Ict/Telecom

‘GSM, Internet No Threat To NIPOST’

The Area post Man

ager of Nigeria Postal Services (NIPOST), Rivers Territory, Mrs Lorretto Nwakanma, has said that the advent of the Global System of Mobile Communication (GSM) and the internet services are no threat to the Nigerian Postal Service (NIPOST), due to the kind of services of readers.

She said this recently during the celebration of the 2014 World Post Day in Port Harcourt.

Nwakanma, noted that both the GSM and internet are only a complement to each other, adding that no form of communication can actually be a replacement for the other.

She said rather than posing any threat to the post, the innovations are functional partners in mail handling and processing.

The NIPOST, pointed that its consciousness to meet the desire of her esteemed customers has led it to repackage some of her traditional services to international standard.

Some of such services, include post cash and parcel post, where online cash transfer services and e-commerce/online shopping are handled.

She also explained that the parcel post, deals with small/large items or merchandise are moved conveniently to any location in Nigeria and abroad.

Others include Cargo logistics, postshop, Agency Service and Deliver Service, which services rangers from the acceptance huge and cumbersome items like household materials to offices/homes mail delivery at an agreed intervals.

However, she has called on Nigerians to transport through the post inorder to safe-guard their items, as she encourage a practice of putting stamp duty mandates on every receipt, bills and other documents.

Meanwhile, she has appreciated some numbers of staff and outstanding customer who were given an award by the corporation for their remarkable services.

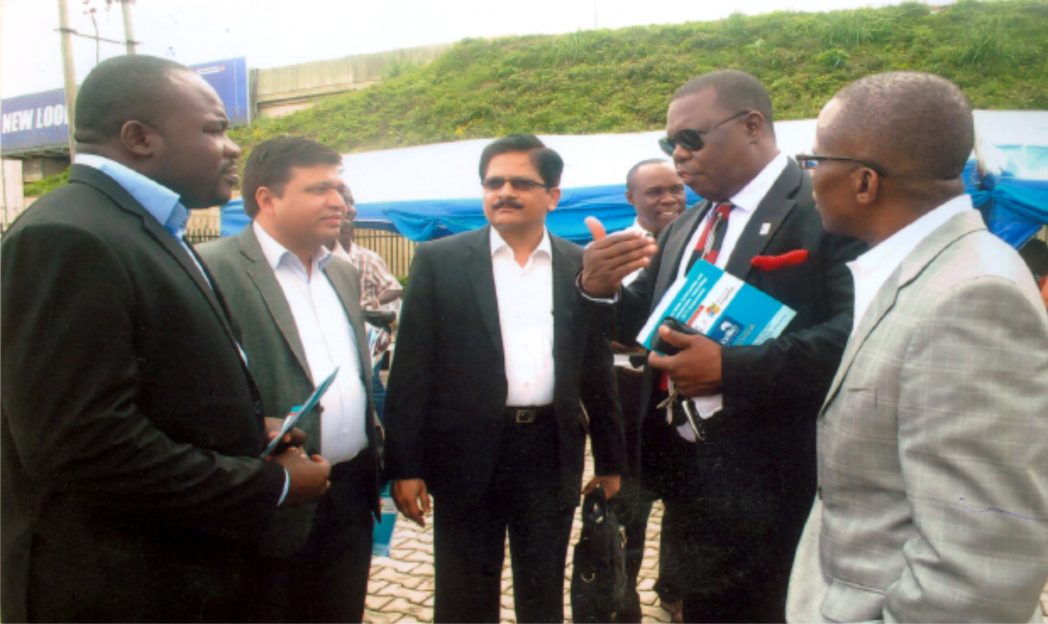

L-R Citizenship and Partners in Learning Manager, Microsoft, Ugochukwu Nwosu, Project Delivery Head, ICT-STP Education Services Ltd, Pradeep Joshi, STP Education Services Ltd, Gautham More, Specail Adviser to the Rivers State Governor on ICT, Engr Goodliffe Nmekini and Speial Assistant to the Rivers State Governor on Environmental Health, Dr Ogu Emejuru, during officail launching of Badiliko Digital Hubs in Port Harcourt, recently. Photo: Egberi A. Sampson.

Ict/Telecom

Technology, Others Responsible For Nigeria’s Bonga Oil Operations

The Managing Director, Shell Nigeria Exploration and Company Limited (SNEPCo), Elohor Aiboni, said Bonga, Nigeria’s first deep-water asset, has recorded major milestones, due to effective leadership, cutting-edge technology, continuous improvement and collaboration with stakeholders.

She noted that since coming on stream in November 2005, Bonga has maintained a track record of production that saw it achieve one-billion-barrel export on February 13, last year.

In her presentation, titled “The Bonga Journey to a Billion Barrels”, at the ongoing 2024 Offshore Technology Conference in Houston, Texas, United States, Aiboni, said: “SNEPCo is grateful for the contributions of all the parties to the Bonga story and we can all be proud of the milestones.

“Bonga has been consistent. In 2014, nine years after coming onstream, it achieved half a billion barrels of crude and doubled it in 2023. We have worked relentlessly to ensure excellent asset management, project and wells delivery and deployment of technology and innovations in our operations”.

According to her, these factors, “coupled with the supportive partnership of the Nigerian National Petroleum Company Limited and our co-venturers – TotalEnergies, EP Nigeria Limited; Nigerian Agip Exploration; and Esso Exploration and Production Nigeria Limited, make Bonga stand out as a world-class investment case”.

She continued that, “SNEPCo also enjoyed the support of the Nigerian Upstream Petroleum Regulatory Commission (NUPRC) and the Nigerian Content Development and Monitoring Board (NCDMB) in the success of Bonga operations”.

Aiboni also listed the challenges of keeping the Bonga Floating Production, Storage and Offloading vessel full as the asset ages and dealing with unexpected developments with subsea wells and equipment.

She said: “SNEPCo responded with a campaign of operational excellence, which among other initiatives, led to the creation of a programme known as the Bonga Business Improvement Plan that continually reviews and identifies improvement initiatives and drives sustainability in operations and upskilling of staff.

“The Bonga success story has been led by Nigerians who have been managing directors of SNEPCo since it was established in 1993, in a deliberate policy by Shell to develop indigenous manpower for deep-water operations in Nigeria.

“Today, some 97percent of the SNEPCo workforce is Nigerian and overall, Bonga has helped to create a new generation of Nigerian deep-water professionals.

“Our vision at SNEPCo remains to be the best deep-water business, powering growth and achieving net zero emissions in line with Shell’s Powering Progress strategy”.

Ict/Telecom

Banks Cut Borrowing From CBN By 44%

Banks’ borrowings from the Central Bank of Nigeria (CBN) fell month-on-month, (MoM) by 44 percent to N12.16 trillion in April from N21.7 trillion in March.

Analysis of latest data from the CBN shows that the 44percent drop represents the first MoM decline in banks borrowing from since January when it increased by 268.7 percent to N3.6 trillion from N976.29 billion in December 2023.

However, further analysis showed that banks’ deposits in the CBN SDF grew MoM by 118.4 percent to N428.97 billion in April from N196.37 billion in March 2024.

Banks make use of the SLF to access liquidity to run their day-to-day business operations while the Standing Deposit Facility window (SDF) on the other hand, is an overnight deposit facility that allows banks to lodge excess liquidity (money) with the CBN and earn interest.

The decline in banks’ borrowing from SLF may reflect an increase in banking system liquidity and also the decision of the apex bank last year to remove the limit on the remunerable daily placements by banks at the SDF.

According to the CBN Governor, Mr. Olayemi Cardoso, the CBN removed the cap on the remunerable SDF to increase activity in the SDF window and manage liquidity.

Ict/Telecom

Expert Highlights Technology Impact On Fintech Industry Growth

A Financial technology expert, Olatunji Akinrinola, has highlighted the exponential growth of the FinTech industry, which according to him, was driven by technological advancements.

Akinrinola made this assertion in a press release recently, where he stressed that the role of technology in driving this exponential growth in the FinTech sector was very outstanding.

According to him, Technology has revolutionised the way financial services are delivered, making them more accessible, efficient, and inclusive.

“Through innovations such as mobile banking, digital payments, and blockchain technology, FinTech companies have been able to reach a larger population and provided them with access to financial services”, he stated.

Akinrinola emphasised the role of technology in enabling financial inclusion, adding: “Technology has democratised access to financial services, particularly in regions with limited banking infrastructure.

“Mobile money platforms and digital wallets have empowered individuals to conduct financial transactions conveniently and securely, without the need for traditional banking services”.

He also underscored the role of Artificial Intelligence (AI) and data analytics in driving innovation within the FinTech industry, noting: “AI-powered algorithms and predictive analytics have revolutionised risk assessment, fraud detection, and customer personalisation in financial services.

“These technologies enable FinTech companies to provide tailored solutions and mitigate risks more effectively, ultimately enhancing the overall customer experience”.

Akinrinola stressed the importance of regulatory frameworks in fostering the growth of the FinTech industry.

“While technology has accelerated the growth of FinTech, it is essential to establish robust regulatory frameworks to ensure consumer protection and maintain market stability. Regulators play a crucial role in balancing innovation with risk management, thereby creating a conducive environment for the sustainable growth of the FinTech sector”, he stated.

Akinrinola underscored the role of technology in driving the exponential growth of the FinTech industry, saying, “Technology has been a game-changer for the FinTech sector, enabling innovation, expanding access to financial services, and driving economic growth.

“As technology continues to evolve, the FinTech industry will undoubtedly play a significant role in shaping the future of financial services ecosystem”.

Corlins Walter

-

Opinion4 days ago

Lagos-Calabar Highway Must Wait

-

Entertainment4 days ago

Davido Reacts To Report Of Sacking His Lawyer

-

News4 days ago

Rivers Policemen Abducted Man, Extorted N1m Via POS, Activist Reveals

-

Politics4 days ago

One Year Not Enough To Judge Tinubu -Kukah

-

News4 days ago

News4 days agoUNICEF Urges ECOWAS Member-States To Allocate More Resources To Healthcare

-

News4 days ago

Businesses Shut Down In Yenagoa As Ijaws, Honour Isaac Boro

-

Entertainment4 days ago

2Baba’s 20 Years Anniversary Of ‘Face 2 Face’

-

News4 days ago

FG To Pay N130bn As Part Of Gas Supply Debt – Minister