Business

Mikano Refutes Claims Of Being Owned By Atiku

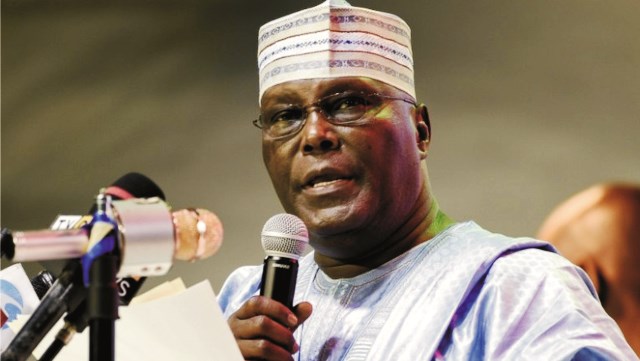

The Management of Mikano International Limited, has said the former Vice President, and current presidential candidate of the Peoples Democratic Party (PDP), Atiku Abubakar, is not the owner of the company.

The company disclosed this in a statement signed by its Managing Director, Firas Mamlouk, as it denied reports that the generator firm was owned or affiliated to the former Vice President.

Various social media posts had claimed that Abubakar was the owner of Mikano International Limited, a Nigeria-based company that was established in 1993 and deals with power generation, steel fabrication, electrical products, and solutions.

Reacting to the claims on Sunday, the firm said, “The attention of the management of Mikano International Limited, promoters of Mikano Generators (among other products), has been drawn to numerous articles and press statements stating that the company is owned by/afflliated with Atiku Abubakar, GCON.

“This disclaimer is a notice to the general public that the news does not represent the true facts as it concerns Mikano International Limited.

“Please be informed that Mikano International Limited is not owned, affiliated, associated, authorised, endorsed by, or in any way officially connected with Atiku Abubakar, GCON. Members of the public are, therefore, advised to disregard the news”, it stated.

The PDP presidential candidate for the 2023 general elections has been in the news lately over wide-range issues, particularly as regards political matters.

The Labour Party and the Tinubu Presidential Campaign Organisations had berated Abubakar on Friday for saying he would win the election next year.

Business

Fidelity Bank To Empower Women With Sustainable Entrepreneurship Skills, HAP2.0

Business

President Tinubu Approves Extension Ban On Raw Shea Nut Export

Business

Crisis Response: EU-project Delivers New Vet. Clinic To Katsina Govt.

-

Maritime5 days ago

Nigeria To Pilot Regional Fishing Vessels Register In Gulf Of Guinea —Oyetola

-

Sports5 days ago

Sports5 days agoGombe-Gara Rejects Chelle $130,000 monthly salary

-

Maritime5 days ago

Customs Declares War Against Narcotics Baron At Idiroko Border

-

Sports5 days ago

Sports5 days agoTEAM RIVERS SET TO WIN 4×400 ” MORROW” …Wins Triple jump Silver

-

Sports5 days ago

Sports5 days agoNPFL Drops To 91st In Global League Rankings

-

Maritime5 days ago

NIMASA,NAF Boost Unmanned Aerial Surveillance For Maritime Security

-

Sports5 days ago

Sports5 days agoNIGER DELTA GAMES PANACEA TO YOUTH DEV”

-

Sports5 days ago

Sports5 days agoNPFL Impose Fines On Kwara United Over Fans Misconduct