Editorial

Nigeria’s Growing Debt Burden

Thursday, July 15, 2021, the Nigerian Senate approved two new foreign loans of $8.325 million and

€490 million respectively. That has raised a lot of questions among many stakeholders in the country, who have equally considered the approval as a bad move in the management of the already battered economy, especially at this period of torturous debt service compulsion.

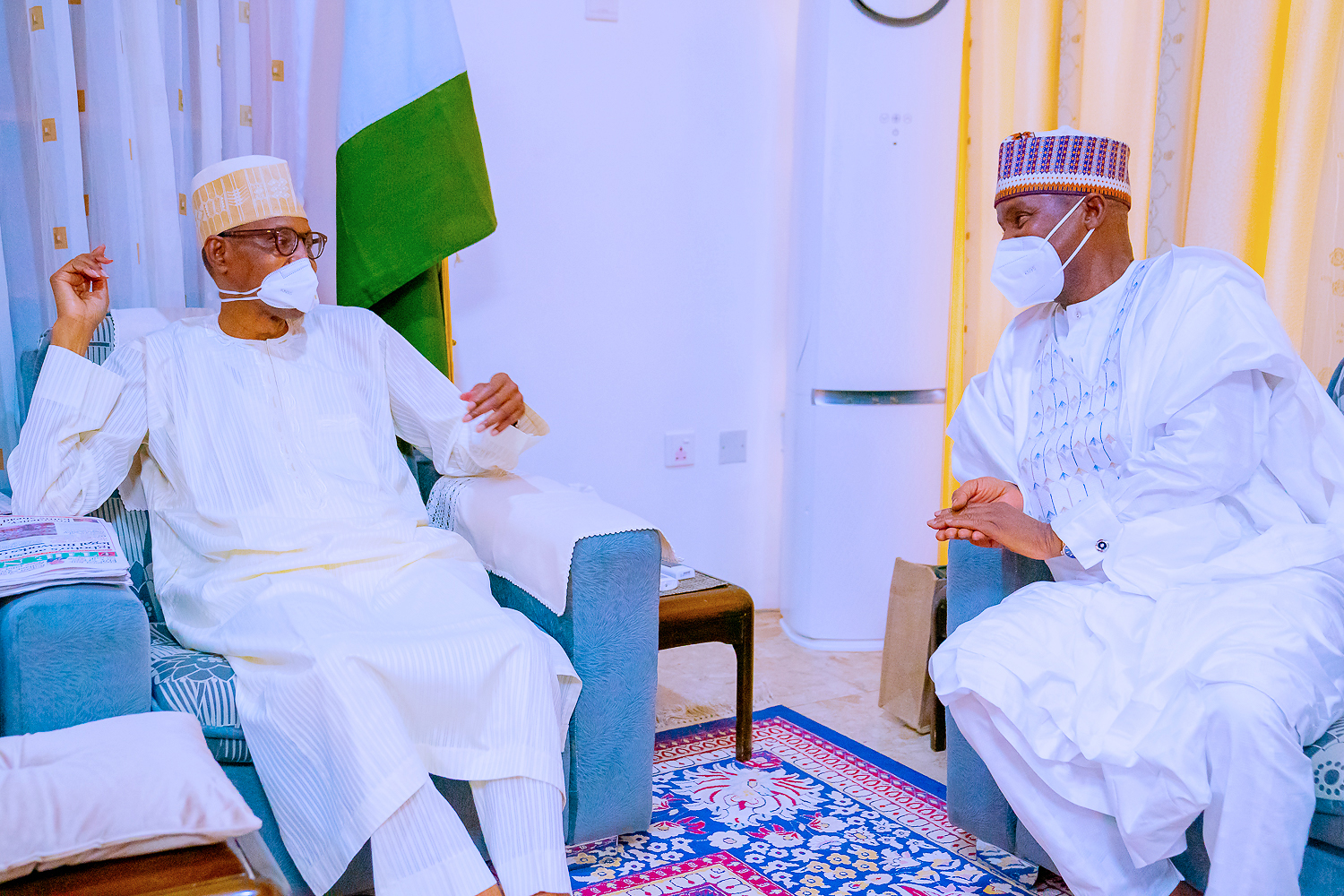

The loans are said to be part of the Federal Government’s 2018-2020 external borrowing plan. It was ratified after the Senate considered the report of the Senate Committee on Local and Foreign Debt. In May this year, President Muhammadu Buhari asked the National Assembly to endorse the loan for funding various “priority projects” in the country.

Earlier, the Senate had approved $1.5 billion and €995 million respectively. The $1.5 billion was to be sourced from the World Bank for the financing of critical infrastructure across the 36 states of the federation under the States Fiscal Transparency, Accountability and Sustainability (SFTAS) programme and Covid-19 action recovery plan.

Similarly, the €995 million was to be procured from the Export-Import Bank of Brazil to finance the Federal Government’s Green Imperative project to enhance the mechanisation of agriculture and agro process to improve food security. These are aside several other loans taken by the administration since inception in May 2015.

Statistics from the Debt Management Office (DMO) on Nigeria’s liability portfolio over the last six years show how the accumulation has progressed hazardously. According to the DMO, Nigeria’s total debt as of June 30, 2015 (the year President Muhammadu Buhari took over) stood at N12.12 trillion. As of December 31, 2020, the country had a debt portfolio of N32.92 trillion. The latest DMO statistics, covering the first quarter of 2021, indicated that the debt portfolio had increased again to N33.10 trillion.

In addition, the Federal Government also incurred another N10 trillion in overdrafts with the Central Bank of Nigeria (CBN). This overdraft, which may also be provided by printing currency, has been reconditioned to be repaid over 30 years. We wonder what the managers of the economy have up their sleeves when they take on these liabilities which have serious implications not only for the present, but also for the future generations of Nigerians.

These allegations of printing of funds that have followed a trend across the country in recent times may be seen as apparently corroborated by this huge N10 trillion owed by the CBN. The CBN may have always relied on printing money to meet the government’s overdraft demands.

The unfortunate and highly impoverished argument still put forward by the government and proponents of increased borrowing is the country’s debt-to-GDP ratio is still sound and below 40 per cent. However, they lose sight of the fact that GDP does not pay the debt, but incomes do. GDP only reflects the size of the economy and not that a mechanism has been put in place to service the loan when it becomes due.

What the Buhari government has done over the past six years, with its incompetent economists, is reckless borrowing, and has obviously borrowed beyond its repayment capacity. That is why the Federal Government is in trouble as far as servicing the debt is concerned. It recently admitted this much, claiming it spent N1.8 trillion on debt servicing from its N1.84 trillion revenues in the first five months of 2021 (January to May).

Thus, the debt-to-revenue ratio of the Federal Government, a key measure of debt sustainability, stands at 97.8 per cent over the reviewed period. How outrageous is that? In 2016, the federal debt service amounted to only 44.6 per cent. But by 2020, the debt-to-revenue ratio had increased to about 84.8 per cent. That is why 33 per cent of the current 2021 budget is dedicated to paying down the debt.

As debts increase for payments, the strain on incomes increases. In the 2019 budget, for instance, over N2.1 trillion was set aside for debt servicing. Also, in the 2020 budget, N2.45 trillion was dedicated for debt repayments. That was close to 25 per cent of the budget. No country can achieve development with such enormous debt settlements.

The huge amount spent on debt servicing leaves the Buhari government with little money for infrastructure. That is why it takes more loans and print money to finance the cost of personnel, pensions and capital expenditures. Since printed currency also forms part of the debt of any government, we are concerned with the staggering way the CBN has printed money over the last six years and handed it to the Federal Government. It increased sharply from N2.2 trillion printed in 2016 to an estimated N10 trillion by the end of 2020.

There is no use borrowing for projects such as railways and airports. No sane government continues to invest in such infrastructure. Investments in areas like that and many others should be led by the private sector while the government creates an enabling environment. Public funds should be expended on health, education and social welfare, not on areas better managed by the private sector.

Nigerians have always been bombarded by constant requests for loans from the President. Such loans have become too numerous and most well-meaning citizens have called for an end to the alarming tendency to incur loans infelicitously. The nation already has a huge debt burden and must not permit this situation so far aggravated by the Buhari administration.

Time and time again, the current government, aided by an implacable legislative assembly proud of its docility, has invoked various excuses to justify its borrowing frenzy. Sadly, the administration does not show creativity when it comes to reducing governance costs and consolidating the revenue base. It is all about here and now: it does not think of the future. The fiscal situation of the country is disastrous and disheartening, and it is time for the government to change course.

Editorial

Beginning A New Dawn At RSNC

Editorial

Sustaining OBALGA’s Ban On Street Trading

Editorial

AFCON ’25: Bravo, Super Eagles, But…

-

Maritime3 days ago

Nigeria To Pilot Regional Fishing Vessels Register In Gulf Of Guinea —Oyetola

-

Sports3 days ago

Sports3 days agoGombe-Gara Rejects Chelle $130,000 monthly salary

-

Maritime3 days ago

Customs Declares War Against Narcotics Baron At Idiroko Border

-

Maritime3 days ago

NIMASA,NAF Boost Unmanned Aerial Surveillance For Maritime Security

-

Sports3 days ago

Sports3 days agoTEAM RIVERS SET TO WIN 4×400 ” MORROW” …Wins Triple jump Silver

-

Sports3 days ago

Sports3 days agoNPFL Drops To 91st In Global League Rankings

-

Sports3 days ago

Sports3 days agoNPFL Impose Fines On Kwara United Over Fans Misconduct

-

Maritime3 days ago

NIWA Collaborates ICPC TO Strengthen Integrity, Revenue