News

Recreate Rivers Economy As Best Investment Destination, Fubara Charges RSIPA Board

Rivers State Governor, Sir Siminalayi Fubara, has restated that the resolve is stronger now than ever to create the climate conducive for growth of agriculture, manufacturing, small and medium enterprises, and key services because they are the productive sectors that will put Rivers’ economy on a competitive pedestal.

The Governor, therefore, charged members of the maiden Governing Board of the Rivers State Investment Promotion Agency (GBoRSIPA) to streamline their activities in such a manner that will attract real investors across critical sectors so that the State can become self-sustaining, comparatively.

Governor Fubara gave the charge when he inaugurated members of the six-man Board at Government House in Port Harcourt on Monday.

Those inaugurated are: Lawrence Fubara Anga, SAN, as Chairman; Dr. Chamberlain Peterside as Director-General; and Mrs Tamunoibuemi Life-George, who is to serve as Secretary.

The rest include, Mr Goodliffe Nmekini, Barrister Havey Ideozu, and Baritor Lenusikpugi Kpagih as members.

Governor Fubara explained that Rivers State used to rank first in the comity of states in terms of productive economic activities, which attracted various business interests and made the State a well-groomed investment haven.

But, he expressed regret that the attendant expansion and population growth were not maximally managed because the challenges overwhelmed those who superintendent over business activities then, lamenting that the expected blessings were wrongly channelled, which left the State in very pitiable economic situation.

Governor Fubara said: “We might be celebrating, that yes, we have a very fat allocation. We have been able to improve our Internally Generated Revenue (IGR), but we still have a lot to do; and, that has to do with this agency.

“The purpose of this agency is to give our people – to assure them, that Rivers State can still come back to that enviable position that it once occupied. Those people that were doing business in Rivers State that left, for one reason or the other – that they can still come back.

“We want to see people who intend to come back and invest because Rivers State is blessed – it has oil, the most important item for development today, which is gas, in abundance.

“Look at what is happening in Trans-Amadi Industrial Layout: We can make Trans-Amadi Industrial Layout come back to what it used to be. We can develop the resources that we have in Onne Town. We have Ogba-Egbema gas hub. These are part of the promises we made during our campaigns, and we must fulfill those promises,” he said.

Governor Fubara emphasised that the agency is established to rigorously harness tenable economic and human potentials abundant in the State that can be translated into making Rivers the economic gateway and one-stop- shop for productive economic activities.

The Governor said: “We have waited for this moment for a long time. It is a moment we all have been praying for because we want to leave a State that will be remembered: Rivers State that can compete, and Rivers State that can stand the test of time as a proud State.

“People that are coming here would begin to know that Rivers State is now serious. Rivers State is not about coming here and saying I want to take the side of maybe, I am interested in 10 percent or 20 percent of what you are coming with, that is not the purpose now”.

He explained that Rivers State is about genuine business interactions that will be mutually beneficial to all parties in a sustainable way, insisting that investors desirous of gaining value from their stakes should boldly come to the State for partnerships that will work in the interest of all stakeholders.

He said, “The purpose is to build our State. The purpose is to grow this State economically in such a way and manner that even if we don’t get federal allocation anymore, for example, we can still sustain ourself (as a State) with our IGR.”

Governor Fubara acknowledged that in discharging its responsibilities, the Board will encounter challenges and stiff opposition from those who abhor change but urged the members to brace up and be forthright in their quest to achieve their mandate.

The Governor clarified that the board should not be preoccupied with people who are only interested in real Estate, which seemed to be the current drive now.

Governor Fubara said: “Not just issues of people coming to build houses and other things. I want your concentration to be more on agriculture, (manufacturing).

“Look to find people who are coming in to invest. People that are coming to build factories because it is only when we start production that employment issues will be resolved, (and we will witness economic boom).

“So, please, those things that will solve the problem of unemployment, and promote creation of wealth for the State should be your focus,” he advised.

Governor Fubara further said: “The responsibility of this agency is going to be very challenging because I know they will want to fight back. But, I know that these crop of men and woman have what it takes, and I am very convinced that they are going to lead Rivers State to where we want the State to be.

“The Chairman of this agency is a private legal practitioner and a businessman that has made his name. Let me say it here: let it be on record that I had to beg him to accept the offer. I even had to send emissaries to him to plead with him.

“He said he doesn’t want to get involved with any political thing. I said this is not about politics. You live in Lagos, you have made your name in Lagos. Please, come and help us. We need help, Rivers State needs to be salvaged.”

Governor Fubara charged them to approach their task with an open mind to make a difference, adding that he nurses no doubt that they will make the State proud with the results they will achieve.

The Governor also assured that his doors will remain open, should they require his attention to tackle any challenge in order to get the necessary support to ensure success.

In his acceptance speech, Chairman of the Governing Board of Rivers State Investment Promotion Agency (GBoRSIPA), Lawrence Fubara Anga, SAN, said they consider their appointment as an opportunity to serve among other Rivers people who are willing to be so appointed.

Anga noted the enormity of the task before them but expressed appreciation that even the Governor understands it so, which is why he consulted widely to gather very distinguished, proven and tested personalities, who depict his foresight.

He said: “Your Excellency, we have heard, listened very attentively to your charge, and that charge resonates, I believe, with everybody in this room.

“This is the time, whether we like it not, to many people, it is a time to want to despair. It is a time of problems, and it is also a time of challenges. And everybody has an option: your cup can either be half-full, or half-empty.

“But Your Excellency has decided that the cup of Rivers State shall be completely full. For every challenge, there is an opportunity. And what His Excellency has done is to tell us: go and look for those opportunities.”

Anga reaffirmed that Rivers State, known and still is the ‘Treasure Base of the Nation’, noting that the charge before them is to make that appellation march the reality of what prevails, desirably.

The chairman assured that they shall offer their best by delivering on their mandate but solicited support to work in strong synergy with other organs: ministries, departments and agencies (MDAs) of government, to succeed.

This, he noted, will reduce unhealthy competition and bureaucratic bottlenecks that often frustrate genuine development efforts because of what he described as likely policy inconsistencies.

He said, “The charge is to restore it (State) to be the ‘Treasure Base of the Nation. The charge is to make Rivers State economy probably the 10th or 12th largest economy in Africa, standing on its own. The charge is to turn Rivers State into the Dubai of Africa. That is what you have told us to do.

“It is not going to happen overnight. It is not going to happen just through us as individuals. It is a collective effort. But, we are convinced that with your support, and with the kind of leadership that you have already provided, it is very possible in the shortest period of time to start the transformation to change the narrative. And once the ship has left the port, nobody can stop it.”

Anga further said: “Your Excellency, investors’ monies have choices. No matter how potentially attractive a business proposition is, where there is insecurity, where there is confusion, where there is bureaucratic bottleneck, investors will run away because they have choices.

“And, one of the things your administration is trying to do is to restore security, safety of lives and property; security of tenor, when you buy land, you know that your title is secured because without security of tenor, you can’t get a loan.

“These are the things your administration is doing, which will go a long way to achieving the goal you have set. I am happy, this is a brand new agency, and we don’t have any excuse. What comes out; we are the ones that will shape it,” he emphasised.

Anga also reassured that: “This board will try its best to provide oversight. This board will try and provide the policy guidance. This board will try and use the rich connections it has to reach out locally and internationally (to attract investments).

“But, in all of these, our youths should stop being applicants. We want to create an environment where the unemployed become entrepreneurs, they become employers of labour. We want to triple the Internally Generated Revenue (IGR) of the State from our home grown businesses.

“We are not just looking for people to bring their money from outside. It’s been proven time and again that if the owners of the place don’t invest, outsiders will not come to invest. And so, your charge to us is to make Rivers State attractive for Rivers people. And when Rivers people invest, the whole world will come and invest. That is our task, and we will strive to achieve it,” he assured.

News

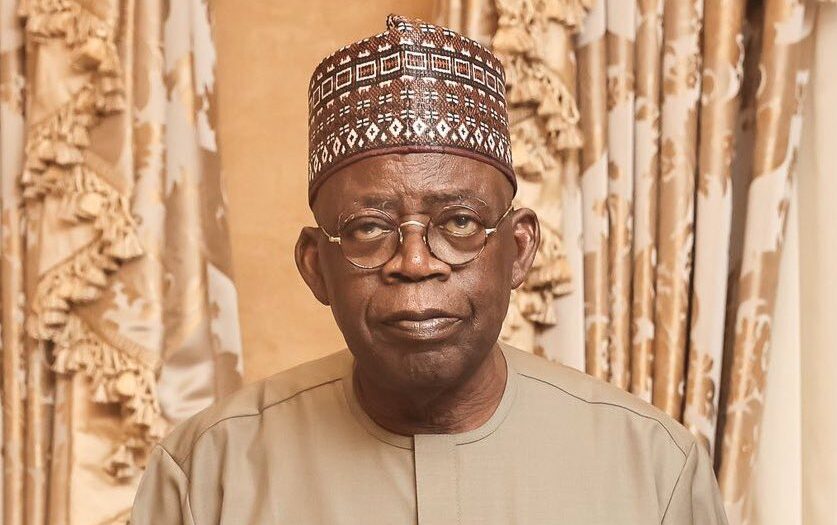

Shettima In Ethiopia For State Visit

Vice President Kashim Shettima has arrived in Addis Ababa, Ethiopia, for an official State visit at the invitation of the Prime Minister, Dr. Abiy Ahmed.

Upon arrival yesterday, Shettima was received at the airport by the Minister of Foreign Affairs of Ethiopia, Dr. Gedion Timothewos, and other members of the Ethiopian and Nigerian diplomatic corps.

Senior Special Assistant to the Vice President on Media and Communication, Stanley Nkwocha, revealed this in a statement he signed yesterday, titled: “VP Shettima arrives in Ethiopia for official state visit.”

During the visit, Vice President Shettima will participate in the official launch of Ethiopia’s Green Legacy Programme, a flagship environmental initiative.

The programme designed to combat deforestation, enhance biodiversity, and mitigate the adverse effects of climate change targets the planting of 20 billion tree seedlings over a four-year period.

In line with strengthening bilateral ties in agriculture and industrial development, the Vice President will also embark on a strategic tour of key industrial zones and integrated agricultural facilities across selected regions of Ethiopia.

News

RSG Tasks Farmers On N4bn Agric Loan ….As RAAMP Takes Sensitization Campaign To Four LGs In Rivers

The Rivers State Government has called on the people of the state especially farmers to access the ?4billion agricultural loans made available by the State and domiciled in the Bank of Industry.

This is as the State Project Implementation Unit (SPIU) of Rural Access and Agricultural Marketing Project (RAAMP), a World Bank project, took its sensitization campaign to Opobo/Nkoro, Andoni, Port Harcourt City and Obio/Akpor local government areas.

The campaign was aimed at enlightening community dwellers and other stakeholders in the various local government areas on the RAAMP project implementation and programme activities.

The Permanent Secretary, Rivers State Ministry of Agriculture, Mr Maurice Ogolo, said this at Opobo town, Ngo, Port Harcourt City and Rumuodumanya, headquarters of the four local government areas respectively, during the sensitization campaign.

Ogolo said apart from the ?4billion, the government has also made available fertilizers and other farm inputs to farmers in the various local government areas.

The Permanent Secretary who is the Chairman, State Steering Committee for the project, said RAAMP will construct roads that will connect farms to markets to enable farmers and fishermen sell their farms produce and fishes.

He also said rural roads would be constructed to farms and fishing settlements, and warned against any act that will lead to the cancellation of the projects in the four local government areas.

According to him, the World Bank and Federal Government which are the financiers of the programme will not condone such acts like kidnapping, marching ground and other acts inimical to the successful implementation of the projects in their respective areas.

At PHALGA, Ogolo asserted that the city will benefit in the areas of roads and bridge construction.

He noted that RAAMP was thriving in both the Federal Capital Territory, Abuja; Lagos and other states in the country, stressing that the project should also be given the seriousness it deserves in Rivers State.

Speaking at Opobo town, the headquarters of Opobo/Nkoro Local Government Area, the project coordinator, RAAMP, Mr.Joshua Kpakol, said the programme would reduce poverty in the state.

According to him, both fishermen and farmers will maximally benefit from the programme.

At Ngo which is the headquarters of Andoni Local Government Area, Kpakol said roads will be constructed to all remote fishing settlements.

He said Rivers State is lucky to be among the states implementing the project, and stressed the need for the people to embrace it.

Meanwhile, Kpakol said at PHALGA that RAAMP is a project that will transform the lives of farmers, traders and other stakeholders in the area.

He urged the stakeholders to spread the information to their various communities.

However, some of the stakeholders at Opobo town complained about the destruction of their farms by bulls allegedly owed by traditional rulers in the area, as well as incessant stealing of their canoes at waterfronts.

At Ngo, Archbishop Elkanah Hanson, founder of El-Shaddai Church, commended the World Bank and the Federal Government for bringing the projects to Andoni.

He stressed the need for the construction of roads to fishing settlements in the area.

Also, a former Commissioner for Agriculture in the state and Okan Ama of Ekede, HRH King Gad Harry, noted that storage facilities have become necessary for a successful agricultural programme.

Harry also stressed the need for the programme to be made sustainable.

In their separate speeches, the administrators of Andoni and Opobo/Nkoro Local Government Areas, pledged their readiness to support the programme.

At Port Harcourt City, the Administrator, Dr Arthur Kalagbor, represented by the Head of Local Government Administration, Port Harcourt City, Mr Clifford Paul, said the city would support the implementation of the programme in the area.

Also, the administrator of Obio/Akpor Local Government Area, Dr Clifford Ndu Walter, represented by Mr Michael Elenwo, pledged to support the programme in his local government area.

Among dignitaries at the Obio/Akpor stakeholders engagement is the chairman, Rivers State Traditional Rulers Council and paramount ruler of Apara Kingdom, HRM Eze Chike Wodo, amongst others.

John Bibor

News

Tinubu Orders Civil Service Personnel Audit, Skill Gap Analysis

President Bola Tinubu has ordered the commencement of personnel audit and skill gap analysis across all cadres of federal civil servants.

The president gave this directive in Abuja, yesterday, while speaking at the International Civil Service Conference, reaffirming his resolve to achieve efficiency and professional service delivery in the civil service.

“I have authorized the comprehensive personnel audit and skill gap analysis across the federal civil service to deepen capacity. I urge all responsible stakeholders to prioritize timely completion of this critical exercise, to begin implementing targeted reforms, to realize the full benefit of a more agile, competent and responsive civil service,” the president announced.

Tinubu further directed all Ministries, Departments and Agencies (MDAs), to prioritise data integrity and sovereignty in national interest.

He called for the capture, protection and strategic publication of public sector data in line with the Nigeria Data Protection Act of 2023.

“We must let our data speak for us. We must publish verified data assets within Nigeria and share them internationally recognized as fruitful. This will allow global benchmarking organisation to track our progress in real time and help us strengthen our position on the world stage. This will preserve privacy and uphold data sovereignty,” Tinubu added.

President Tinubu hailed the federal civil service as the “engine” driving his Renewed Hope Agenda, and the vehicle for delivering sustainable national development.

He submitted that the roles of civil servants remain indispensable in modern governance, declaring that in the face of a fast-evolving digital and economic landscape, the civil service must remain agile, future-ready, and results-driven.

“This maiden conference is a bold step toward redefining governance in an era of rapid transformation. An innovative Civil Service ensures we meet today’s needs and overcome tomorrow’s challenges.

“It captures our collective ambition to reimagine and reposition the civil service. In today’s rapid, evolving world of technology, innovation remains critical in ensuring that the civil service is dynamic, digital” the President said.

Head of the Civil Service of the Federation, Didi Walson-Jack in her welcome address told the President that his presence and strong words of commendation at the conference has renewed the morale and mandate of public servants across the country.

Walson-Jack described Tinubu as the backbone of driving transformation in the Nigerian civil service, and noted that the takeaways from past study tours undertaken to understudy the civil service in Singapore, the UK and US under her leadership, is already yielding multiplier effects.

Walson-Jack assured Tinubu that her office, in collaboration with reform-minded stakeholders, will not relent in accelerating the implementation of the Federal Civil Service Strategy and Implementation Plan, FCSSIP 25.

She affirmed that digitalisation, performance management, and continuous learning remain key pillars in strengthening accountability, transparency, and service delivery across MDAs.

Walson-Jack reaffirmed that the civil service is determined to exceed expectations by embedding a culture of innovation, ethical leadership, and citizen-centred governance in the heart of public administration.

-

News5 days ago

News5 days agoReps Probe Police Over Alleged ?6bn Contract Splitting, Asset Sales

-

Niger Delta4 days ago

Niger Delta4 days agoRSNC Head Charges NAOMEW On Professionalism, Effective Service Delivery

-

Sports5 days ago

Give Rest Of ‘94 Eagles Their Houses – Amuneke

-

News5 days ago

News5 days agoRivers High Court Judges Begin 2025 Vacation, July 21

-

Rivers5 days ago

Obalga SOLAD Presents Fire Extinguishers To Council …. Commiserates With traders over Rumuomasi Market Fire

-

Business5 days ago

NPA Assures On Staff Welfare

-

News5 days ago

News5 days agoFour Internet Fraudsters Get Jail Sentences In PH

-

Sports5 days ago

President Federation Cup: Sanwo-Olu, Abdulrazaq Set To Grace Grand Finale