Business

IPMAN, MEMAN Eye Fuel Price Reduction From PH Refinery

Following the expected commencement of production by the Port Harcourt Refinery in April, the Independent Petroleum Marketers Association of Nigeria (IPMAN) and the Major Energy Marketers Association of Nigeria (MEMAN) have projected a marginal reduction in the pump price of Premium Motor Spirit, popularly called petrol, produced from it.

IPMAN and MEMAN also declared their readiness to load products from the facility, and urged the Nigerian National Petroleum Company Limited (NNPCL) to fulfill its promise of pumping refined products from the plant in two weeks time.

Recall that on Friday the Group Managing Director, NNPCL, Mele Kyari, announced that the Port Harcourt refinery would commence operations in about two weeks time.

Appearing before the Senate Ad-hoc Committee investigating the various Turn Around Maintenance projects of refineries, Kyari stated then that mechanical works had been completed on the Port Harcourt, Warri, and Kaduna refineries.

He also said the Kaduna refinery would commence operations in December.

“We did a mechanical completion of the (Port Harcourt) refinery, that was what we said in December. We now have crude oil already stocked in the refinery. We are doing regulatory compliance tests that must happen in every refinery before you start it, and I assure you that this Port Harcourt refinery will start in the next two weeks.

“Completing the mechanical work means that you are done with the rehabilitation work, now you have to test to see how it works. Of course, we have also completed the mechanical work on the Warri refinery.

“It is also undergoing regulatory compliance: processes that we are doing with our regulator, and this will soon be completed and it will be ready.

“The Kaduna refinery will be ready by December. We have not reached that stage in Kaduna, but we promise Kaduna will be delivered by December”, Kyari explained.

On Monday, the National President, IPMAN, Abubakar Maigandi, told The Tide’s source that marketers had been informed of the development and were ready to start lifting products.

He said immediately productikn starts from the plant, the cost of petrol would reduce, but stressed that this would be a marginal reduction.

“As independent petroleum marketers, immediately we received the information, we told all our members to start preparing for loading, especially those in the South-South region of the country, because it is closer to them.

“So, at any time they (NNPCL) say we should come and start loading, we are ready. We are just waiting for them to start”, Maigandi stated.

He continued that “Price reduction is obvious when they start releasing products, and there will be availability because it would serve as support to the imported products. So we are expecting a change in price, for no matter how small the reduction is, it is still a reduction.

“Also, the commencement of operations there will create more employment for Nigerians. So, it is a welcome development and IPMAN is happy about this, especially if products start coming out from the plant in the next two weeks as promised by NNPCL”.

Also speaking, the Executive Secretary, MEMAN, Clement Isong, said major oil marketers had been buying products from the trading arm of NNPCL, adding that this arm of the national oil firm would be in charge of the products to come out from the Port Harcourt refinery.

He noted that though the facility would not be able to provide all the volumes of petrol required by the consumers, MEMAN would definitely load from the plant by buying refined products through the trading arm of NNPCL.

“Sure, we have been buying from the trading arm of NNPCL and we will continue once products from the refinery are being released. On price reduction, this is going to be marginal, because the product is being produced in Nigeria”, he stated.

Kyari had told the Senate that over 450, 000 barrels of oil had been stocked into the Port Harcourt refinery, which means the plant is ready to deliver refined crude to the market.

“All crude lines are active and have actually delivered over 450,000 barrels into Port Harcourt refinery.

“We are confident of the integrity of it. Yes, there may be security issues, but also the government is responding to the situation”, Kyari had assured.

In December 2023, the Federal Government announced that the mechanical completion of Port Harcourt refinery had been completed, and that products from the plant would get to the market before the end of last year.

Though Nigerians anxiously expected the commencement, it didn’t happen, as Nigeria kept importing refined petroleum products till date through the NNPCL.

Business

NCDMB Tasks Media Practitioners On Effective Reportage

Business

FCTA, Others Chart Path To Organic Agriculture Practices

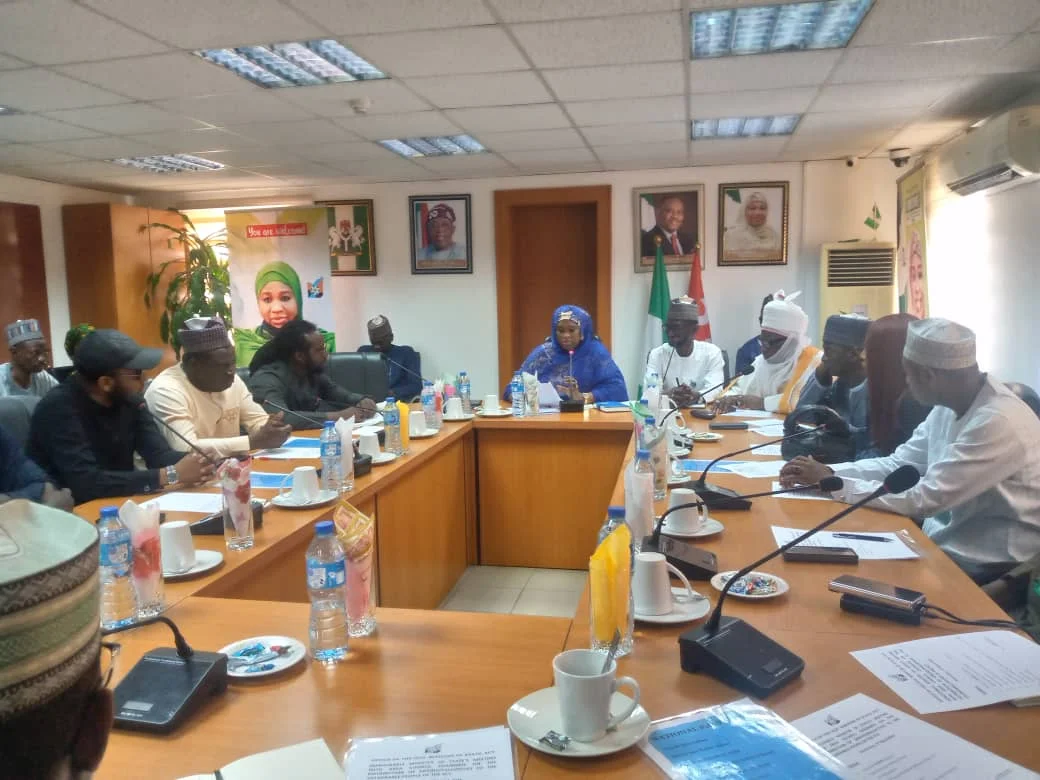

The Federal Capital Territory Administration (FCTA) and other stakeholders have charted path to improved organic agriculture practices nationwide.

At a 2024 national organic and agroecology business summit held recently in Abuja, stakeholders took turn to speak on the additional areas of promoting the practices.

The Mandate Secretary, FCT Agriculture and Rural Development Secretariat (ARDS), Lawan Geidam, advocated for sustainable practice to develop resilient food systems that will benefit people.

The event, with the theme,”Towards Policies for Upscaling Organic Agroecological Businesses in Nigeria”, is aimed at fostering growth in the organic agriculture sector.

Geidam, who was represented by the Acting Director, Agric Services, in the Secretariat, Mr. Ofili Bennett, emphasised the success of organic and agroecological farming, reling on the active involvement of farmers, businesses and consumers.

He reassured attendees that the FCT Administration, led by the Minister, Nyesom Wike, and Minister of State, Dr. Mariya Mahmoud, remains dedicated to supporting initiatives that enhance the livelihood of residents.

Geidam described the partnership between the Secretariat and the organic and Agroecology initiative for a monthly exhibition and sale of organic products in the FCTA premises as a testament to this commitment.

“The ARDS remains committed to driving policies and initiatives that align with national goals and global standards”, Geidam said.

On her part, the Chairperson of Organic and Agroecology Initiative, Mrs. Janet Igho, urged residents to embrace healthy eating habits to sustain a good lifestyle. She stressed the importance of adopting organic practices, highlighting the benefits of going organic, growing organic and consuming organic products.

Igho expressed her optimism regarding the Agricultural Revival Programmes as articulated in President Bola Ahmed Tinubu’s “Renewed Hope Agenda”, which aims at fostering food and nutrition security.

She also extended her gratitude to ARDS for graciously allocating a space in the FCTA premises for the exhibition and sale of organic products, noting that the platform has been effectively used to advance the promotion of organic agriculture in FCT.

Igho outlined several benefits of organic agriculture which includes improved soil health, increased biodiversity, availability nutritious and healthy food and a reduced carbon footprint.

Stakeholders at the summit, underscored the critical need for enhanced private sector involvement and robust capacity building initiatives for farmers.

They highlighted the importance of implementing supportive policies to foster the growth of the organic agriculture sector.

In the light of the significant challenges facing Nigeria’s agricultural landscape, stakeholders decided that organic agricultural practices present sustainable solutions and a pathway for a more resilient and productive farming systems.

The three-day summit featured exhibitions showcasing organic foods, fruits, vegetables and fertilizers, providing an opportunity for residents to better appreciate the benefits of production and consumption of organic agricultural products.

Business

Dangote Refinery Exports PMS to Cameroon

-

Rivers1 day ago

Ministry Debunks Akpana’s Leadership Of JONAPWD … Sets Stage for Peaceful Election

-

Editorial1 day ago

Editorial1 day agoA New Dawn For Rivers’ Workers

-

Business1 day ago

Business1 day agoNADF, NASC Partner To Boost Food Security

-

Politics1 day ago

Politics1 day agoGanduje Gets February 13 Date For Hearing In Alleged Bribery Trial

-

Sports1 day ago

Football Panacea For Peace, Creates Good Relationship – LG Boss

-

Nation1 day ago

Senate Summons Wike Over Demolition Of Houses …Set To Investigate FCDA Activities

-

Rivers1 day ago

Diaspora Group Wants Respect For Ogoni Traditional Rulers

-

News1 day ago

Unpaid Arrears: Health Workers Threaten Showdown In Ikwerre LGA