Business

‘Nigeria On A Self-Rediscovery, Redemption Mission’

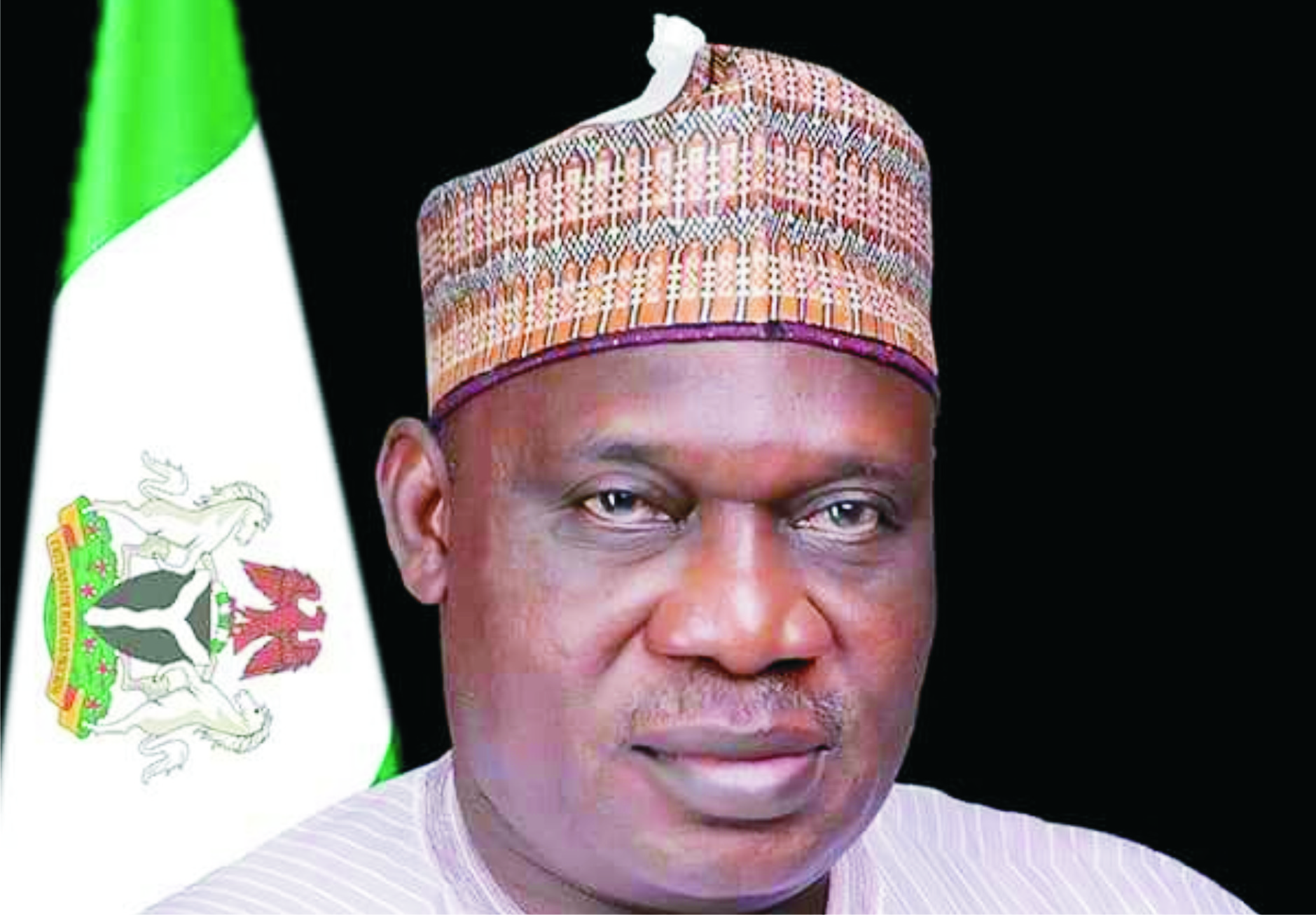

The Director-General Nigeria Mining Cadastre Office (MCO), Mr Obadiah Nkom says the country is in historic times as it is on a mission of self-rediscovery and redemption.

He said this during his investiture as president of the Nigeria Mining and Geosciences Society (NMGS) weekend in Abuja.

The Tide news reports that he was elected as the society’s 30th president in March, at its 55th Annal International Conference in Enugu.

Nkom recalled that the country prior to the discovery of oil and gas in commercial quantity was known for its tin, columbite, and coal.

“Mining was one of main-stay of the country’s economy, leading to the establishment and development of cities such as Jos and Enugu where generations were raised.

“Mines and mining camps were homes to people from diverse corners of this country, guarantying the earning of decent living wages,” he said.

This, the NMGS President said promoted cohesive family lives and above all cemented the bond among the people.

Nkom said such days were only now remembered with nostalgia, especially so, because many of the mining entities had long been consigned to the dustbin of history.

He, however, said that efforts were being made by some Nigerians to get the country back to those “winning ways again”, a reason he said the country was on a mission of self-rediscovery and redemption.

The director-general assured Nigerians that as the President Muhammadu Buhari-led administration enters the next level of development, the NMGS would continue to work closely and harmoniously with government and its agencies to achieve its objectives.

He noted that jobs in the oil and gas sector was becoming endangered as the world was aggressively looking for alternatives to fossil fuels.

Nkom advised that the Nigerian oil and gas sector should therefore, as a matter of fact begin to also pursue the maximisation of the potential inherent in the sector.

“Nigeria should shift from exporting unrefined crude to becoming a nation of petrol chemicals, we should pursue the conversion of this black gold into finished products and raw material feedstocks for industries.

According to him, this will hasten the country’s industrialisation process and create more jobs for teaming unemployed Nigerians.

He said it was regrettable that we export jobs that were badly needed by the teeming youth in the country.

Nkom explained that when we export crude oil, the country is denied the full benefits of our God given potential.

He, however, said that political will and a determined populace desirous of forgoing current short-time pleasure and comfort for a secured and sustainable future was required to achieve the full potential of the country’s solid mineral deposits.

According to him, in order to achieve this, there is the need for the Federal Government to formulate a licensing policy to encourage oil companies to becoming petrol-chemical producers rather than extractors and exporters of crude.

The ceremony was also attended by some traditional rulers from across the country, among whom was Malam Tagwai Sambo, the Chief of Marwa, in Kauro Local Government Area of Kaduna State.

Business

Eazipay Offers Zero-Interest Loans To 150,000 SMEs, Employees

With a mission to ignite growth, encourage business continuity and help businesses and employees thrive, Eazipay is gearing up to propel the dreams of 150,000 SMEs and employees to new heights through her relief fund.

Gone are the days of financial constraints and stifled dreams. With Eazipay’s support, SMEs and employees alike can bid farewell to limitations and embrace a world of endless possibilities.

Whether it’s start up, business expansion or personal development, Eazipay is here to make dreams come true.

The mind-blowing initiative, which kicked off this month, would end in December, and will also offer a range of perks and benefits designed to put a smile on the faces of SMEs and employees alike.

From exclusive discounts to various advisory services and beyond, Eazipay is committed to spreading happiness and creating lasting impact in people’s lives and to the growth of businesses.

The technology company which offers products and services that range from payroll management to IT/Device management and assessments, “Eazipay isn’t just providing financial support but also unleashing a wave of growth and prosperity for SMEs and employees across the nation.

“Interested businesses and individuals can take part in this initiative directly from the Eazipay website: www.myeazipay.com”.

Business

SMEs Critical For Sustainable Dev – Commissioner

The Commissioner of Finance, Lagos State, Abayomi Oluyomi, has described Small and medium Enterprises (SMEs) as a critical engine for sustainable development in any economy.

He said this recently at the 10th anniversary of the Alert Group Microfinance Bank and the opening of their new head office in Lagos.

According to the National Bureau of Statistics, SMEs accounted for about 50 per cent of Nigeria’s gross.

He commended the positive impact of the Alert MFB as it empowers SMEs in the State.

“Alert MFB in the past 10 years has been at the forefront of empowering SMEs in Lagos State, disbursing over N30bn in loans to over 30,000 individuals having small to medium businesses over that period, which is quite remarkable”, he said.

Speaking, the Group Managing Director of Alert Group, Dr Kazeem Olanrewaju, revealed that the financial institution commenced business in 2013 as a microfinance bank.

“We started this journey in 2013 and it has been expanding. Today, they have about 10 branches across Lagos. They have supported well over 30,000 clients and have disbursed over N30bn.

“The company has been profitable since the second year. Looking at the market and the available opportunity, the Alert MFB board decided to come together to establish a Microfinance Institute (MFI), which is the Auto Bucks Lenders”, Dr. Olanrewaju said.

The GMD further stated that the company was focused more on supporting businesses and small and medium enterprises.

“The loan to support business represents over 98 per cent. The consumer loans you will see are the ones given to entrepreneurs. So, the area of focus of Alert MFB and Auto Bucks Lenders is to support businesses across the country.

“With the establishment of Auto Bucks Lenders, we have the opportunity to also do business outside Lagos. So, presently, we have offices in Ogun State and Oyo State. We intend to go to every part of Nigeria to support what we are doing”, he declared.

Business

Retailers Explain Price Drop In Cement Cost

The cement market, in the last couple of weeks, has seen a significant turnaround with prices tumbling from between N10,000 and N15,000 per 50kg bag to between N7,000 and N8,000.

The sudden rise in the prices of cement and other major building materials in February this year upsets the construction industry, especially in real estate, where many developers were forced to abandon building sites.

A recent market survey conducted by The Tide’s source in different locations across the country confirmed a price drop, ranging between N7,000 and N7,500 per bag, though BUA cement is selling for N7,500 to N7,800 per 50kg bag, depending on location.

Both entrepreneurs and major distributors who were interviewed, explained that the price drop is due to low demand and government’s intervention.

At the peak of the price hike, the Federal Government called a meeting with major producers where it was agreed that a bag of cement should be between for N7,000 to N8,000, depending on location.

But the producers did not comply with this agreement immediately, followin which “Nigerians stopped demanding for cement; many project sites were abandoned as developers sat back and waited for the prices to come down.

“So, what has happened is an inter-play of demand and supply with price responding, which is Economics at work”, Collins Okpala, a cement dealer, told the source in Abuja.

In the Nyanya area of the Federal Capital Territory, a 50-kg bag of Dangote cement now sells for between N7,000 and N7,500, while BUA cement sells for between N8,500 and N9,500, down from between N11,000 and N12,000 respectively.

In Lagos, the product has seen significant price drop too. In Ojo area of the state, Sebastin Ovie, a dealer, told our reporter that what has happened is a crash from the January price, attributing the crash to low demand and stronger naira.

“The current price of the product is between N7,000 and N7,500 per 50kg bag, depending on the brand. This is a significant drop from the average of N12,000 which most dealers were selling in February and March”, he said.

A dealer in Agege area of the state who identified himself as Taofik Olateju, told the source that sales are picking up due to the drop in price.

He recalled that Nigerians at a point stopped buying due to the high price of the product at N15,000 per bag.

“I am sure most dealers ran at a loss then because we had mainly old stocks which we wanted to offload quickly”, he said, confirming that the product sells for between N7,500 and N8,000, depending on the brand and the demand for the brand.

Continuing, Olateju noted that “because the naira is now doing well against the dollar, it will be unreasonable for manufacturers to continue to sell the product at the old prices. I also believe that the federal government’s intervention and the threat to license more importers may have worked, leading to the reduction in price”.

In Enugu, the source reports that the product sells for between N7,200 and N7,500 depending on the brand and location.

“This is a city where the price of a 50kg bag went for as high as N12,000 and N13,000 in some cases in February and March”, Samuel Chikwendu said.

He added that the prices of other building materials, especially iron rods, have also dropped considerably which is why, he said, activities are picking up again at construction sites.

The story is slightly different in Owerri, the capital of Imo State, where Innocent Okonkwo told the source that low demand was also driving the price drop, adding that a 50kg bag was selling for N9,000 on the average in the state.

Sundry market observers are optimistic of further price reductions, but they remain cautious as manufacturers, wholesalers, and retailers continue to play critical roles in setting prices for end-users.

They lamented, however, that despite Nigeria’s status as one of the largest producers of cement in Africa, the price of the product continues to rise, particularly in the face of high inflation impacting the building materials market generally.

Okpala in Abuja highlighted the variations arising from direct sourcing from manufacturers versus procurement through dealers, with traders holding old stocks selling products at prices ranging from N8,500, N8,300 to N8,000 per bag.

Lucy Nwachukwu, another dealer in Abuja, said the significance of procurement volume in determining cement costs, noting that stability in prices has been observed over the past month, with the product retailing for between N7,000 and N7,800 depending on the brand.

In Port Harcourt also, a customer, Daniel Etteobong Effiong, said the price goes between N7500 to N8500, depending on the brand and the location one is buying from.

-

Opinion4 days ago

Agriculture: Solution To Hunger, Inflation, Food Insecurity

-

News4 days ago

Pan-Igbo Group Hails Dangote Group For Reducing Diesel Price

-

Featured13 hours ago

Featured13 hours agoBe Firm In Fight Against Oil Theft, Fubara Tells CNS …As Navy Moves Training Hqtrs To Rivers …Seizes 14 Vessels In Three Months

-

Business12 hours ago

Diri Tasks NCDMB, SPDC On Projects Completion

-

Sports4 days ago

Minister Renews Hope For Sports Dev, Signs MoU

-

Rivers4 days ago

Rivers4 days agoBayelsa LG Polls: BYSIEC Issues Return Certificates To Chairmen, Others

-

Politics13 hours ago

Fubara’ll Leave Rivers Better Than Expected – LG Boss

-

Sports12 hours ago

Eaglets Held In Pre-WAFU Friendly