Featured

Nigeria Losing $30bn Annually From Revenue Leakages, Reps Alert

The Joint House of Representatives Committee on Finance, Banking and Currency has said that Nigeria lost about $30billion from 2005 to 2019 annually from revenue leakages.

The leakages were basically from activities of agencies and companies in banking, oil exploration, engineering, procurement, construction, installation, marine transportation, manufacturing and telecommunications.

According to the committee, the country has lost significant foreign exchange and revenue shortfall from the infractions.

Consequently, it grilled the management of two banks over several of the alleged infractions, accusing them of compromises.

The Chairman of House Committee on Finance and Co-Chairman of the Joint Committee, Hon James Faleke, in his remarks at the commencement of the investigative hearing on the allegations, said the House at its sitting on March 5, 2020, resolved to conduct an investigative hearing on revenue leakages in excess of $30billion.

He said, “The necessity and commencement of this investigation was as a result of growing problems in the financial management of all the God-given resources in our country, Nigeria, from our vast natural resources to the value added by these resources in the form of foreign exchange earnings and revenue generation, etc, into these investment environment and opportunities.

“Thus, this committee deemed it imperative to investigate revenue leakages and loopholes in the system, that have contributed to a loss of over $30billion in annual federation tax revenue between 2005 and 2019.

“The investigation, therefore, was premised on the documents received from target agencies and companies in banking, oil exploration, engineering, procurement, construction, installation, marine transportations, manufacturing and telecommunications upon which the committee -noted significant foreign exchange and revenue shortfall infractions against the Federal Republic of Nigeria by these stakeholders.

“This places an imperative need to put an end to, or at best, minimise all attributable infractions that have been instruments in the hands of some stakeholders in bringing economic woes to this country and her people.

“During our documentation compilation and a further look at the economic woes caused the country by some companies, the committee has noted the following major infractions which have multiplier effects on other infractions.

“Lifting of some crude oil and gas by oil exploration companies, that were not wholly and legally allocated to the Consignors in JV, PSC and PSA exploration activities including those whose crude oil Certificates of Quantity were not signed by the Department of Petroleum Resources (DPR) and terminal operators.

“Concealment and non-disclosure of some crude oil liftings that ought to have been subjected to Petroleum Profit Taxation at PPT rates ranging between 50 per cent of profit for PSC and PSA companies, and 85 per cent of profit for JV companies.

“Inflow of foreign investments in the form of equity, foreign cash loans, equipment loans whose utilizations are majorly subject to tax, end up in transactions, foreign transfers that were at variance with the purpose of such inflows.

“Overnight and fictitious disappearance of Naira proceeds of foreign inflows from the bank accounts of Nigerian beneficiaries, and subsequent allocations of foreign exchange by CBN for capital repatriations, principal loan repayments and Interest payments.

“Multiple foreign exchange allocations to holders of foreign inflow Certificates of Capital Importation (CCI) over and above the amount brought into the country, leading to capital flight of the country’s much needed and scarce foreign exchange.

“Loan backed Certificates of Capital Importations without evidence of transfer to the foreign lenders in the form of principal repayment and interest payments.

“Some expected imports that were funded by foreign equipment loans and other direct allocations of foreign exchange for foreign exchange valid transactions were neither translated to imports nor their import duties paid to the Nigerian Customs Service.

“Capital Flight using the Form ‘M’ valid for Forex and Forex obtained by the beneficiary companies without utilization of the forex to reflate the economy and taxes paid.

“The committee shall extensively review all of the above infractions, among others, to ensure that all federally collectible revenues are not only identified and recovered, but also to sanction companies involved in the other non-civil infractions in order to serve as a deterrent to potential classmates of the affected companies.”

Interfacing with the representative of one of the two banks, Ngozi Omoke on the allegations, the committee accused the bank of not making remittances to the federation accounts from certain transactions.

It also picked holes in the presentation made by the representative of the second bank, Hassan Imam, saying there were many irregularities.

“Some of the infractions listed against the banks included outstanding withholding tax collectible on Form A: $2, 544, 973, 484; outstanding VAT collectible on Form A $1, 081, 383, 885; outstanding withholding tax collectible on known Form A bank transfers by customers $927, 556, 300; outstanding VAT collectible on known Form A bank transfers by customers from your bank is $463, 778, 150; breakdown of foreign exchange leakage infractions on Form A transactions filed with CBN as taxation services but not traced to the Federal Inland Revenue Service collection platforms $171, 256, 297 and foreign exchange inflow from capital importation yet to be accounted for in the foreign exchange sales voucher is a $17, 655, 410, 376.

“Others are Form A transfers for loan repayment and interest with no evidence of capital importation and payment of withholding tax on interest $210, 013, 266; Capital importation on loans with no evidence of principal repayment and interest payment $1, 072, 868, 110; Capital importation on equity with no evidence of dividend payment and capital repatriation is $1, 134, 835, 320; Dividend transfers in excess of capital importation on equity without payment of withholding tax is $3, 027, 298, 192; Form A transfers for dividend repatriations with no evidence of capital importation, either foreign equity and payment of withholding tax is $305, 725, 840.

“Also listed are foreign transfers for principal loan repayment and interest payment in excess of capital importation loan without payment of withholding tax on interest in $110, 635, 050; and foreign exchange on Form A transferred payment filed with the committee but not traced to CBN returns without payment of taxes is $510, 816, 573.”

Faleke further stated that the committee discovered that one of the banks had Form A transfer by customer through their bank accounts that were not filed with the CBN and committee, with no evidence of withholding tax amounting to $3,107, 398, 073.

The committee also disagreed with the bank’s position on advertisement, saying it was a taxable item.

Faleke, therefore, directed the bank to make available all the receipts of various transactions, and directed the clerk of the committee to write to the Federal Inland Revenue Services (FIRS), to appear before it to confirm the remittances.

Responding to the allegations, Mrs. Ngozi Omoke said the bank conducted its activities within the Foreign Exchange Monitoring and Miscellaneous Provision Act.

She said, “I will just say in a summary before I go to specifics. Our presentation is that we are guided by the Foreign Exchange Monitoring and Miscellaneous Provision Act and from time to time, the Central Bank of Nigeria as well as issues guidelines to regulate transactions on foreign exchange.

‘’It is in the light of this that we have reviewed all the allegations and the transactions mentioned in the report sent to us and we want to affirm again that we were not in any way in contravention of any of the guidelines in the Act or in the foreign exchange manual.”

“If you permit me, sir, I will just take the items one by one as read before. The first is outstanding withholding tax collectible on form A transaction. The total in this regard is $2,544, 973,484.04. We noticed that the committee or whoever computed this applied the total amount that was remitted and applied certain rate which is either 10 percent or 5 percent to arrive at the potential withholding tax or VAT.

‘’A lot of transactions that were documented or mentioned do not attract withholding tax or VAT. So, if I give some examples which you said here are not subject to VAT or withholding tax: Advertisement, airline remittances, principal loan repayments.

‘’What attracts withholding tax is interest on loan repayment not the principal itself; education, credit card, home remittances, BTA and so on. It should be noted that payments made on the basis of Form A by banks to customers are not payments for services rendered to the bank itself. I am glad that the chairman also mentioned it when he was speaking.

“So, withholding tax for the purposes of this amount that has been alleged here applies only to dividend remittances and interest on loan repayment or sometimes when there are consultancy on related transactions.

‘’Those are the only ones that attract withholding tax as guided by Foreign Exchange Miscellaneous Act and FX manual. So, in total, if I can speak to this amount, only $1.29billion and N357million were eligible for withholding tax and in those cases, they were duly deducted and remitted to appropriate authorities.”

Similarly, Imam, who is the Executive Director, North of the second bank, told the committee when confronted with the allegations that the bank only made transactions and would not be in a position to know what their customers did with their funds.

Featured

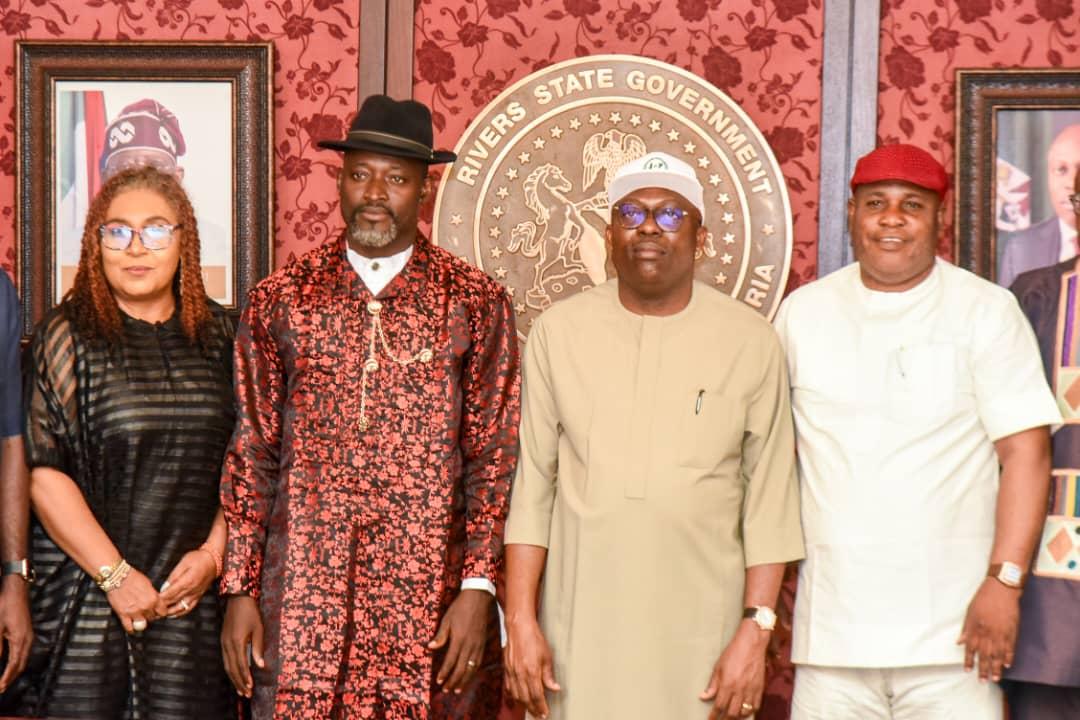

Be Firm In Fight Against Oil Theft, Fubara Tells CNS …As Navy Moves Training Hqtrs To Rivers …Seizes 14 Vessels In Three Months

Rivers State Governor, Sir Siminalayi Fubara, has encouraged the Nigerian Navy to be firm in the fight against all forms of economic sabotage, particularly crude oil theft, in the nation’s waterways.

The Governor noted with delight the positive results already recorded by the Navy in the State due largely to the tremendous support it has received from his administration.

Governor Fubara spoke when he hosted on courtesy visit, the Chief of Naval Staff, Vice Admiral Emmanuel Ikechukwu Ogalla with his delegation of top officers of Navy High Command at Government House in Port Harcourt,yesterday.

The Rivers State Governor stated that Nigeria was facing myriad of crises, including economic challenges, rising insecurity and criminal activities that threaten the national economy, which should not be overlooked.

He said, “We are working together, we will give you all the support to make sure that you deliver on your mandate.

”And what is the mandate? You were appointed at a time when our country is facing a lot of crises, and your duty, among others, include to reduce, if it cannot be eliminated completely, the criminalities perpetrated on the waterways; oil theft and others.

”And I am happy that they are positive and commendable records of achievement so far, in the course of your tenure.”

Governor Fubara said the good news of reduced level of oil theft in Rivers State is evidence of the many positive things that are happening in the State beyond the much hyped negativity, and assured that such positive achievements will be sustained.

The State Chief Executive insisted: “The success of the Nigerian Navy in our State, in the areas of oil theft, is because the State Government has given you all the necessary support.

”We have collaborated with the command here. We supported them morally, and with all the necessary logistics.

”We have also maintained good relationship with the communities to make sure that whatever it is that is required for these operations to be successful were granted. I am happy to be associated with these very laudable achievements.”

Governor Fubara said: “So, I have to say that I am happy that the Chief of Naval Staff, today, is commending the success of the exercise. He is commending the doggedness of the men in fighting oil theft, not just in the Niger Delta, but particularly in our State.

”I want to assure you that we will continue to give them the support, and discourage any act that would be a sabotage to the economy of our State.”

Governor Fubara said that Rivers State was not named in error: there are several water channels that can boost the operations of the Navy. This is why we are requesting that the Nigerian Navy move all its bases to the State.

”It was not a mistake they called it Rivers State. It is surrounded with all forms of rivers. You want the Atlantic region, you can get it here. You want those small creeks, you can also get it here. Maybe, if you want an Island, you can also find it here.

”So, it is proper if we work with you and you have all that is required within this geographic region, to have all your bases relocated to Rivers State,” he said.

He further said: “We must continue to give you the necessary support to make sure that you succeed. I am happy to also say that, as the Governor of the State by the special grace of God, we are still here, not minding the dramas here and there. We will not let our people down in ensuring that we protect their interest.

”We will support the genuine course of governance; the protection of lives and provision of basic amenities. And these can only be achieved when there is a peaceful environment.

”And the peaceful environment can only come when there is a collaboration with security agencies to prevent crimes, and protect lives and property of residents.”

In his address, the Chief of Naval Staff, Vice Admiral Emmanuel Ikechukwu Ogalla, reiterated that the Nigerian Navy and Rivers State are like conjoined twins who cannot do without each other.

This is because, he said, they needed collaboration on various aspects of their activities ranging from training, operations, logistics, adding that Rivers State is key to their performance.

”My purpose of coming here today are three folds. The first is to inform His Excellency that on Saturday, we are graduating a set of former civilians who have been trained at our Basic Training School, Onne, and are graduating to join the ranks of the Nigerian Navy as ratings in order to beef up our strength.

”The second reason is to first appreciate the Governor and the entire Rivers State Government for the schools they donated to us: the Ambassador Nne Krukrubo Model Secondary School at Eleme in Eleme Local Government Area, and the Model Secondary School, Egbelu in Oyigbo Local Government Area.”

Vice Admiral Ogalla stated further: “We also want to use this opportunity to inform His Excellency that following that donation, and based on our strategic plan of moving our facilities to areas where we have enough space to be able to carryout out duties, we have renovated the school at Eleme.

”We are happy to report, today, that the erstwhile location of Headquarters of Naval Training Command, Lagos, is moving to that particular school location in Eleme, tomorrow.’

Speaking on the operational successes recorded thus far, he said that propelled by the charge given to them by President Bola Tinubu, the Nigerian Navy, under his watch, has impounded 14 vessels caught to be conveying stolen crude oil and several other individuals arrested, adding that investigations into their culpability were ongoing.

”I am here today to report Sir, that, with the “Operation Delta Sanity”, launched in January, 2024, we have been very successful, and within the period, we have recorded tremendous successes and achievements.

”Over 14 large crude carrying vessels have been arrested within that period. Most of them are at various levels of investigation. We have also arrested several barges and other companies and organizations that are involved in oil theft.

”As a result of the operations, we are happy to report that there has been tremendous improvement in terms of security in the maritime environment,” Ogalla added.

Featured

118 Inmates Escape As Rainstorm Destroys Niger Prison

A heavy downpour has wreaked havoc on the Medium Security Custodial Centre in Suleja, Niger State, resulting in extensive damage to the facility and facilitating the escape of 118 inmates.

This was disclosed in a statement signed by the spokesperson, Federal Capital Territory Command of the Nigerian Correctional Service, Adamu Duza, yesterday.

Duza noted that the downpour which occurred on Wednesday night, caused severe damage to the custodial centre’s infrastructure, including a breach in the perimeter fence, which allowed the inmates to flee.

However, 10 fleeing inmates had been recaptured following a swift response by the NCoS in collaboration with other security agencies.

Duazu promised that efforts were ongoing to recapture the remaining fleeing inmates, adding that their database would soon be made known to the public.

Recognising the vulnerability of ageing facilities, many of which were built during the colonial era, Duza acknowledged that the NCoS was committed to modernising its infrastructure.

The statement further noted that the Controller of Corrections, FCT Command, Francis John, assured the public that the situation was under control and urged them to carry on with their daily activities without fear.

The public was encouraged to remain vigilant and report any suspicious activities or sightings of escaped inmates to the nearest security agency.

The statement read in part, “A heavy downpour that lasted for several hours on the night of Wednesday, April 24, 2024, has wreaked havoc on the Medium Security Custodial Centres, Suleja, Niger state, as well as surrounding buildings, destroying parts of the custodial facility, including its perimeter fence, giving way to the escape of 118 inmates of the facility.

“The service has immediately activated its recapturing mechanisms, and in conjunction with sister security agencies, has so far recaptured 10 fleeing inmates and taken them into custody, while we are in hot pursuit to recapture the rest.

“The service is not unmindful of the fact that many of its facilities were built during the colonial era and that they are old and weak. The Service is making frantic efforts to ensure that all aging facilities give way to modern ones.

“The Controller of Corrections, FCT Command, Francis John, wishes to assure the public that the service is on top of the situation and that they should go about their normal businesses without fear or hindrance.”

Meanwhile, the United States has underscored the significant challenge of overcrowding in Nigerian prisons.

The US, according to its ‘2023 Country Reports on Human Rights Practices: Nigeria,’ published on its website on Tuesday, noted that numerous correctional facilities were grappling with a staggering 50 per cent increase in the number of inmates beyond their intended capacity, revealing a systemic issue.

Furthermore, it disclosed that a notable proportion of these prisons, some with histories dating back 70 to 80 years, faced difficulties in meeting even the most fundamental standards of living.

Featured

Rivers’ll Be Known For Peace, Not Crisis -Fubara

Rivers State Governor, Sir Siminalayi Fubara, has said that peace has prevailed because he draws strength from God to resist insults and tantrums thrown at him while frustrating attempts by some disgruntled persons who wanted to plunge the State into unending crisis.

The Governor also said that because he has anchored his Government on promoting peace, the enabling atmosphere has been provided for investments and sustainable development to flourish.

Governor Fubara made the assertion when he received a delegation of members of the Bishops and Gospel Ministers’ Association International Incorporated, Rivers State Chapter, at Government House in Port Harcourt, yesterday.

Represented by the Head of Rivers State Civil Service, Dr George Nwaeke, Governor Fubara said while most people took his meekness for weakness, his stance on peace has unarguably enhanced harmonious atmosphere of concord as residents sleep with their two eyes closed, and investors and shareholders are happy with the returns on investment.

He said, “Before, what they hear of Rivers State is that they are fighting, and some genuine investors will not come. Some people even ask you: How are you coping in Rivers State?

“But now”, he asserted: “The Governor has brought about a lot of changes in the State. One of the most important things is that he has changed the negative narrative. It is no longer Rivers of blood. It is now Rivers of peace.

“We are enjoying our lives here. Why? Because there is a change in the narrative. We have peace. The Governor is, as much as possible, absorbing any level of insult at him only for one purpose: that Rivers State may have peace; that we may grow; that this state will experience genuine development.”

Governor Fubara urged them, as members of the Christian family in the State, to continue to pray for the State and the Government so that the enemies of the State will be put to greater shame.

“This peace is what I want you to embrace. Go and continue to pray, because when the sower of the seed went and sowed, the enemy went in the night and sowed tares inside there. But the Governor is sowing peace.

“When I listened to the leader of the team, His Grace Eddy Ogbonda, he said you came all the way from Eleme Junction, and stopped at major junctions, and you uttered prayers for the peace of Rivers State.”

He also said: “I, hereby want to thank you for identifying with the Governor at a time like this. At a time when it looks as if someone wants the Governor’s peace posture misunderstood as weakness.

“When someone has the strength to fight back, but refuses to fight back. That is a bigger strength; that power of restrain does not just come, it can only come from God.

“You cannot give peace, if you do not have peace within you. The Governor is not interested in any form of trouble or violence. What he is interested in is known, and it is: let there be peace in Rivers State,” he said.

In his address, leader of the group, Archbishop Eddy Ogbonda, said they had observed a week-long intensive prayers that culminated into a peace rally, which brought them to Government House, and assured the Governor that God will continue to give him victory over his adversaries while preserving Rivers State.

“It is Rivers State Prophetic Prayer Convocation and Rally 2024 with the theme: ‘Peace be still’. Of a truth, everyone of us understands that we live in a time when we need peace much more than any other thing.

“Rivers State needs peace. Everyone as individuals need peace. The country needs peace, and the world at large needs peace. So, we are here to do a peace march. We pray that God will command His peace to reign in Rivers State,” he said.

-

Politics5 days ago

Politics5 days agoNEC Meeting: PDP’ll Wax Stronger – Farah Dagogo

-

News5 days ago

FG Targets Production Of Locally Made Vehicles By Dec

-

Niger Delta15 hours ago

Bayelsa Wants Quota Filled In Federal Fire Service

-

Business14 hours ago

IMF Harps On Economic Diversification For Nigeria

-

Sports5 days ago

Sports5 days agoWilkins Backs Rivers Hoopers To Spring Surprises At 2024 BAL

-

News16 hours ago

FAAN Diverts Flight Operations As Fire Breaks Out At Lagos Airport

-

Politics14 hours ago

Edison Ehie: Clearing The Doubts

-

Sports14 hours ago

Cricket: Nigeria Wins ICC Award