another passenger, Mr Baderin Hakeem, said that the BRT buses should be increased to ensure that they were in line with their mandate of rapid movement of passengers.

Hakeem urged the management of BRT to handle the buses well so as to serve the people longer before they get spoilt.

“Some of the buses are still in operation since the time BRT was established by the Fashola regime.

“Most of the BRT buses in use now are in a very bad shape and need effective management by the operators, to make them last long in servicing the people.

He, however, commended the management of the organisation for injecting new busses to ease the stress of passengers using BRT routes across the state.

Solomon Akinola who patronises BRT buses, urged the management of BRT to maintain the tempo set by the immediate past administration in the state and phase out worn buses in its fleet.

Akinola stressed the need for BRT to increase the number of its buses so that people would not be waiting before moving to their various destinations.

Business

Fidelity Bank To Empower Women With Sustainable Entrepreneurship Skills, HAP2.0

Business

President Tinubu Approves Extension Ban On Raw Shea Nut Export

Business

Crisis Response: EU-project Delivers New Vet. Clinic To Katsina Govt.

-

News3 days ago

News3 days agoAmend Constitution To Accommodate State Police, Tinubu Tells Senators

-

Politics3 days ago

Politics3 days agoSenate Urges Tinubu To Sack CAC Boss

-

News3 days ago

News3 days agoDisu Takes Over As New IGP …Declares Total War On Corruption, Impunity

-

Business3 days ago

President Tinubu Extends Raw Shea Nuts Export Ban To 2027

-

Business3 days ago

Crisis Response: EU-project Delivers New Vet. Clinic To Katsina Govt.

-

Business3 days ago

President Tinubu Approves Extension Ban On Raw Shea Nut Export

-

Sports3 days ago

NDG: Rivers Coach Appeal To NDDC In Talent Discovery

-

Rivers3 days ago

Etche Clan Urges Govt On Chieftaincy Recognition