Business

Revenue Generation: The Rivers Example

When the American economist, Cirero wrote that: “man does not realise how great a revenue economy is”, he was apparently referring to the prime objective of taxation as the bulwark needed to obtain the economic expansion for stable growth and development in any given society.

Today, modernisation of tax systems in line with global best practices and policies has become a major concern of economies and governments. Tax administration is however determined by the peculiar economic environment it operates.

The strategic location and natural disposition of Rivers State makes it a destination for prospective companies and individuals who tap from its enormous economic potentials for their corporal survival.

With such unfettered altraction offered by Rivers State to myriads of corporate organisations with vested business concern, and other fortune seekers, existing infrastructures are stretched.

This places a burden and bulk of responsibilities on the government in terms of provision of basic amenities to cater for the yearning aspirations and spiraling increase in the population of the state.

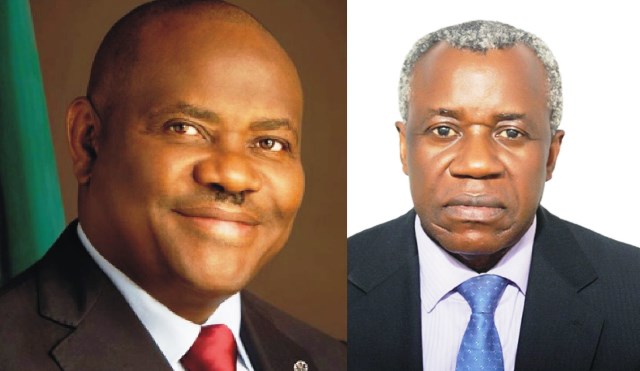

However, determined to live up to its responsibilities of governance, the present administration in Rivers State led by Chief (Barr.) Nyesom Ezenwo Wike has put in place pragmatic reform policies to shore up revenue generation in the state, through effective tax administration.

The new tax regime in the state is premised on the objective that the thrust of governance depends on constant redefinition of goals and vigilance of governance to tackle inefficiencies in administrative procedures.

The first step made by the government of Rivers State is this direction was the reorganisation of the management of the Rivers State Internal Revenue Services. (RIRS).

The new management of (RIRS) assumed office with specific mandate to overhaul the tax administration system in the state and put in place a more robust and compliance friendly regime.

The fundamental objective of the new tax policy is to ensure that all those who do legitimate business in Rivers State pay their taxes accordingly without extraneous influence or doubt in the verification process.

The fact been that the previous system was inundated with the activities of touts who paraded themselves as tax administrators.

Speaking with newsmen during a briefing recently, the Chairman of the Rivers State Internal Revenue Services, Chief Adoage Norteh said the Rivers State Government has introduced on-line transaction in its tax administration to check the errors and palpable defects in the manual system of operation which was previously in use.

The RIRS Chairman said the e-transaction was introduced to encourage voluntary compliance on the part of the tax-paying public, noting that the facilities have component of detecting fraud in the system.

He said: “before we came on board, tax clearance was manual and cumbersome, the process was chaotic and prone to infiltration by touts, but the Rivers State Internal Services introduced an on-line system to make transactions easier for the tax-paying public”.

He pointed out that the new system accommodates complaints and promote 24 hours services, adding that enumerators from (RIRS) were on ground to take data and ensure that income earners pay their taxes accordingly.

While the Rivers State Government is softening the ground for tax-payers in the state to leverage upon, the government has also made bold its resolve to tackle tax evasion headlong.

According to the RIRS chairman, tax defaulters in the state henceforth risk jail as the government will ensure that those with such criminal tendencies are fished out and prosecuted.

As part of its innovations to promote voluntary tax compliance in the state, RIRS has also embarked on the free registration of all eligible tax payers in the state, with strict caution against any monetary demands from anybody including staff of RIRS.

By the new policy which is expected to be fully implemented from the first quarter of 2019, companies are expected to carry out all tax clearance and registration by the end of January 2019, while deadline for individual registration will end in March 2019. The Rivers State Internal Revenue Services, (RIRS) has also made it mandatory that all tax payments must be paid to designated government accounts, while those parading as tax administrators and making cash demands should be treated as touts.

According to the RIRS Chairman, “90% of people parading as tax administrators are touts, task drive from RIRS is conducted in an organised manner, we don’t demand money at the door, all money should be paid to government account”.

Another interesting aspect of the new tax regime in Rivers State, is the nature of its service delivery. The new system is completely devoid of partisan involvement, as it is handled professionally by experts.

This absence of partisan meddlesomeness has given desired impetus to the system to strive, thereby bringing commensurate result.

The RIRS Chairman affirmed this when he declared that the new tax regime in the state has so far recorded significant improvement and checked the inefficiencies of the past.

He said the level of compliance has boosted the internally generated revenue based in the state which has robbed off positively in the development of critical infrastructures.

Although the RIRS Chairman admitted that tax has its darker side, he noted that tax remains the fundamental incentive that builds industries, create jobs and improve the general standards of living of the people.

On the perceived discontent of some people over alleged multiple taxation by the Rivers State Government, the RIRS Chairman said the Rivers State Government was not involved in multiple taxation. Rather he said that Rivers State operates one of the best tax friendly regimes by collecing task on individual earnings, Pay As You Earn (PAYE) and urged the tax-paying public to reciprocate the gesture through voluntary compliance.

The Rivers State Internal Revenue Services (RIRS) also identified inadequate information as the bane of effective tax system.

It therefore blamed some of the misgivings on the part of the tax-paying public on poor information.

As part of measures of ensuring a robust tax regime in the state, the RIRS Chairman said modalities have been concluded to partner with the media to critically engage the tax-paying public through public sensitisation of its activities.

Describing the media, as critical stakeholders in the polity, he said media houses should make it part of their corporate social responsibilities to inform the public on Government policies.

Perhaps one of the major breakthrough in the tax system in Rivers State is the unnerving of the sacred cow syndrome.

Most of the virulent critics of the new tax regime in the state are those that are rooted out of their comfort zones of deliberate tax default. These include company owners who refuse to open up their records for scrutiny, and as such defraud the state government.

According to the Rivers State Internal Revenue Services (RIRS) Chairman, such a deliberate neglect of the tax system is the shortest route to economic ruins and will not be tolerated in Rivers State. It could be recalled that the Rivers State Governor, Nyesom Ezenwo Wike had at different fora, restated the commitment of his administration towards good governance and prudent use of resources for the development of the state.

However, to keep faith with this social contract and public trust, the government also needs to leverage on an improved internally generated revenue based to complement the dwindling federal allocation.

Taneh Beemene

Business

Fidelity Bank To Empower Women With Sustainable Entrepreneurship Skills, HAP2.0

Business

President Tinubu Approves Extension Ban On Raw Shea Nut Export

Business

Crisis Response: EU-project Delivers New Vet. Clinic To Katsina Govt.

-

Maritime5 days ago

Nigeria To Pilot Regional Fishing Vessels Register In Gulf Of Guinea —Oyetola

-

Sports5 days ago

Sports5 days agoGombe-Gara Rejects Chelle $130,000 monthly salary

-

Maritime5 days ago

Customs Declares War Against Narcotics Baron At Idiroko Border

-

Sports5 days ago

Sports5 days agoTEAM RIVERS SET TO WIN 4×400 ” MORROW” …Wins Triple jump Silver

-

Maritime5 days ago

NIMASA,NAF Boost Unmanned Aerial Surveillance For Maritime Security

-

Sports5 days ago

Sports5 days agoNPFL Drops To 91st In Global League Rankings

-

Sports5 days ago

Sports5 days agoNIGER DELTA GAMES PANACEA TO YOUTH DEV”

-

Sports5 days ago

Sports5 days agoNPFL Impose Fines On Kwara United Over Fans Misconduct