Business

Lagos Closes N85.14bn Bond Issuance

Lagos State Government has announced the closure of the N85.14 billion Series 2 Bond Issuance, targeted at physical and social infrastructure development.

The Commissioner for Finance, Mr Akinyemi Ashade, said in a statement in Lagos, Monday, that the bond was issued in two tranches.

Ashade said tranche 1 would be N46.37 billion at 16.75 per cent, adding that tranche 2 worth N38.77 billion at 17.25 per cent.

According to him, the bonds are to mature in August 2024 and same month in 2027 respectively, under the N500 billion ‘Third Debt Issuance Programme’.

Ashade recalled that the government had on Friday, August 12, issued an N85.14 billion Series 2 Bond in two tranches with a 7-year N46, 37 billion bond at 16.75 per cent bond, maturing in August 2024.

The tranche 2, including a 10-year N38, 77 billion at 17.25 per cent bond maturing in August 2027.

The commissioner said both were also under the N500 billion Third Debt Issuance Programme by way of a book building.

According to him, the N85.14 billion Series II issuance was the largest bond issuance in Nigerian capital markets in the last four years and the second largest issuance ever.

He also said that it was the first time any non-FGN issuer in Nigeria had issued out up to 10 years, thereby extending the non-sovereign yield curve.

“We value the reputation we have earned as the most responsible issuer in the Nigerian capital markets and thank everyone who has worked with us to deliver a successful outcome,” Ashade said.

The commissioner said that Chapel Hill Denham acted as Lead Issuing House and Bookrunner led an issuing party, including 10 other Bookrunners, on what he described as a landmark transaction.

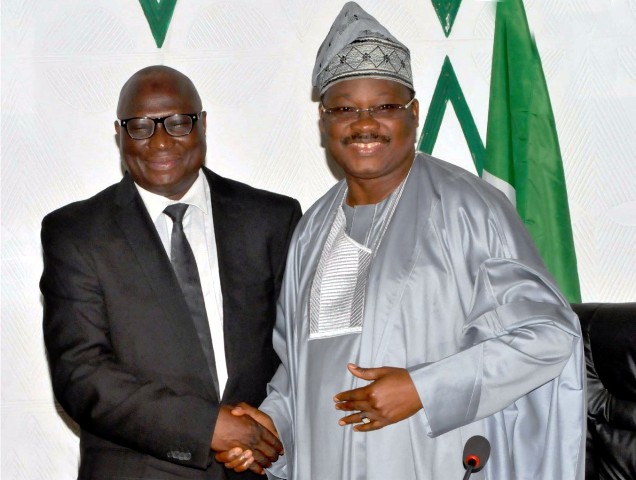

Ashade, however, quoted Governor Akinwunmi Ambode as saying, “In challenging market conditions, we are encouraged by the sustained support that the Lagos State credit story has received from investors for which we are grateful.

“This support is critical to our quest to improve the physical and social infrastructure in the State and lift the economic and social welfare of all citizens of Lagos state.”

Business

Fidelity Bank To Empower Women With Sustainable Entrepreneurship Skills, HAP2.0

Business

President Tinubu Approves Extension Ban On Raw Shea Nut Export

Business

Crisis Response: EU-project Delivers New Vet. Clinic To Katsina Govt.

-

News2 days ago

News2 days agoAmend Constitution To Accommodate State Police, Tinubu Tells Senators

-

Politics2 days ago

Politics2 days agoSenate Urges Tinubu To Sack CAC Boss

-

News2 days ago

News2 days agoDisu Takes Over As New IGP …Declares Total War On Corruption, Impunity

-

Business2 days ago

President Tinubu Extends Raw Shea Nuts Export Ban To 2027

-

Business2 days ago

Crisis Response: EU-project Delivers New Vet. Clinic To Katsina Govt.

-

Business2 days ago

President Tinubu Approves Extension Ban On Raw Shea Nut Export

-

Business2 days ago

FG Pushes Cassava Bioethanol Drive To Boost Industrial Growth

-

News2 days ago

25 Killed In Adamawa Jihadist Attacks