SMEs

BoI Honoured For Financial Inclusion Initiatives

The Bank of Industry (BoI) has been honoured at the just-concluded Sust-ainability, Enterprise and Responsibility Awards also known as the SERAS CSR Awards 2021.

Specifically, BoI won the award for the ‘Best Company in Financial Inclusion’ in recognition of its development impact in providing solutions to ensure that financial services are more accessible to unbanked and under-served groups. The Bank also received the award for ‘Best New Entry.’

Speaking on the awards, Managing Director/Chief Executive Officer, Bank of Industry, Olukayode Pitan, said “We are honoured to be recognised for our continuous efforts and strategic investments aimed at improving financial health and inclusion within Nigeria’s business landscape and economy.

“We remain committed to galvanizing more resources to scale up impact for economic, environmental and social responsibility, in line with our business strategy for sustainable development.

“These awards align with our mission of transforming Nigeria’s industrial sector through sustainable business practices as Africa’s leading Development Finance Institution operating under global best practices.”

SMEs

SMEDAN Directs N5bn Loan Applicants To Submit CAC Certificate

The Small and Medium Enterprises Development Agency of Nigeria (SMEDAN) has reviewed the selection process for beneficiaries of a N5billion credit facility allotted, meant for small businesses in the country.

With the new procedure, the agency has mandated the submission of Corporate Affairs Commission (CAC) certificate and Tax Identification Number as a compulsory requirement to obtain the loan.

The Head of Corporate Affairs, Moshood Lawal, SMEDAN, made the disclosure during an interview with our correspondent recently in Abuja.

According to the report,last year SMEDAN signed an agreement with Sterling Bank to disburse loan options ranging from N250,000 to N2,500,000 at a single-digit interest rate of nine per cent, to facilitate the growth of small businesses through enhanced financial access.

The credit, with the target to assist over 10,000 Small and Medium Enterprises (SMEs), has a duration period of 12 months, to enable small businesses to leverage the facility fully.

Speaking at the signing ceremony, the SMEDAN’s DG, Charles Odii, described it as “an important milestone in our efforts to stimulate economic growth and drive prosperity by enhancing SME access to finance.

“We believe that the financial support, which comes at a very competitive rate, will help SMEs expand operations, hire additional employees, and contribute to an overall upswing in beneficial trade and economic activities”, he said.

But giving an update on the issue four months after, the spokesperson said a software application had been developed to smoothen the process and limit human interference on the credibility of the process.

He added that submission of CAC certificate and tax identification number was needed to identify fake applicants and ensure the fund is given to the right persons.

He said, “Concerning the N5bn loan for small businesses, We have developed an app and it is ready now. We are now taking submissions via the software application. Everyone is expected to download it, put in their business plan and every other detail. Then, they would be evaluated on the app.

“We had to move to an app to avoid human interference because almost everyone had a brother or a sister who tried to influence the process. So, it is better to register via the application, upload the Corporate Affairs Commission certificate, Tax Identification Number and other necessary documents.

“Once that process is fulfilled, the request will be evaluated and those qualified will get a reply immediately but if we had continued with former procedure, the process may be influenced.

“We also noticed that most applicants do not have their CAC certificate and that is a very important document to be submitted.

“Some persons have claimed not to have these certificate but we have insisted that it would be a very important criteria to receive the loan or they would be ineligible. We have promised to be transparent about this initiative and that promise will be kept”.

On the status of applicants who had registered earlier, Moshood explained that those applicants must start the process again using the newly developed app in order to be considered for disbursement.

“Everyone that initially applied for the grant would have to do it again. During the former procedure, they were not asked serious questions, they were only told to register but now we are asking specific questions on how the money will be utilised, the business turnover per month. It is via those questions we will be able to sort out real businessmen and fake ones”, he stated.

According to the report, over 200,000 small-scale businesses had earlier signified their interest to obtain the credit facility with successful applicants receiving emails from the bank.

The alarming rate of small scale business mortality in the country has been a reoccurring issue with the SMEDAN DG revealing that around three million businesses were lost due to varying factors such as insecurity, fraud, global competitiveness and lack of ease of doing business in the past few years.

Financial experts had expressed the view that with improved access to finance, more small business will become drivers of economic progress and important contributors to employment as well as economic and export growth.

SMEs

Entrepreneurs Support Vulnerable Nigerians Amid Economic Hardship

As the economic condition continues to bite, a group of young entrepreneurs has extended support to some vulnerable Nigerians via a feeding scheme.

The group said in a statement that the initiative is aimed at providing nourishment to those in need, while drawing inspiration from the teachings of Jesus Christ.

A total of 820 individuals benefited from the programme, enjoying a diverse menu which included Chinese spaghetti, jollof rice, white rice, fried rice, and various soups.

The group from the Redeemed Christian Church of God Youth Church in Ikeja, Lagos, said the act reflects the commitment of the young entrepreneurs to make a positive impact on their community and address societal needs.

The initiative aligns with the Christian Social Responsibility mandate advocated by The Redeemed Christian Church of God, which emphasize the importance of demonstrating love and compassion to uplift communities and individuals.

Part of the statement reads, “The gesture is also in line with the Christian Social Responsibility mandate from The Redeemed Christian Church of God as a mission to meet societal needs through the demonstration of love that positively impacts communities and individuals to make a meaningful mark on the lives of individuals and families, spreading hope and nourishment in the community which is done at least once a month.

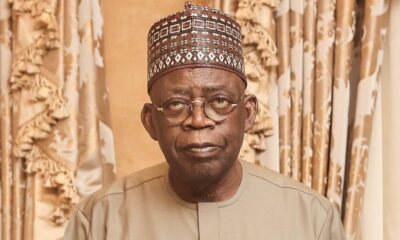

“This was led by the Provincial Youth Pastor of Province 1, Pastor Bisi Akande alongside Pastor Femi & Life Oyewunmi, Pastor Shola & Derayo Oladejo and Pastor Leke Adeboye & Titilope Adeboye”.

SMEs

Customs Bolsters Collaboration With Benin Counterpart

The Nigeria Customs Service (NCS) has deepened its relationship with its Benin counterpart in enhancing trade.

This follows a meeting held last Thursday between a deligation led by the Comptroller-General of Customs (CGC), Bashir Adewale Adeniyi, and his Republic of Benin counterpart at the Director-General of the Customs Administration of Benin Republic to strengthen collaboration between them.

The primary focus of the meeting, as outlined by the Customs boss, was to deliberate on strategies aimed at amplifying trade activities between the two nations and ensuring the seamless implementation of recommendations previously discussed during their rendezvous in Cotonou.

Highlighting the significance of the collaboration, the CGC said, “We are cognizant of the established framework for cooperation between our respective customs administrations.

“This framework was established at a higher level by the authorities of the heads of State, President Patrice Talon of Benin, and His Excellency President Bola Ahmed Tinubu of Nigeria, both expressing a desire to work together.

“It is upon this foundation that the Customs of both countries are united in their efforts”.

The Director-General of Benin Customs Administration, Mrs Adidjatou Hassan Zanouvi, in her remarks reiterated their steadfast commitment to executing the mutually agreed-upon measures.

Mrs Zaniuvi emphasised the importance of thorough monitoring to ensure effective implementation.

She noted that collaborative endeavours between the Nigeria Customs Service and the Benin Republic Customs Administration serve as a testament to their shared commitment to facilitating seamless trade operations and ensuring the efficient management of cross-border activities for the mutual benefit of both nations.

The CGC seized the opportunity to inspect ongoing projects within the Nigeria Customs Service, Seme Area Command.

He was accompanied by the Customs Area Controller, Seme Border, Comptroller Timi Bomodi.

By: Nkpemenyie Mcdominic, Lagos

-

News5 days ago

News5 days agoTinubu Orders Civil Service Personnel Audit, Skill Gap Analysis

-

Women5 days ago

How Women Can Manage Issues In Marriage

-

Politics5 days ago

Church Bans Political Speeches On Pulpits

-

Politics5 days ago

Presidency Slams El-Rufai Over Tinubu Criticism …Says He Suffers From Small Man Syndrome

-

Politics5 days ago

10 NWC Members Oppose Damagum Over National Secretary’s Reinstatement

-

News5 days ago

News5 days agoRSG Tasks Farmers On N4bn Agric Loan ….As RAAMP Takes Sensitization Campaign To Four LGs In Rivers

-

Politics5 days ago

Politics5 days agoMakinde Renames Polytechnic After Late Ex-Gov

-

Featured5 days ago

Featured5 days agoTinubu Signs Four Tax Reform Bills Into Law …Says Nigeria Open For Business