Business

NHF: Civil Servants Task FMBN On Accomodation

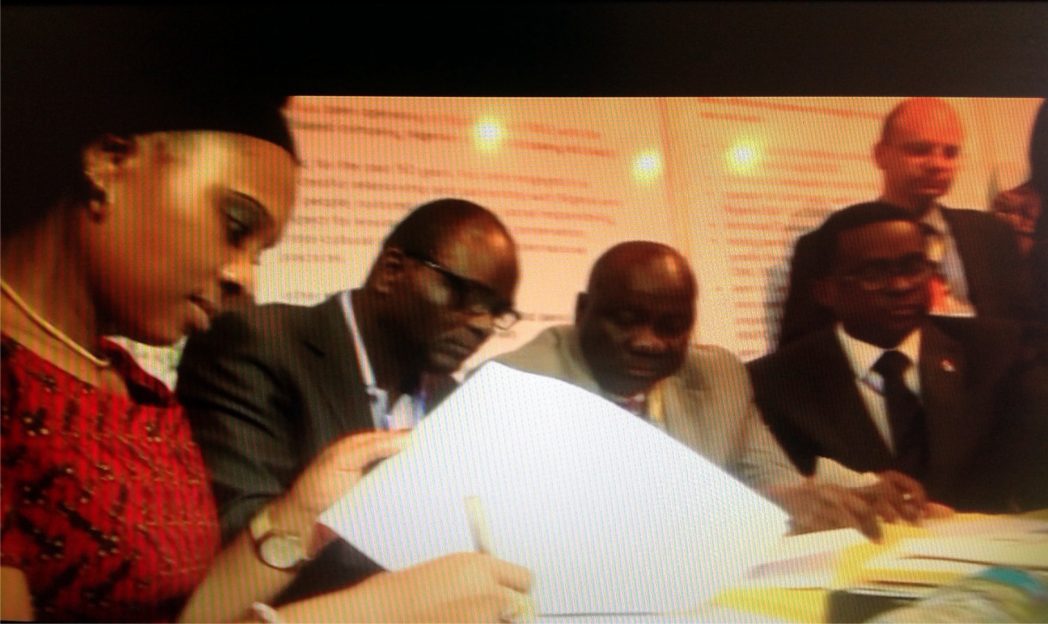

The General Manager, Nigerian Content Development/Nigerian Agip Oil Company, Mrs Callista Azogu (1st right) signing the M.o. U between Nigerian Agip Exploration and Petroleum Technology Association of NIgerian while others watch, recently in Port Harcourt

Civil Servants in Rivers

State have appealed to the management of the Federal Mortgage Bank of Nigeria (FMBN) to ensure that its promise of accommodation through the National Housing Fund was fulfilled.

Some civil servants who spoke with The Tide in Port Harcourt at the weekend said they were weary of such promise which always ended in the pages of newspapers.

One Mrs Ibilagba West said that over the years, some ‘smart’ people in the banking industry have used such means to dupe civil servants of their hard earned income.

She regretted that the workers have now become a platform to execute all sorts of transactions. West, said if the FMBN are claiming to be sincere in their promise, they should commence the first phase of the project before the end of the first quarter of next month.

According to her, executors of such ventures also capitalise on the plights of the average Nigerian worker to rob them of some other attainable benefits, while calling on the Labour Congress to set up machineries that will henceforth regulate such promises.

Another respondent, Mr Joe Ogbu blamed the situation on the inability of the government to provide some basic needs of its workers.

He recalled that in the Western world, things like accommodation have been almost forgotten issue, due to the level of attention given to it.

Ogbu, also tasked those in authority to as a matter of urgency, draw attention to the welfare of the workers.

Concerning the issue of ATM card issuance as promised by FMBN to the contributors of the National Housing Fund in June, the civil servants called on Bank to expedite action, maintaining that they were tired of what they described as too much explanations.

They argued that since the workers are the main source of the country’s economic productivity, it would be a healthy practice to also make them the first partakers of every other of its benefits.

They also described as pitiable a situation where most civil servants retire with nothing to show for it, adding that something meaningful ought to be done.

FMBN, had promised to give out loan of up to the tune N15 million, to stretch within 30 years with an interest rate of six per cent.

Business

NCDMB, Jake Riley Empower 250 Youths On Vocational Skills

Business

NUJ Partners RSIRS On New Tax Law Education

Transport

Nigeria Rates 7th For Visa Application To France —–Schengen Visa