Business

PoS Operators Take CAC To Court

In response to the directive by the Corporate Affairs Commission (CAC) for Point of Sales (PoS) operators to register with it, the body, the “Association of Mobile Money and Bank Agents in Nigeria (AMMBAN)” says it has concluded plans to head to court to address the legality of the directive.

President of the association, Fasasi Sarafadeen, faulted the directive mandating PoS operators to register with the CAC, saying the move had forced the association to go to court to seek a redress.

Sarafadeen said the directive from the CAC violated the provision of the Companies and Allied Matters Act, Laws of the Federation of Nigeria, 2004, which “explicitly states that the commission has no jurisdiction over individuals not operating as a company”.

“According to section 863(1) of the Companies and Allied Matters Act, 2004, the order to enforce CAC directive on individual PoS agents operating under their name is wrong and will be challenged, as it contravenes the Companies and Allied Matters Act, Laws of the Federation of Nigeria, 2004, which explicitly states that CAC has no jurisdiction over individuals not operating as a company.

“We shall challenge it legally. The court will have to intervene in the interpretation of the quoted section of the CAMA if individuals operating as a sub-agent (likened to a bank branch) must register with CAC.

“CBN is right, no issue, the memo is clear, it only applies to non-individuals, unlike the Corporate Affairs Commission who generalised. We are in talks with the lawyer representing the association already, and a league of human rights lawyers whom we are not disclosing who they are for now”, he said.

Explaining the categories, he stated that there were two categories of Point-of-Sale agents.

“CAMA only mandates registration of individuals operating as a company. There are two categories of POS agents: individuals and non-individuals. Individual agents operate under their names, such as Musa Caroline or Abubakar Audu, and are typically profiled with financial institutions under their names.

“Non-individual agents, on the other hand, operate under registered or unregistered business names, such as Wale Ventures or Johnson Enterprises.

“It is this second category of agents that the Corporate Affairs Commission can enforce the law on, as they are required to register their business names by the law”, Sarafadeen explained.

He noted that sub-agents are independent branches of a company already registered with the Corporate Affairs Commission.

“Sub agents are not carrying out as an independent company but branches of a company. For example, while commercial banks operate with bank branches across the country, Fintechs (MMO, super agents, and co) operate with a network of sub-agents.

“It is, therefore, lack of knowledge of the workings in a Fintech/agent banking industry to be tagging sub-agents as illegal”, he added.

According to the AMMBAN boss, the CAC should focus its efforts on addressing the high failure rate of registered businesses in Nigeria, rather than enforcing regulations on individual POS agents operating under their names.

“The Corporate Affairs Commission should prioritise addressing the alarming failure rate of registered businesses in Nigeria, rather than targeting sub-agents. With over 4.9 million businesses registered, 50 per cent of which fail every five years, this should be the focus.

“In addition, the Central Bank of Nigeria’s memo specifically addressed non-individual agents, not individual sub-agents, and CAC’s threat to harass sub-agents is unwarranted and excessive”, he added.

He noted that the clampdown on agent banking in the name of CAC registration was not in line with President Bola Tinubu’s renewed Hope agenda, which prioritises job creation and opposes policies that cause unemployment.

“We are aware that President Bola Ahmed Tinubu is not approved of any policy that will cause unemployment, noting that agent banking has created over 1.9 million jobs in the last few years. Clampdown in the name of CAC registration is not in line with the renewed Hope agenda of Mr. President and we are appealing to Mr. President, the Senate, and the House of reps to intervene as they did for the anti-masses policy of cyber security levy.

“CAC should be concerned about how 50 per cent of registered businesses in Nigeria fail within the first few years, resulting in growing unemployment year-on-year. Rather than embarking on policies that will eradicate entrepreneurs, escalate unemployment, and reverse the gains of financial inclusion in Nigeria”, he stated.

The Federal Government through the Corporate Affairs Commission had issued a two-month registration deadline for Point of Sales companies, to register their agents, merchants, and individuals with the commission in line with legal requirements and the directives of the Central Bank of Nigeria.

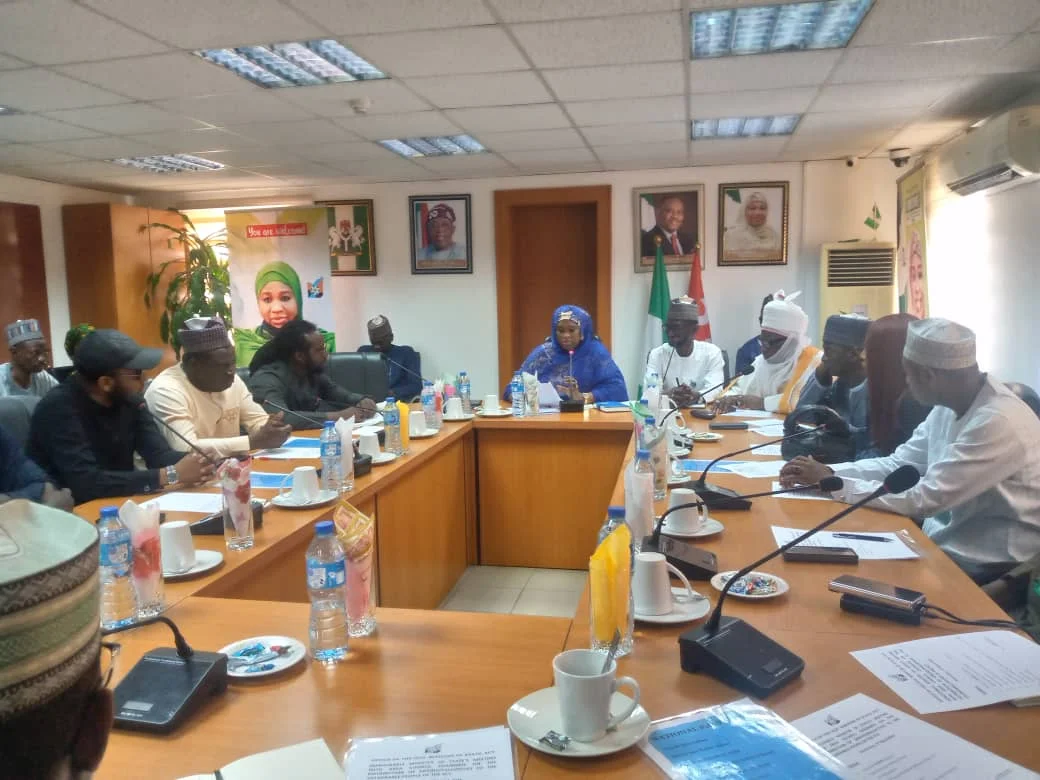

The agreement was reached during a meeting between Fintechs and the Registrar-General CAC, Hussaini Ishaq Magaji, in Abuja.

CAC said the move would curb kidnapping and payment of ransoms.

According to the Nigeria Inter-Bank Settlement System, there are over 1.9 million PoS terminals deployed by merchants and individuals nationwide.

This new directive came against the backdrop of frequent fraud incidents involving POS terminals and plans to stop trading in cryptocurrency or any virtual currency by the Central Bank of Nigeria. POS terminals accounted for 26.37 per cent of fraud incidents in 2023, according to a fraud report by the Nigeria Inter-Bank Settlement System Plc.

Last week, the CBN stopped major fintech firms like Kuda, Opay, PalmPay, and Moniepoint from onboarding new customers and instructed the companies to warn their customers against trading in cryptocurrency or any virtual currency on their apps, threatening to block any accounts found engaging in such activities.

The CBN’s move was linked to an ongoing audit of the Know-Your-Customer process of the fintechs, which have been under scrutiny in recent months over concerns around money laundering and terrorism financing.

Before the CBN’s directive, the Economic and Financial Crimes Commission had obtained a court order to freeze at least 1,146 bank accounts owned by various individuals and companies allegedly involved in illegal foreign exchange transactions.

Business

NCDMB Tasks Media Practitioners On Effective Reportage

Business

FCTA, Others Chart Path To Organic Agriculture Practices

The Federal Capital Territory Administration (FCTA) and other stakeholders have charted path to improved organic agriculture practices nationwide.

At a 2024 national organic and agroecology business summit held recently in Abuja, stakeholders took turn to speak on the additional areas of promoting the practices.

The Mandate Secretary, FCT Agriculture and Rural Development Secretariat (ARDS), Lawan Geidam, advocated for sustainable practice to develop resilient food systems that will benefit people.

The event, with the theme,”Towards Policies for Upscaling Organic Agroecological Businesses in Nigeria”, is aimed at fostering growth in the organic agriculture sector.

Geidam, who was represented by the Acting Director, Agric Services, in the Secretariat, Mr. Ofili Bennett, emphasised the success of organic and agroecological farming, reling on the active involvement of farmers, businesses and consumers.

He reassured attendees that the FCT Administration, led by the Minister, Nyesom Wike, and Minister of State, Dr. Mariya Mahmoud, remains dedicated to supporting initiatives that enhance the livelihood of residents.

Geidam described the partnership between the Secretariat and the organic and Agroecology initiative for a monthly exhibition and sale of organic products in the FCTA premises as a testament to this commitment.

“The ARDS remains committed to driving policies and initiatives that align with national goals and global standards”, Geidam said.

On her part, the Chairperson of Organic and Agroecology Initiative, Mrs. Janet Igho, urged residents to embrace healthy eating habits to sustain a good lifestyle. She stressed the importance of adopting organic practices, highlighting the benefits of going organic, growing organic and consuming organic products.

Igho expressed her optimism regarding the Agricultural Revival Programmes as articulated in President Bola Ahmed Tinubu’s “Renewed Hope Agenda”, which aims at fostering food and nutrition security.

She also extended her gratitude to ARDS for graciously allocating a space in the FCTA premises for the exhibition and sale of organic products, noting that the platform has been effectively used to advance the promotion of organic agriculture in FCT.

Igho outlined several benefits of organic agriculture which includes improved soil health, increased biodiversity, availability nutritious and healthy food and a reduced carbon footprint.

Stakeholders at the summit, underscored the critical need for enhanced private sector involvement and robust capacity building initiatives for farmers.

They highlighted the importance of implementing supportive policies to foster the growth of the organic agriculture sector.

In the light of the significant challenges facing Nigeria’s agricultural landscape, stakeholders decided that organic agricultural practices present sustainable solutions and a pathway for a more resilient and productive farming systems.

The three-day summit featured exhibitions showcasing organic foods, fruits, vegetables and fertilizers, providing an opportunity for residents to better appreciate the benefits of production and consumption of organic agricultural products.

Business

Dangote Refinery Exports PMS to Cameroon

-

News2 days ago

120 To Bag First Class At RSU Convocation

-

Nation2 days ago

NASS Set To Receive Tinubu’s N47.9trn 2025 Budget

-

Business2 days ago

NNMDA To Train 5m Nigerian Youths On Cassava Plantation

-

Women2 days ago

Cooking And Its Importance To Women

-

Niger Delta2 days ago

Bayelsa, Rivers To Establish Joint Anti-Vandalism Taskforce On National Grid, Others

-

Business2 days ago

Business2 days agoFCTA, Others Chart Path To Organic Agriculture Practices

-

Business2 days ago

Business2 days agoDangote Refinery Exports PMS to Cameroon

-

News2 days ago

Bill For Compulsory Counselling For Convicted Corrupt Nigerians Scales Second Reading