Business

Aganga Identifies New Strategy To Boost MSMEs

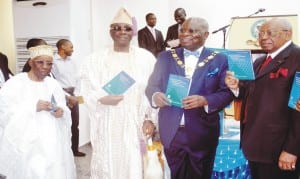

L-R: Founder, Chartered Institute of Bankers of Nigeria, (Cibn), Alhaji Oladimeji Otiti; Oba of Lagos, Obarilwan Akiolu; President, Cibn, Dr Sina Aina and Chairman, First City Monument Bank, Otunba Micheal Balogun, during the Unveiling of a Book Titled “The Economy of Financial Inclusion in Nigeria” written by Dr Aina in Lagos recently.

The Minister of In

dustry Trade and Investment, Mr. Olusegun Aganga has described the newly inaugurated Nigerian Business Development Services Network (NBDS) as another milestone in the current administration’s determination to reposition the Micro, Small and Medium Enterprises (MSMEs) sector.

Aganga said the new initiative is a network of private sector business development service providers that will work with MSMEs to achieve economic growth.

He said the move was aimed at achieving effective and productive performance by the sector especially in the area of mentoring and provision of financial link to the federal government’s N39.6 billion MSME development programme.

According to the minister, the federal government has made MSMEs the centre of economic policy, adding that the present initiative would enable the sector grow and contribute significantly to Gross Domestic Product (GDP) growth.

He said that NBDS would also serve as indirect collateral for small business operators, adding that the initiative will go a long way in helping MSMEs to formalise their operations.

The minister said this would strengthen the book keeping records of the sector operators which has been a major setback in their dealings with financial institutions.

Aganga commended the World Bank for its productive partnership with the Ministry of Industry, Trade and Investment (MITI), adding that the initiative would help in addressing some specific challenges affecting the sector.

Business

Fidelity Bank To Empower Women With Sustainable Entrepreneurship Skills, HAP2.0

Business

President Tinubu Approves Extension Ban On Raw Shea Nut Export

Business

Crisis Response: EU-project Delivers New Vet. Clinic To Katsina Govt.

-

Maritime5 days ago

Nigeria To Pilot Regional Fishing Vessels Register In Gulf Of Guinea —Oyetola

-

Sports5 days ago

Sports5 days agoGombe-Gara Rejects Chelle $130,000 monthly salary

-

Maritime5 days ago

Customs Declares War Against Narcotics Baron At Idiroko Border

-

Sports5 days ago

Sports5 days agoTEAM RIVERS SET TO WIN 4×400 ” MORROW” …Wins Triple jump Silver

-

Sports5 days ago

Sports5 days agoNPFL Drops To 91st In Global League Rankings

-

Maritime5 days ago

NIMASA,NAF Boost Unmanned Aerial Surveillance For Maritime Security

-

Sports5 days ago

Sports5 days agoNIGER DELTA GAMES PANACEA TO YOUTH DEV”

-

Sports5 days ago

Sports5 days agoNPFL Impose Fines On Kwara United Over Fans Misconduct